Over the past decade, malnutrition has emerged as a significant global challenge, bringing with it substantial social consequences. One major aspect of this issue has been the rising prevalence of obesity, driven by various factors. The increasing cost of living and reduced disposable income for families have led many to rely more often on inexpensive, low-quality, energy-dense foods. Overconsumption of unhealthy food has contributed to higher rates of obesity and related health complications, including diabetes, heart attacks, and cardiovascular diseases. With public health systems struggling to cope with the escalating costs of healthcare, addressing these conditions may bear more pressure on the system over time.

Weight loss drugs, introduced by biopharma companies Eli Lilly and Novo Nordisk have reversed the course on what seemed to be a downward spiraling trend. Supported by a growing of ‘organic’ trend in people’s diets, new prescriptions grew exponentially in the last 36 months, at great benefit to the performance of Eli Lilly and Novo Nordisk. Food manufacturers have seen their expected revenue growth lag because of the projected decrease in consumption. One way food manufacturers can avoid this fate is a strong pivot to healthier food options.

The food paradox: health vs accessibility

According to the UN and FAO, global obesity has nearly tripled since 1975, with 2.5 billion adults over the age of 18 classified as overweight and 890 million classified as obese in 2022. Over the long term, several reasons have contributed to this strong rise in weight gain. In the last years, some noticeable dynamics have been: (i) changing taste preferences, (ii) deteriorating consumers’ ability to spend, in part due to (iii) food cost inflation. These have contributed to making the consumption of fast foods and snacks become more commonplace.

Indeed, over the last two decades, food inflation has caused the purchasing power of the average consumer to decrease, as nearly 66% of countries reported food price increases of 10% or more since 2022. This has led to worsening diets, with c42% of the world’s population not being able to afford healthy foods (with these numbers being closer to 70-80% in Africa and South Asia).

Source: Bank of America, FAOStat. Data as at 04/03/2024

Diabetes, along with other malnutrition conditions such as cardiovascular complications, musculoskeletal disorders like osteoarthritis, and even some cancers, are examples of proliferating conditions which may be contributing to the current strain on global healthcare systems and could engender increases of some healthcare costs.

Today, consumer preferences are again changing. There has been a shift to a health-focused lifestyle and predominantly healthy diets. And while the release of highly effective obesity medications (GLP-1 agonists) by Novo Nordisk and Eli Lilly may represent one of the most impactful milestones in biopharma history, they also have come about at an optimal moment.

GLP-1 (Glucagon-like peptide-1) drugswork by stimulating brain receptors that suppress appetite, diminish cravings, and control addictive tendencies. Novo Nordisk’s Wegovy and Ozempic, along with Eli Lilly’s Zepbound and Trulicity, are GLP-1 therapies that can lead to substantial weight reduction due to their broad range of effects.

The GLP-1 revolution

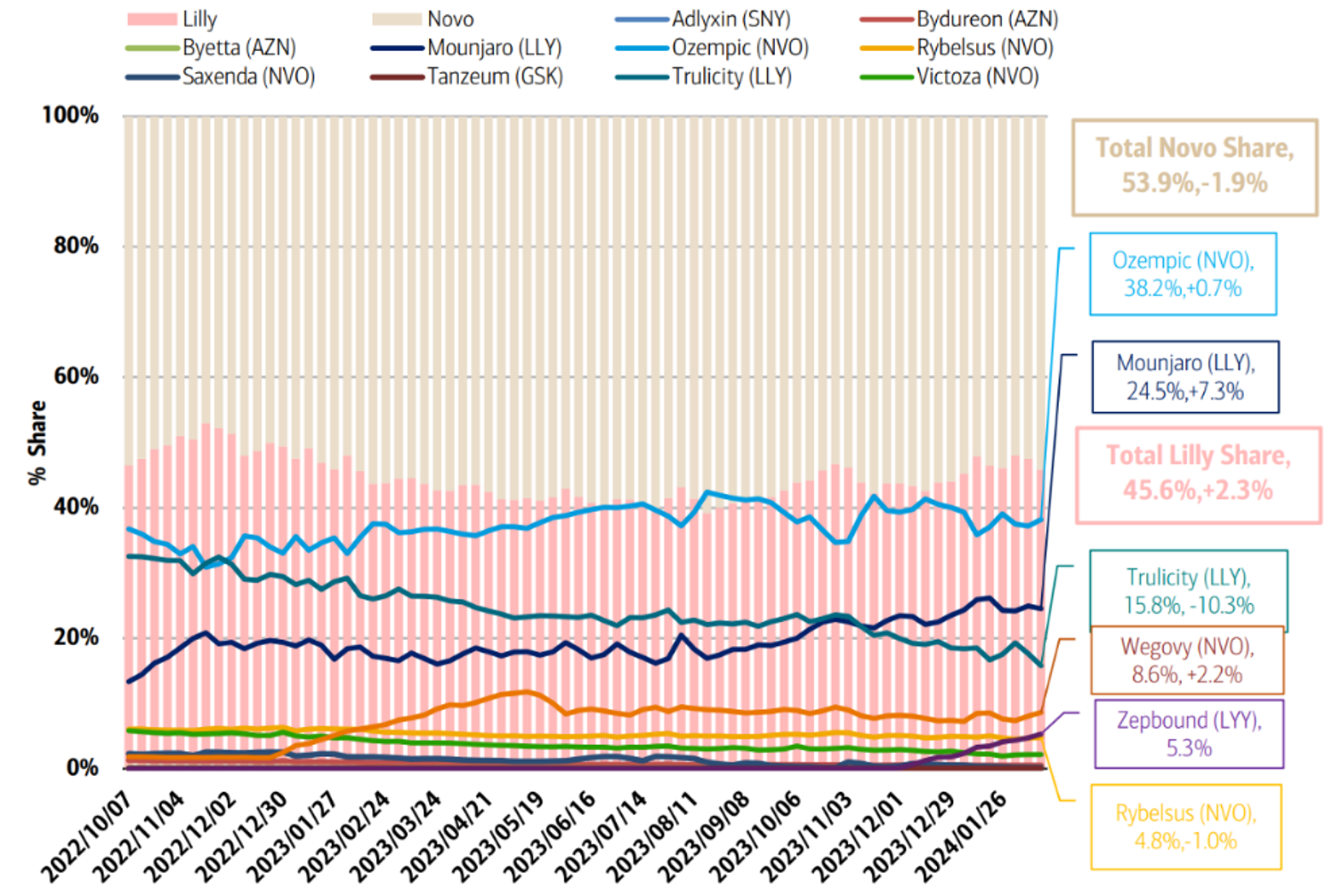

The GLP-1 market is dominated by two main players – a duopoly of sorts – with Eli Lilly and Novo Nordisk controlling c99% of prescriptions across various treatments as of February 2024. Novo, a Danish company, leads with a c54% market share, thanks to its diverse range of GLP-1 products, including Ozempic for diabetes, Wegovy for weight loss, and the oral variant of their GLP-1 lineup, Rybelsus. Eli Lilly, on the other hand, only offered GLP-1 treatments for diabetes until the release of its obesity medication, Zepbound, in December 2023.

Source: Bank of America, IMS. Data as at 26/02/2024

Since its launch, Zepbound has enabled Eli Lilly to gain momentum, helping them increase their GLP-1-market share by c2% in less than a year according to Bank of America (figure 2).

Capitalising on the high barriers to entry endemic to the pharmaceutical industry, Novo and Eli are mostly competing between themselves for the time being. Their head start is mostly due to their R&D advantage compared to other companies in the sector. In 2023, Novo Nordisk spent c$9.3 billion, while Eli Lilly deployed c$4.7 billion.

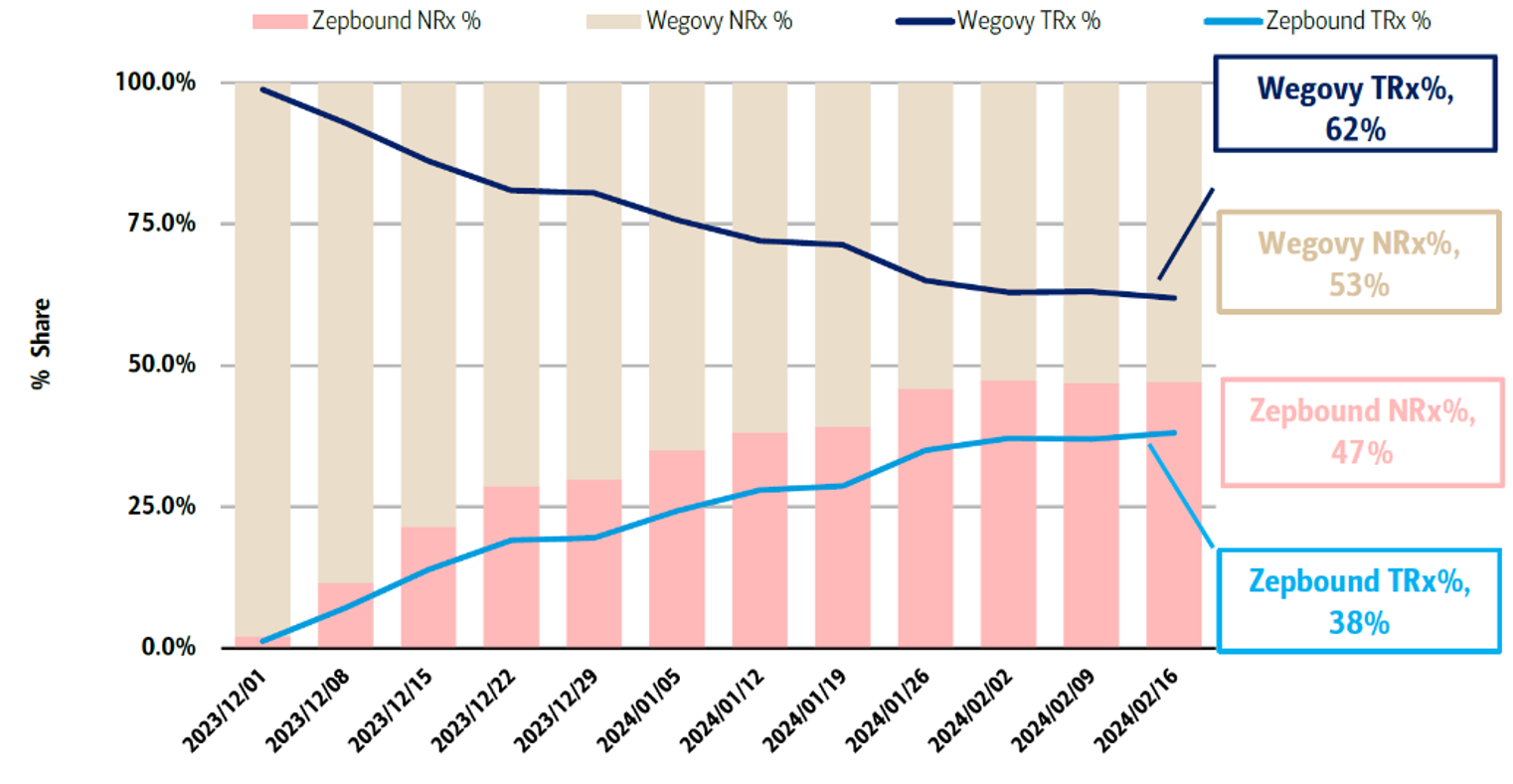

Source: Bank of America, IMS. Data as at 26/02/2024

Indeed, notwithstanding Novo Nordisk’s first-mover advantage with Wegovy, Eli Lilly’s Zepbound has seen the largest increase in total prescriptions (referred to as TRx), growing c38% between the start 1H23 to 1H24 as seen in figure 3.

Yet, the GLP-1 market has grown significantly over the last 36 months and potentially can continue to do so thanks to two drivers: a societal motivation to be healthier in a world where half the global population (c4 billion people) is expected to be impacted by overweightness by 2035, and the lower costs that these prescriptions entail for government healthcare compared to obesity, which currently costs the US government $173 billion per year according to the World Obesity Federation 2023. As such, given the expected growth potential and pace of expansion, other players such as Roche, Vertex Pharmaceuticals and Zeeland Pharma might also have a place in the future GLP-1 landscape pending various FDA approvals. However, their value proposition might shift slightly from focusing solely on weight loss to improving the patient experience during the weight loss process. This includes orally administered drugs, as well as lowering potential comorbidities.

Adoption fuels growth

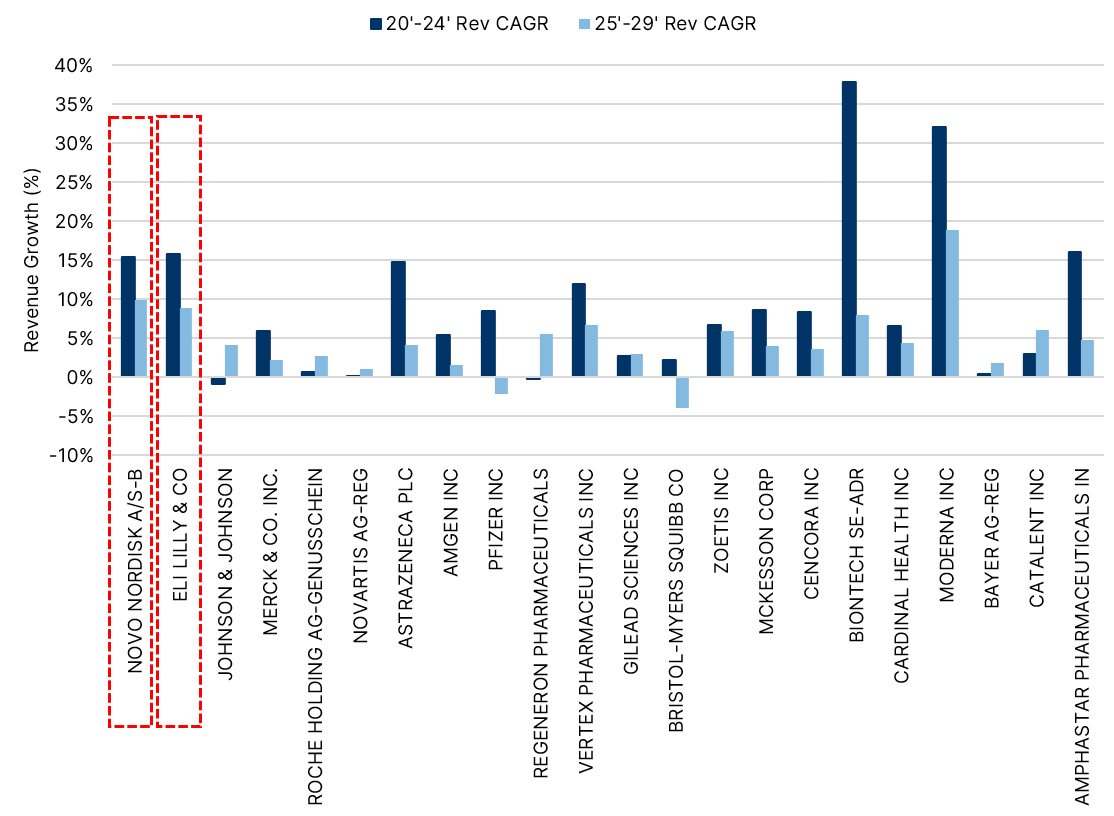

Strong momentum supporting the adoption of GLP-1 drugs have generated resilient financial performance for both Novo Nordisk and Eli Lilly compared to peers. Over the last 5 years, Novo and Eli have had a revenue compound average growth rate (CAGR) of 15% and 16% respectively, as shown in figure 4. And where their peers expect mid- to high-single digit revenue growth between 2025 and 2029, consensus aims higher with estimates of a low double-digit revenue CAGR for these two companies (see the red squares).

Source: Algebris Investments. Bloomberg Finance LP. Data as at 20/01/2025. Prospected scenarios may not materialise.

However, rapid growth is expected to extend throughout the pharmaceutical industry, benefiting many biopharmaceutical companies. Novo reports that, as of 2023, approximately 890 million people are affected by obesity, only about 1 million patients were treated with Novo Nordisk’s anti-obesity medications for a full year, indicating a penetration rate of less than 1%. A similar outlook is applicable to Eli Lilly and gives space for other players to enter the market.

Biopharmaceutical companies are likely to maintain a competitive edge through an S-curve-like rate of innovation, thanks to the significant R&D spending commonplace to the pharmaceutical industry creating a self-fulfillment pattern. In 2023, whereas Novo Nordisk and Eli Lilly spent 27% of sales and 15% of sales respectively on R&D, the average R&D spend across industry peers was c26% of sales. Strong R&D paves the way to consistently introducing novel formulations and advanced delivery mechanisms leading to new trajectories of growth. Additionally, their strategic geographic expansion will enable them to penetrate emerging markets, particularly those with a high prevalence of diabetes, as well as markets in middle-income countries consuming many low-quality foods.

Lastly, biopharmaceutical companies’ collaborations with healthcare providers and insurers have further strengthened their market presence and widespread acceptance of their offerings. From a government perspective, Ozempic/Wegovy, Zepbound, and other incoming GLP-1-based medications are likely to be part of the dialogue when it comes to price negotiations and inclusion in Medicare in the US. While this may create price pressures for biopharmaceutical companies, it may also provide more visibility long term.

Strengthened by supporting policy such as the Treat and Reduce Obesity Act of 2021, biopharmaceutical companies have worked to secure regulatory approvals for new variations and extended use cases that have significantly broadened the potential user base for their products, driving continued growth and market dominance. The tumultuous current policy landscape ahead may also pose some risks, however. Where the growing weight loss trends have prompted the occasional misuse of the diabetes drugs for weight loss, rather than the made-for-purpose ones such as Ozempic, some policies may be introduced to control distribution and dosage. Though the inclusion of these drugs in government and insurance programs is likely to tone down this risk, policies may impact Novo, Eli, and especially new entrants, in a variety of ways – unforeseen until the policies are made public.

A slimmer future for food companies

Food companies are the most exposed to the negative repercussions of these advancements in biopharma. On average, Americans consume around 1.3 billion calories daily (about 3,800 calories per person, according to the UN’s FAO). By the 2030s, if 25-50 million people start using anti-obesity drugs and experience a 15-20% reduction in their caloric intake, the overall food and beverage sector could see a 1-3% decline in total calorie consumption following analyses by Bank of America.

While we see this option as a distant possibility, there are noticeable carrying drivers that could lead to this outcome. In fact, a decrease in low-quality food consumption could be supported by the existing (and strengthening) consumer preference shift towards healthier diets and now accelerated by growing adoption rates of GLP-1 drugs. Together, both factors could have behavioral repercussions impacting companies across the food and beverage sector, namely via:

- Consumption of processed and high-fat foods could decline in the coming years, with people consuming less premade meals, and lead to snacking or other improvised eating occasions possibly coming under pressure.

- Fewer visits to fast food chains and take-away restaurants may mean more priority given to traditional meals, like lunch or dinner at home. In turn, increased home cooking (healthier cooking overall) is likely to impact consumer preferences at the grocery stores. Additionally, more restaurants may serve healthier food to attract more customers.

- Grocery chains are likely to see wavering demand for packaged foods, and a spike in interest in more organic and healthy produce.

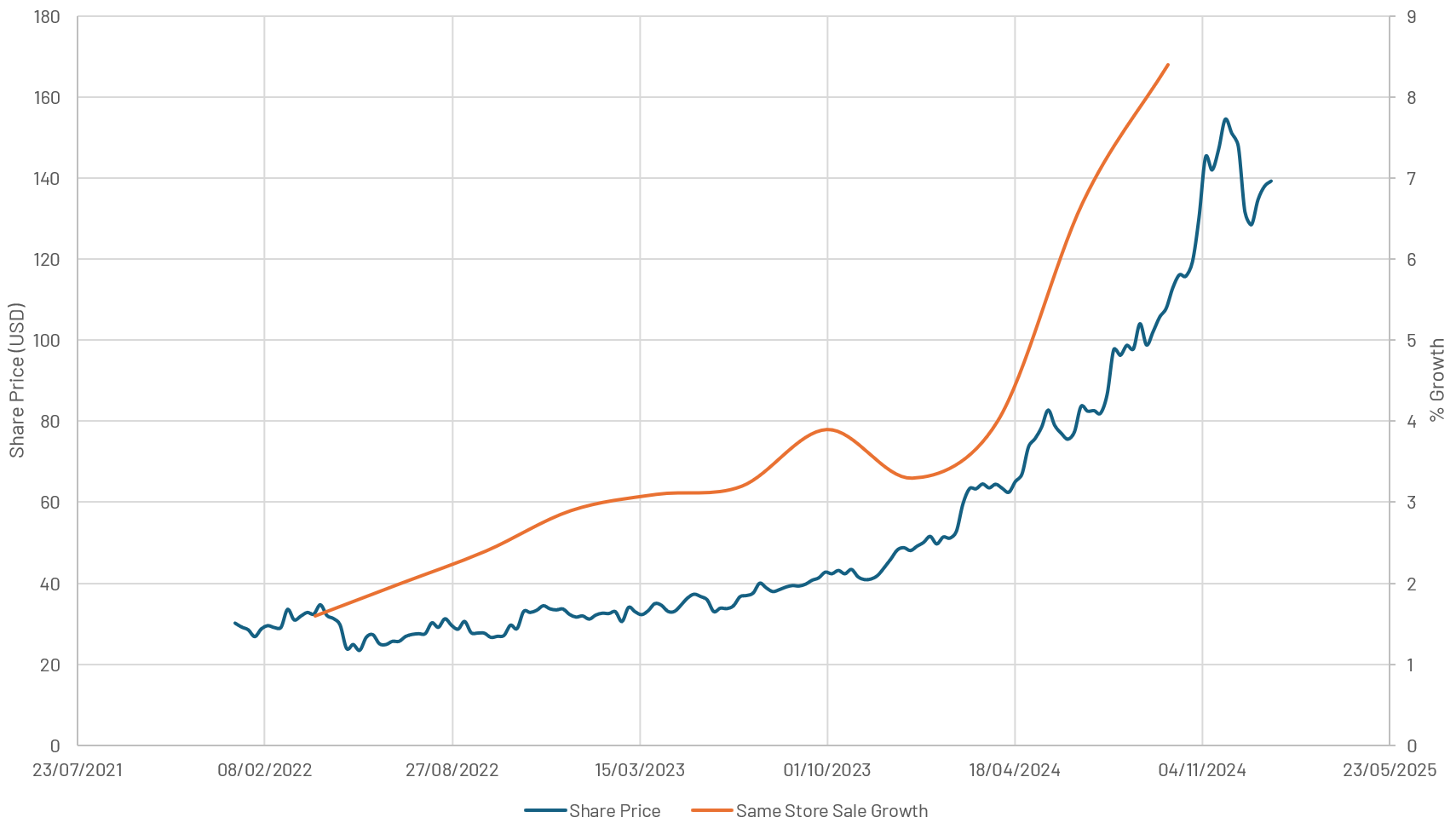

One such example has been the meteoric rise of Sprout Farmers’ Market, which has grown 55% annually over the last 5 years thanks to its widespread adoption across the US (see figure 5).

They have strongly positioned themselves as ‘farm to table’ leaders, targeting specific geographic locations where much of the healthy-diet trend began, and helped the social shift pick up speed over the last 3 years.

Source: Algebris Investments. Bloomberg Finance LP. Data as at 20/01/2025. Prospected scenarios may not materialise.

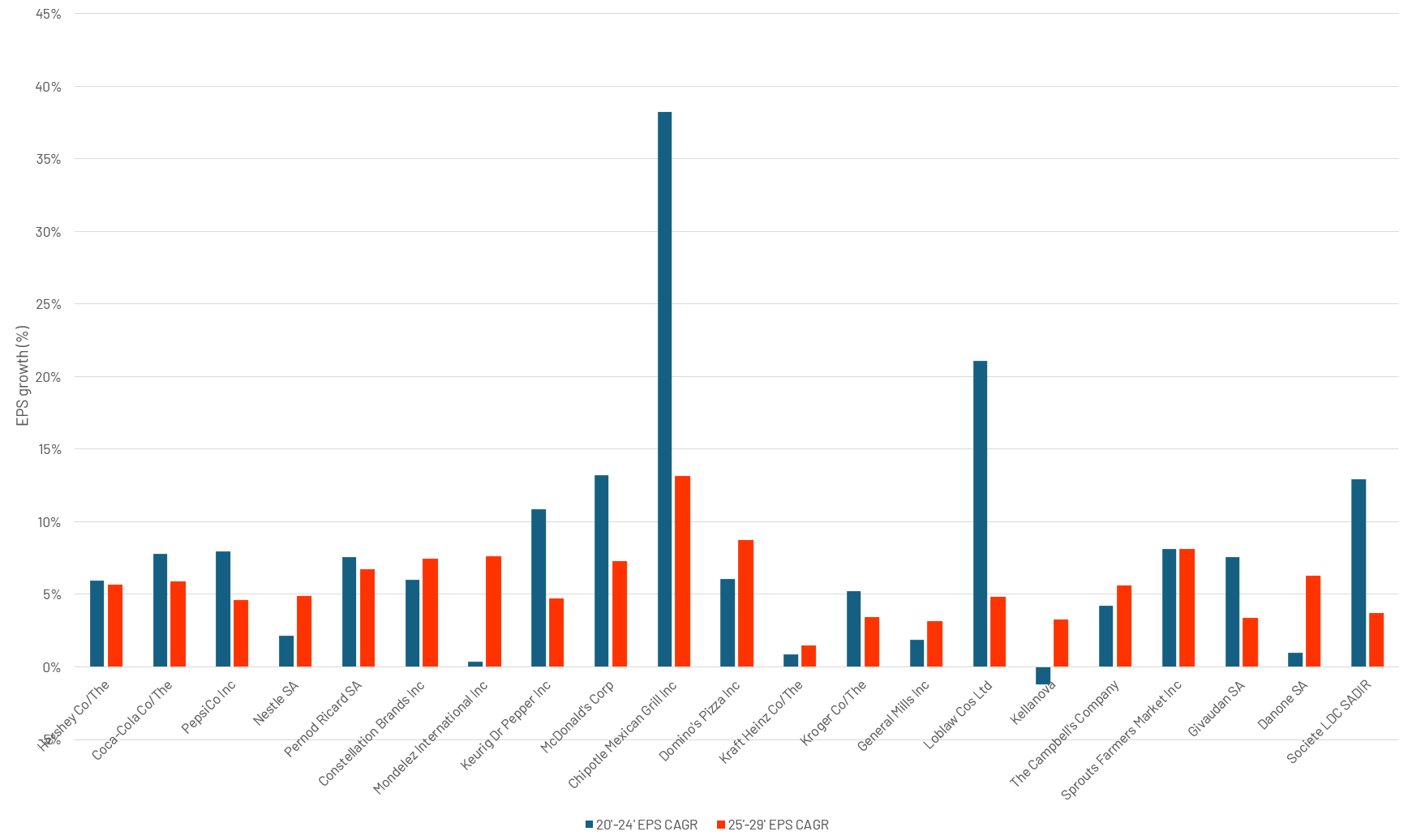

Consequently, current estimates reflect the reality that faltering demand could likely drag on projected earnings growth over the next 5-year period, where packaged food producers US Foods and Constellation Brands and grocery and retail Loblaws’ all see expected decreasing EPS growth in the 25’-29’ period compared to the earnings performance in the 20’-24’ period (see figure 6 for more examples).

With these challenges on the horizon, F&B companies are likely to see a need to adjust their product offerings, rebrand some of their product lines and advertise them to consumers as more health-conscious alternatives to retain buyers and market share. Many companies will also have to make slight supply chain adjustments to source healthier ingredients. Doing so may incur some costs in the short term, which is likely to put even more downward pressure on EPS forecasts, shifting into slower-growth territory.

Source: Algebris Investments. Bloomberg Finance LP. Data as at 20/01/2025. Prospected scenarios may not materialise.

Towards a healthier tomorrow

In summary, the growing adoption of GLP-1 drugs and the rising momentum of healthier diet trends signal a fundamental shift in consumer behavior, with widespread implications for the food industry. While biopharmaceutical companies like Novo Nordisk and Eli Lilly capitalize on these changes with unprecedented growth in obesity treatments, food manufacturers and retailers face mounting challenges but also potential long-term opportunities.

Declining caloric intake, driven by appetite suppression and changing dietary preferences, poses a risk to revenue growth, particularly for companies heavily reliant on processed and calorie-dense products. Grocery chains and fast-food operators are likely to feel the strain as demand for traditional foods and snacks gives way to healthier and organic alternatives.

To navigate this new reality, food companies will need to pivot toward health-conscious offerings, rebrand their product lines, and overhaul supply chains, though these efforts come at significant cost. As consumer behavior evolves, companies that fail to adapt risk losing relevance, while those that embrace innovation may find opportunities for growth in the long run.

This document is issued by Algebris Investments. It is for private circulation only. The information contained in this document is strictly confidential and is only for the use of the person to whom it is sent. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Algebris Investments is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

This document is being communicated by Algebris Investments only to persons to whom it may lawfully be issued under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 including persons who are authorised under the Financial Services and Markets Act 2000 of the United Kingdom (the “Act”), certain persons having professional experience in matters relating to investments, high net worth companies, high net worth unincorporated associations and partnerships, trustees of high value trusts and persons who qualify as certified sophisticated investors. This document is exempt from the prohibition in Section 21 of the Act on the communication by persons not authorised under the Act of invitations or inducements to engage in investment activity on the ground that it is being issued only to such types of person. This is a marketing document.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© 2024 Algebris Investments. Algebris Investments is the trading name for the Algebris Group