Der überwältigende Wahlsieg der Republikaner in den USA liess den amerikanischen Traum neu aufleben. Präsident Trump würde eine disruptive Kraft sein – jedoch eine, die Amerika zugutekäme. Eine expansive Fiskalpolitik und Zölle würden die Binnennachfrage ankurbeln, während angebotsseitige Wirtschaftspolitik die Finanzierung sichern und die Kapazitäten erweitern würde. Die US-Wirtschaft würde zweifellos profitieren, auch um denPreis vorübergehend höherer Inflation und Zinsen. Die restliche Welt hingegen würde die Kosten tragen – in Form einer schwächeren Währung und der Rückverlagerung der Produktion in die USA. Amerika würde wieder aussergewöhnlich sein.

Die ersten beiden Monate der neuen Regierung erzählen jedoch eine andere Geschichte. Die US-Wirtschaftspolitik scheint sich stärker darauf zu auszurichten, die Wählerbasis zu beschwichtigen, anstatt Wachstum zu generieren. Die grassierende Unbeständigkeit führt zu Unsicherheit, was wiederum das Wachstum bremst. Zudem sind die Zwischenwahlen noch weit entfernt, und der politische Spielraum ist begrenzt. Die Hürde für wirtschaftsfördernde Massnahmen ist daher höher, als die Märkte es derzeit einschätzen. Wir vermuten, dass eine Wachstumsverlangsamung bevorsteht, für die Risikowerte noch nicht eingepreist sind.

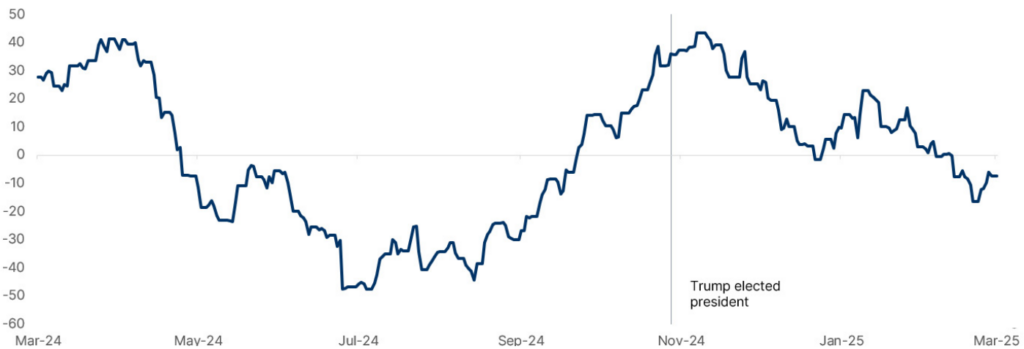

Die US-Wirtschaftsdaten verschlechtern sich spürbar. Die Zahl der Arbeitslosenanträge steigt, wodurch die Beschäftigung ausserhalb der Landwirtschaft auf den niedrigsten Stand seit sechs Monaten sinkt und die Arbeitslosenquote über 4 % klettert. Wirtschaftliche Überraschungen sind seit November kontinuierlich rückläufig (siehe Grafik 1).

Quelle: Citi Bank, Bloomberg Finance LP, Algebris Investments. Stand 07.03.2025. Hinweis: Citi US Economic Surprise Index.

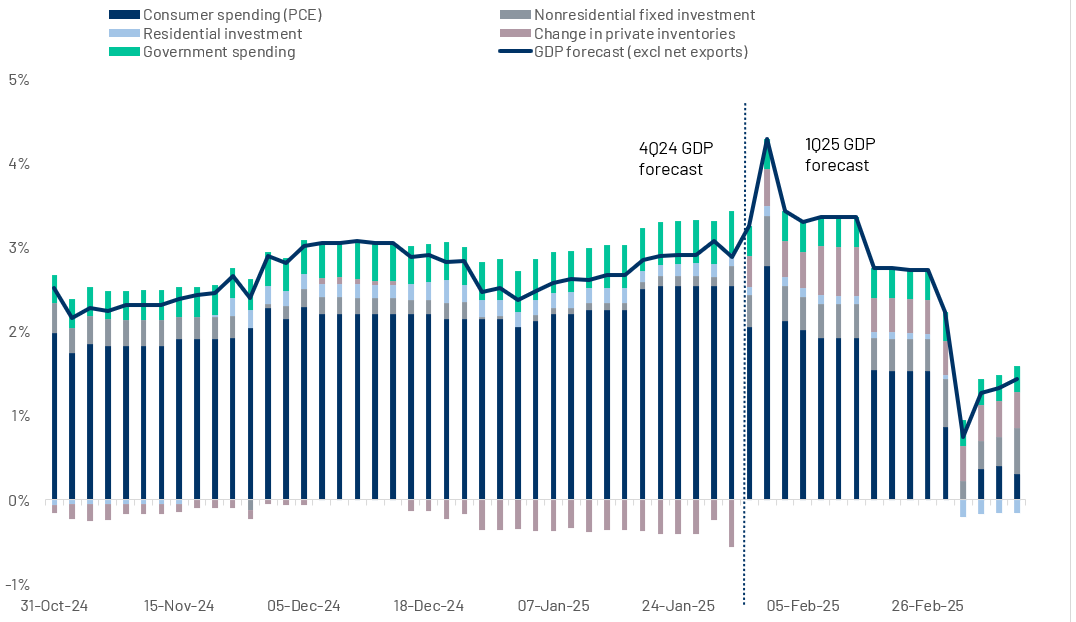

Das Verbrauchervertrauen – der zentrale Treiber der Expansion von 2023-24 – hat sich 2025 verschlechtert (Grafik 2), insbesondere aufgrund negativer Wahrnehmungen zur Geschäftslage und zum Arbeitsmarkt. Echtzeit-Indikatoren für das US-BIP fallen rapide (Grafik 3), beeinflusst sowohl durch steigende Importe als auch durch eine schwächere Konsumnachfrage.

Source: Conference Board. Data as of 07.03.2025.

Note: Consumer Confidence Next 6 Months. Pessimistic Expectations: Business Conditions..

Quelle: Atlanta Fed. Stand 07.03.2025. Hinweis: Teilkomponenten-Beiträge zur GDPNow-Prognose für das 4. Quartal 2024 und das 1. Quartal 2025.

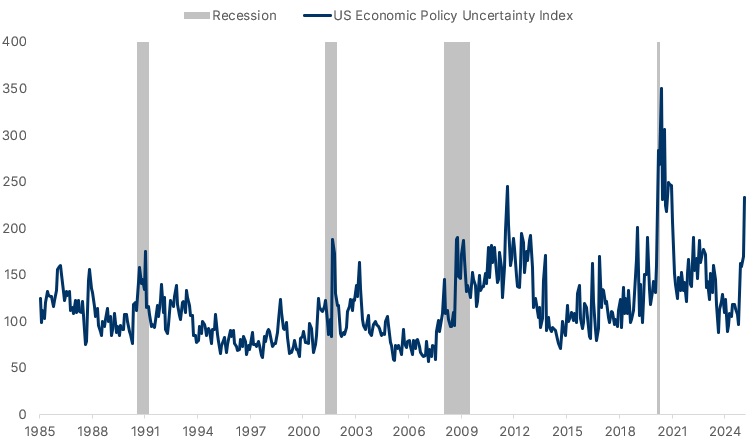

Wir vermuten, dass die USA derzeit einen tiefen Unsicherheitsschock durchleben. Studien zeigen, dass politische Unsicherheit ähnlich schädlich für Konjunkturzyklen sein kann wie ein exogener Schock. Wenn Unsicherheit hoch ist, stellen Unternehmen Investitionen und Neueinstellungen plötzlich und vorübergehend ein. Produktion und Beschäftigung tendieren dann dazu, schnell zu sinken. Die politische Unsicherheit in den USA befindet sich auf dem zweithöchsten Stand der letzten vierzig Jahre (Grafik 4).

Quelle: Baker, Scott R.; Bloom, Nick; Davis, Stephen J., Stand: 07.03.2025. Hinweis: US Economic Policy Uncertainty Index

Jede vergleichbare Spitze in der Vergangenheit wurde von einer wirtschaftlichen Abschwächung begleitet. Unternehmensumfragen aus Januar und Februar zeigen deutliche Rückgänge bei neuen Aufträgen und Beschäftigung.

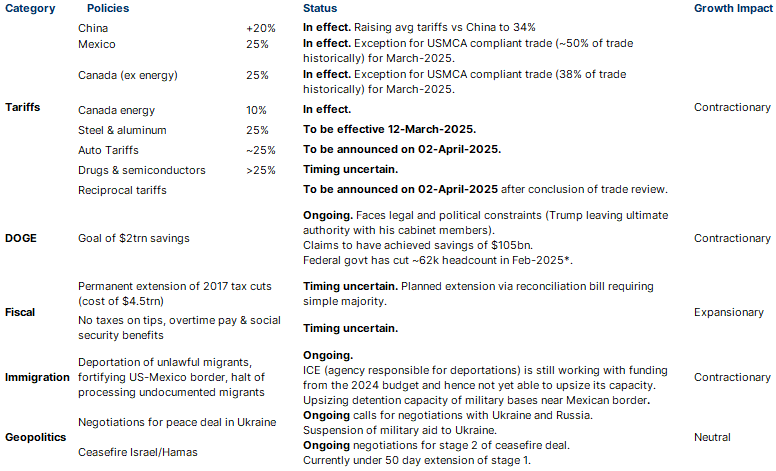

Die ersten politischen Massnahmen sind ebenfalls nicht ermutigend.

Die Regierung setzt vorrangig wirtschaftsunfreundliche Massnahmen um, darunter Stellenstreichungen im öffentlichen Sektor und Handelsrestriktionen (Tabelle 1). Der US-Zollsatz stieg dieses Jahr auf 4 % und könnte unter voller Umsetzung auf 10–15 % ansteigen. Jüngste Forschungen des IWF schätzen, dass die durch Zölle verursachte Wachstumsbelastung für die US-Wirtschaft bei 0,8 % über ein Jahr liegt. Die Wachstumsimpulse sollen grösstenteils durch Steuersenkungen erfolgen – diese müssen jedoch erst durch den Kongress gehen und ihre Zusicherung ist noch unklar.

Quellen: Veda Partners, Oxford Economics, Signum, The Guardian, Bloomberg LP. Stand: 08.03.2025. *Hinweis: Der Stellenabbau in der Bundesregierung kann nicht direkt mit den DOGE-Initiativen in Verbindung gebracht werden.

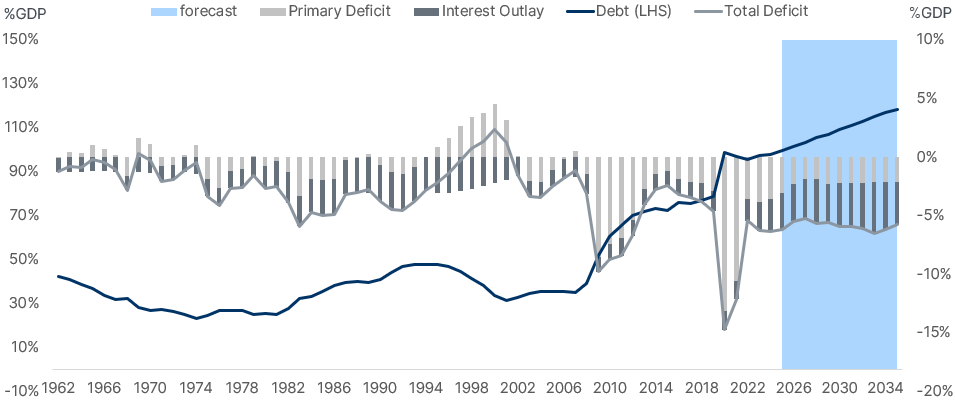

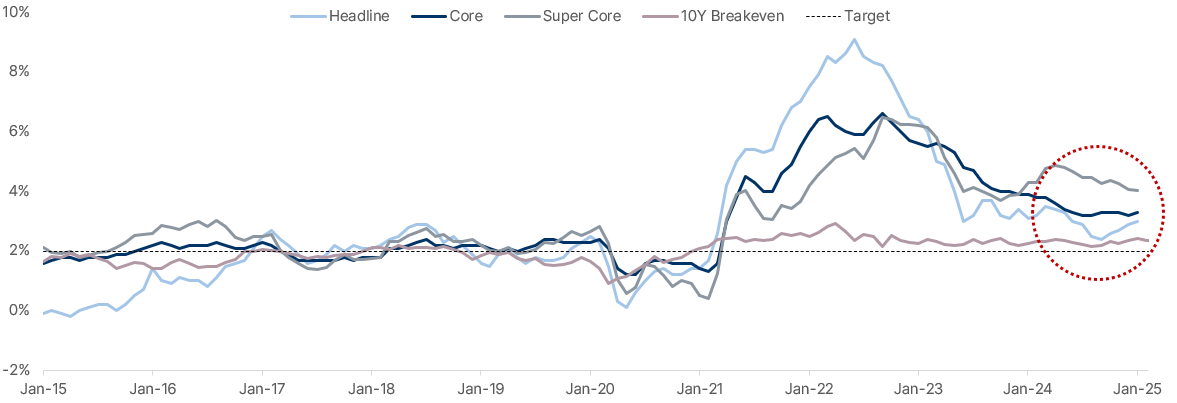

Die Kosten eines US-Konjunkturabschwungs wären hoch, da der politische Handlungsspielraum zur Reaktion begrenzt ist. Die US-Verschuldung ist hoch und wird sich bei einer Wachstumsabschwächung weiter erhöhen (Grafik 5). Die Zinskosten liegen knapp unter 3 % des BIP, was den Spielraum für primäre Staatsausgaben einschränkt. Die Inflation in den USA liegt weiterhin über dem Zielwert und hat sich Ende 2023 nicht weiter verlangsamt (Grafik 6). Eine durch den Handel ausgelöste Abschwächung ist nicht zwingend deflationär, wodurch sich die Fed in einer schwierigen Lage befindet. Finanzminister Bessent betonte, dass die Erfolgskennzahl der Regierung eher der Preis zehnjähriger US-Staatsanleihen als die Aktienkurse sei – eine Botschaft, die Präsident Trump bekräftigt hat. Diese Rhetorik deutet darauf hin, dass keine Eile für wirtschaftsstützende Massnahmen besteht.

Quelle: CBO, Algebris Investments. Stand: 17.01.2025. Hinweis: Alle Kennzahlen in % des BIP.

Quelle: Bloomberg Finance LP, Algebris Investments. Stand: 07.03.2025. Hinweis: Gesamtinflation (Headline): US CPI Urban Consumers YoY NSA (CPI YOY Index). Kerninflation (Core): US CPI Urban Consumers ohne Lebensmittel & Energie YoY NSA (CPI XYOY Index). Supercore: US Bloomberg BLS CPI Core Services ohne Wohnkosten (Supercore) YoY (CSXHSPCY Index). US 10-Jahres-Breakeven-Inflation: USGGBE10 Index. Berechnung: Durch Subtraktion der Realrendite der inflationsgebundenen Laufzeitenkurve von der Rendite der nominalen Treasury-Laufzeit.

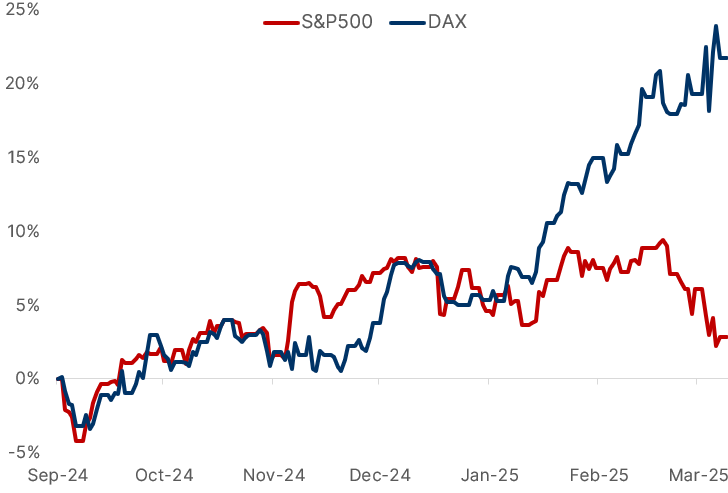

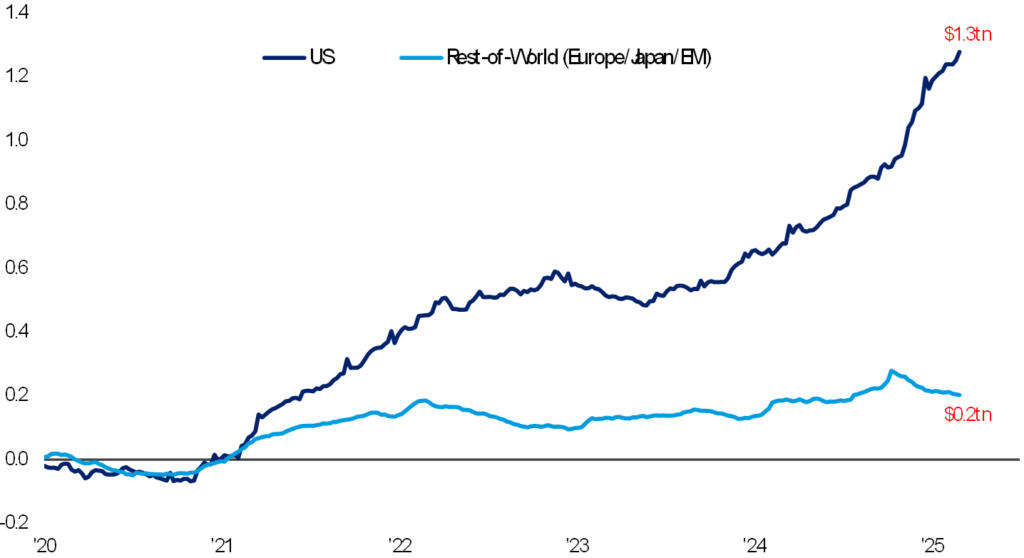

Der amerikanische Exzeptionalismus verblasst in den Daten, ist aber in den Märkten noch präsent. Der S&P 500 wird mit einem Kurs-Gewinn-Verhältnis von 23 gehandelt – 15 % über dem Zehnjahresdurchschnitt. Der reale Wechselkurs des US-Dollars liegt auf einem Vierzigjahreshoch, obwohl das US-Wachstum in den letzten zwanzig Jahren langsamer war als das der meisten asiatischen Länder. Beide Trends kehren sich nun rasch um (Grafik 7 und 8), aber die über Jahre hinweg starke US-Asset-Nachfrage könnte für eine weitere Korrektur sorgen.

Quelle: Bloomberg Finance LP, Algebris Investments. Stand: 07.03.2025. Hinweis: Gesamtrenditen in lokaler Währung für S&P 500 und DAX.

Quelle:Bloomberg Finance LP, Algebris Investments. Stand: 07.03.2025. Hinweis: US Dollar Index (DXY).

Risikowerte haben sich gut entwickelt, doch in den USA stehen grosse makroökonomische Anpassungen an. Dies könnte zu einer schnellen Neubewertung der Gewinner der letzten zwei Jahre führen. Wir sehen insbesondere US-Aktien und den US-Dollar als gefährdet. Europäische Vermögenswerte sind weitgehend unterbewertet, obwohl die Begeisterung über den neuen fiskalpolitischen Rahmen die Bewertungen stützt. Der Kreditmarkt bleibt insgesamt angespannt, doch es gibt attraktive Sektoren, insbesondere in Europa, wo die Divergenz hoch ist. Wir sehen mehr Wert in US- als in europäischen Zinslandschaft. Die Bewertung von Anleihen aus Schwellenländern ist eng, aber auf lokalen Märkten ergeben sich Chancen.

In den letzten drei Jahren haben sich die Märkte mit der Idee höherer Inflation und Zinsen arrangiert, aber Konjunkturabschwächungen wurden dabei ausser Acht gelassen. Für 2025 sehen wir die Voraussetzungen für eine solche Abschwächung, während Investoren grösstenteils unvorbereitet sind. Die Volatilität nimmt zu – und aktive Anlagestrategien werden sich voraussichtlich als besonders vorteilhaft erweisen.

Quelle: BofA Global Investment Strategy, EPFR, Algebris Investments. Stand: 10.03.2025. Anmerkung: kumulierte Zuflüsse in Aktienfonds.

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Alle geäußerten Meinungen sind diejenigen von Algebris, stellen keine Tatsachenaussagen dar, können sich ändern und sind nicht als Anlageberatung zu verstehen.

Es darf zu keinerlei Zweck auf die in diesem Dokument enthaltenen Informationen und Meinungen oder auf deren Richtigkeit oder Vollständigkeit vertraut werden. Keine der Gesellschaften von Algebris Investments, ihre Mitglieder, Mitarbeiter oder verbundenen Unternehmen gibt ausdrücklich oder stillschweigend Zusicherungen, Gewährleistungen oder Verpflichtungen hinsichtlich der Richtigkeit oder Vollständigkeit der in diesem Dokument enthaltenen Informationen oder Meinungen ab, und keine dieser Personen übernimmt diesbezüglich eine Haftung.

© Algebris Investments. Algebris Investments ist der Handelsname der Algebris-Gruppe.