Veronica Franco’s journey to wealth and influence is a testament to resilience, talent, and strategic skill. Despite numerous challenges, notably her trials during the Inquisition, her education, literary talent, social acumen, and financial expertise helped her navigate 16th-century Venice and become a celebrated figure. After a brief marriage, Franco followed her mother’s path into courtesanship, building influential relationships with nobles, politicians, and artists.

Understanding the importance of financial security, she invested in properties, which provided her with a reliable income. Property ownership was a key means of ensuring financial independence in the 16th century, and her real estate investments were particularly significant. Her story serves as a lasting inspiration for overcoming adversity through determination and skill.

Today women can benefit from her example: putting financial security in the hands of investments to bridge the gender pay gap, as well as benefit from harbouring their wealth from losing against inflation. Private bankers and financial institutions play a pivotal role in addressing the matter. Moreover, by focusing on sustainability-aligned strategies in the realm of equities, women can purposefully invest in high-value companies that may yield strong returns, and simultaneously advocate for equal pay by providing capital to companies at the forefront tackling the issue firsthand.

Mind the gaps

Women are more likely to have lower incomes compared to men, a disparity rooted in systemic inequalities in the labor market and societal roles. These income disparities are often attributed to several interrelated factors, including the gender pay gap that results from career interruptions due to caregiving responsibilities, and the overrepresentation of women in part-time or lower-paying jobs. Many women face challenges in advancing their careers, especially in obtaining early promotions, which hinders their progress to higher-paying roles. Additionally, societal expectations often place a disproportionate burden of unpaid labor, such as child and elder care, on women, further reducing time in the workforce and earning potential.

Source: Eurostat 2024, Algebris Investments. Data as at 28/02/2024

Source: (Ministero dell’Economia e delle Finanze, 2022). Data as at 11/10/2024.

Lower incomes over the life cycle

and interrupted career trajectories

have profound consequences on women’s

financial security, especially in old age.

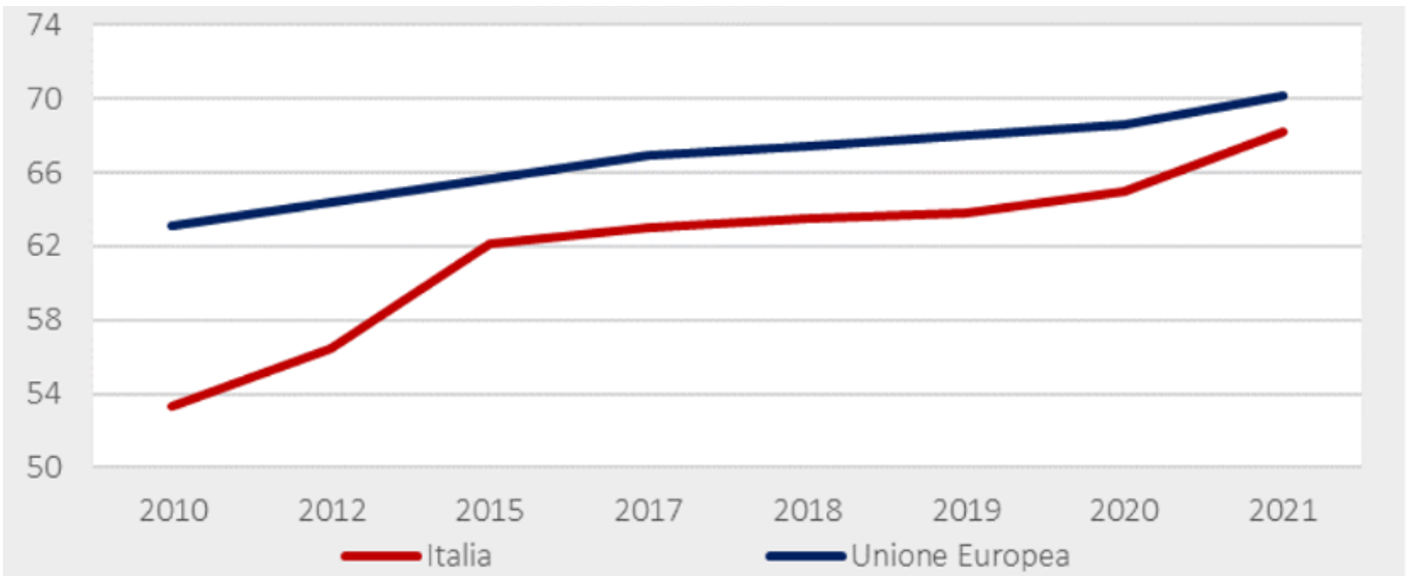

While Italy’s Gender Equality index grew

over the last decade with respect

to the European average, it is still below

as of 2021 (see figure 2).

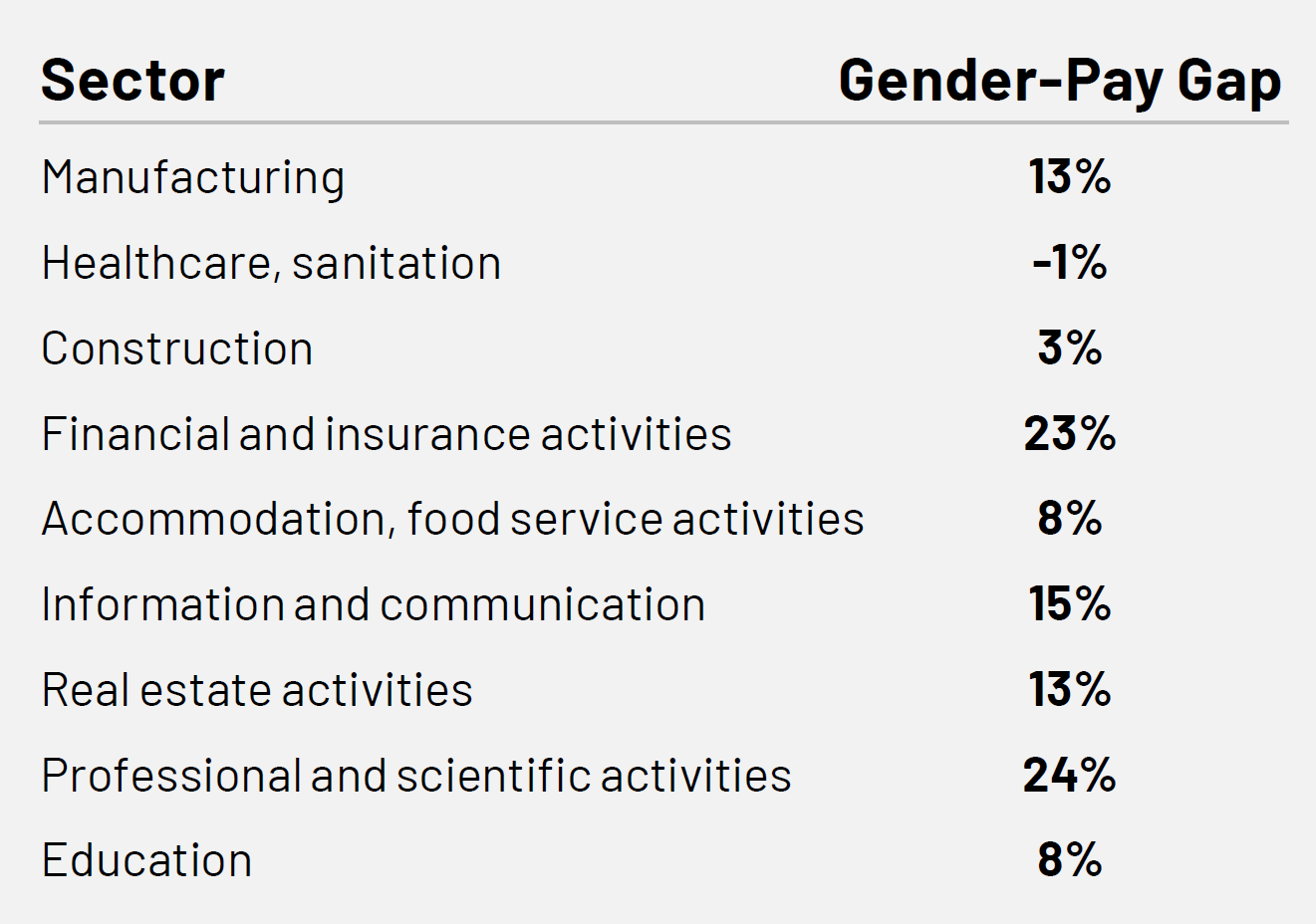

As such, the income gap of women’s hourly wages in Italy’s private sector was quantified to be around 11% greater for men than for women across sectors (see Figure 1) – (Banca d’Italia, 2023). The income gap directly translates into a pension gap, leaving women with lower retirement income compared to men. Having lower inflows than men as they enter their older age requires women to adopt a more long-term view to strengthen their financial position.

Women’s investing behaviour tend to reflect this reality by displaying traits of higher risk averseness, relative under-confidence, and thereby displaying a higher propensity to save. According to CONSOB’s report on financial investments of Italian Households conducted in 2022, women were found to be more prone to both planning and saving , with 74% of the women respondents showed to be risk averse (compared to 67% of men) and 40% of women displayed under-confidence (compared to about 30% of men).

Also adding to this challenge is women’s greater longevity – estimated to be over 4 years more compared to men in Italy as of 2023 (WHO, 2023 ). The combination of lower earnings, higher risk aversion, and increased longevity places women at a higher risk of financial shortages in their old age, thereby exacerbating an already strong reliance on savings to stretch further and sustain expenses. Whereas higher lifetime savings provide a buffer, not investing those savings in the most appropriate way can potentially exposes women to risks of wealth losing its value over time.

A largely untapped wealth opportunity

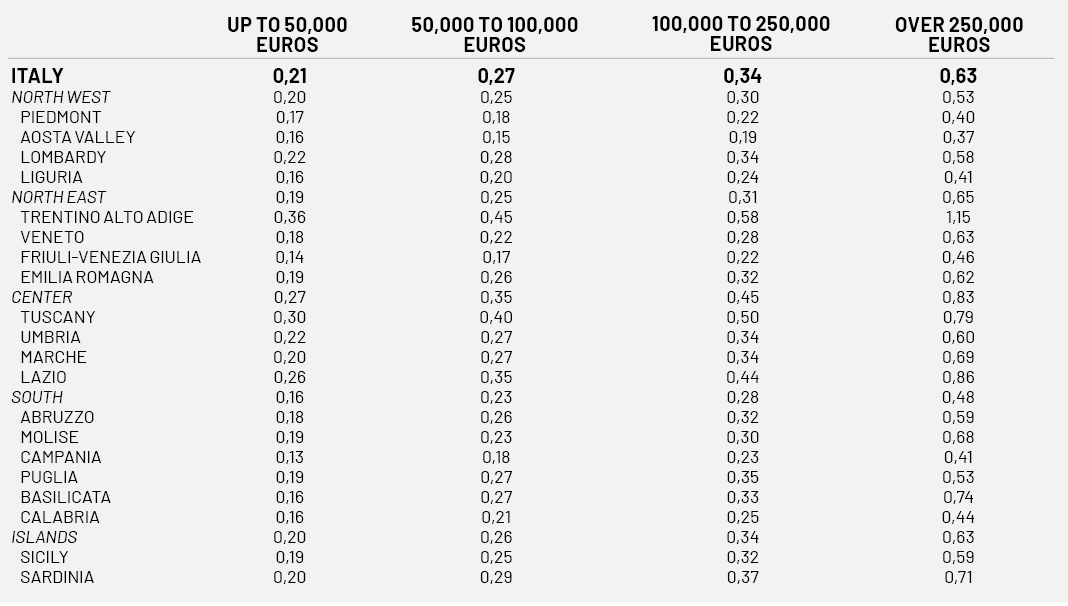

One way to empower women towards the late stages of their career/retirement is to provide returns to their savings by supporting them in their investment journeys. As analysed from national surveys from CONSOB and data from Banca d’Italia, women in Italy represent a significant pool of potential investors, given their propension to saving. Although there is not an official number, we calculate that in Italy there might be roughly 400-450 billion EUR of liquidity in current accounts held by women). This is a massive source of untapped capital that women could leverage also considering the different interest rates applied on current accounts which are definitely not offset by inflation – see figure 3 (FABI, 2024).

Source: FABI, 2024. Data as at 11/10/2024

In our view, women investors have two clear characteristic traits, compared to their male counterparts:

- First, the tendency to invest with a long-time horizon and with a focus on value-oriented themes, to make up for the income gap.

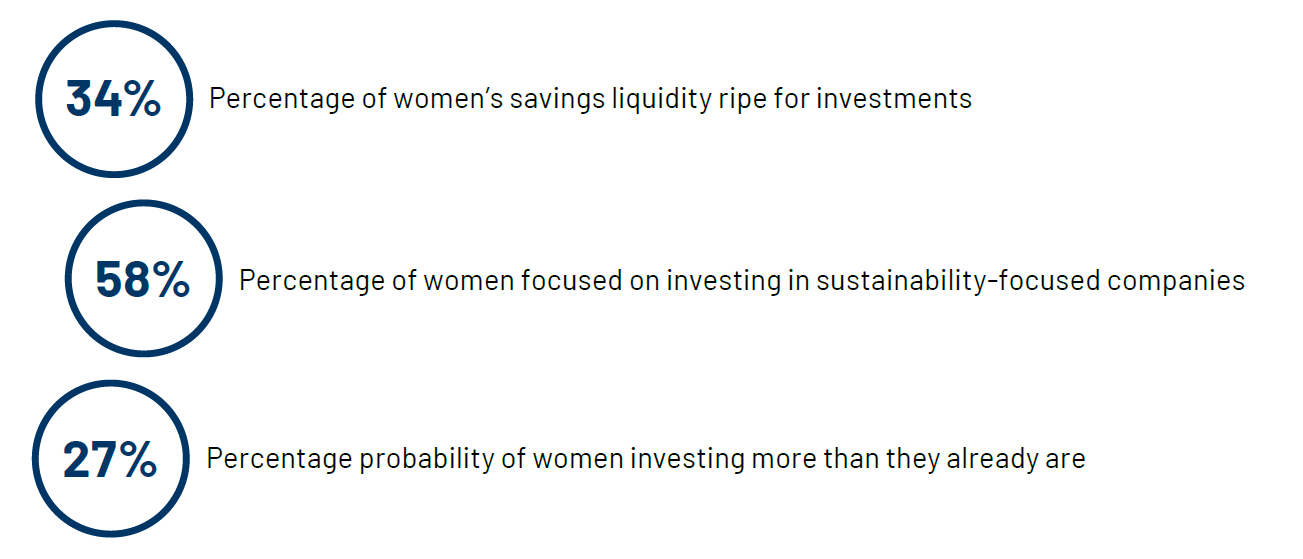

Research shows that women tend to adopt more cautious, well-researched investment strategies than men and are less likely to change course during market volatility. They also prioritize value-aligned investments, particularly those focused on sustainability. A 2022 JP Morgan survey found that 58% of women strongly supported investing in sustainability-focused companies, making them well-suited for long-term sustainability strategies (see figure 4).

- And second, the need for higher returns over the investment horizon, to be able to sustain living costs together with growing the savings.

Source: JP Morgan Asset Management, 2022. Data as at 11/10/2024

Given income and pension disparities, we see that women’s wealth could be best utilised in assets with higher returns, such as equities, which offer growth potential to offset inflation and close income gaps despite higher risks. Professional guidance on managing risk could help address women’s risk aversion, an area institution should focus on. Equities also provide liquidity, which is valuable for managing unpredictable costs in older age.

Where sustainable equities can bridge the gap

We believe that certain equity strategies with a rigorous long-term sustainability backbone might be a solution for having both higher yield returns and strong value-alignment. Algebris Investments has always been at the forefront of responsible investments fully embracing the growing importance of assessing and engaging ESG in its investment processes and wider activities.

Source: Algebris Investments (2023). Data as at 10/14/2024. The use of the Index is for illustrative purposes only and it is not directly comparable with Algebris Investments’ sustainable strategies.

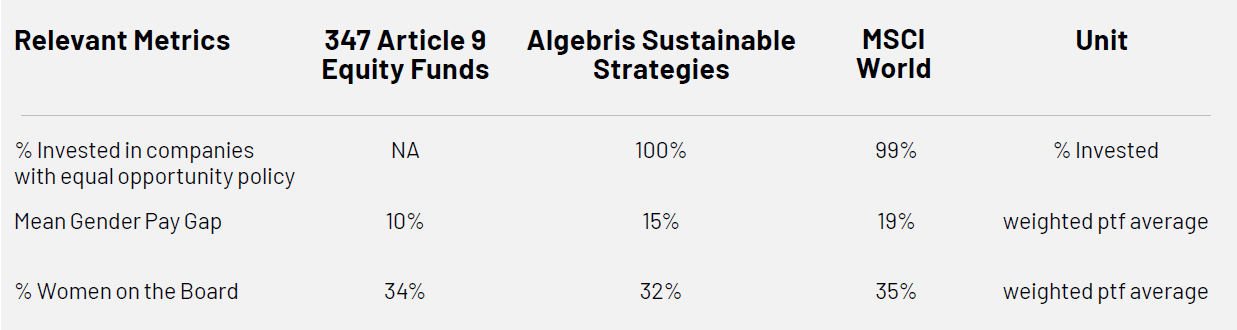

Sustainable equity funds, for example, dually focus on the underlying fundamental performance of the companies they invest in, as well as monitoring various environmental, social and governance standards. These include performance indicators on women equality in the workplace, whether quantified through the perspective of mean gender pay gap or the presence of equal opportunity policies supporting women throughout their careers, shown in Figure 5. Therefore, this is one of the asset classes that matches both sustainability performance and positive returns goals, while also improving the status quo.

In conclusion, we strongly believe when people choose to invest in companies that prioritise gender pay equality, they automatically help to kickstart a positive cycle for change encouraging companies to maintain and improve gender equity practices, report better metrics over time, and ultimately diminish disparities in the workplace. This virtuous cycle enables women to actively address the root of the problem, while benefiting from the financial growth that equity investments provide and strengthening their current financial position.

This document is issued by Algebris Investments. It is for private circulation only. The information contained in this document is strictly confidential and is only for the use of the person to whom it is sent. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Algebris Investments is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

This document is being communicated by Algebris Investments only to persons to whom it may lawfully be issued under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 including persons who are authorised under the Financial Services and Markets Act 2000 of the United Kingdom (the “Act”), certain persons having professional experience in matters relating to investments, high net worth companies, high net worth unincorporated associations and partnerships, trustees of high value trusts and persons who qualify as certified sophisticated investors. This document is exempt from the prohibition in Section 21 of the Act on the communication by persons not authorised under the Act of invitations or inducements to engage in investment activity on the ground that it is being issued only to such types of person. This is a marketing document.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© 2024 Algebris Investments. Algebris Investments is the trading name for the Algebris Group