Our core focus since 2006

Our core focus since 2006

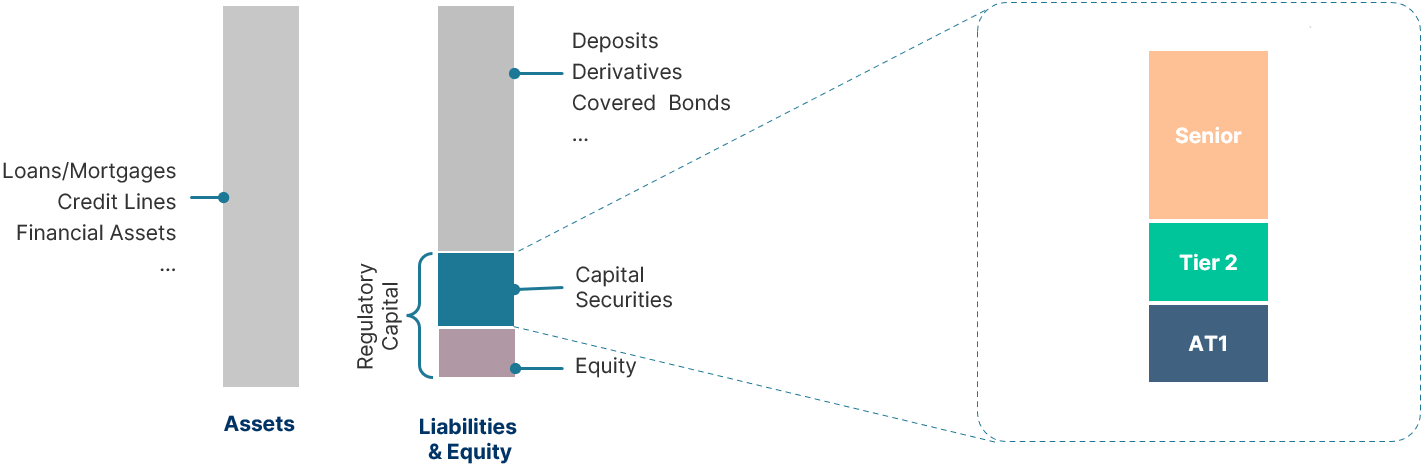

Since 2006, financials have been at the core of our expertise. Over nearly two decades, we have developed a deep understanding of the sector, enabling us to navigate its complexities with precision and insight. Our approach extends across the entire capital structure, from equity to debt to AT1 bonds, providing a holistic perspective that allows us to identify opportunities and mitigate risks effectively. Our financial sector expertise allows us to value global financial institutions against metrics that are often ignored, including regulatory changes, institutional complexity, leverage, volatility, and dispersion of returns. This historical focus has allowed us to build a track record of delivering value to clients, leveraging our deep industry knowledge, with a particular focus on subordinated debt and systemic financial institutions.

We believe that the global financial sector offers an abundant source of investment opportunities in the medium to long term given its size, diversity, and complexity. Highly complex regulations and business models differ substantially from non-financial companies which raises barriers to entry from a research perspective, creating an edge for specialists over generalists. We believe that the global financial services industry offers attractive investment potentials. Our team is able to find alpha opportunities in the complexities of the banks’ capital structures that are not seen or understood by generalists. Algebris is recognized for its contributions to the global regulatory oversight to the financial sector, which provides us with profound insight into the direction of financial sector regulation and its effect on bank capital across equity and credit. The increasing regulatory oversight in the past decade has resulted in more transparency into the bank balance sheets for G-SIFI. Because regulation has shaped the financial subordinated debt market since the 2008 financial crisis, active participation in the regulatory debate has been key to our success in the asset class. Our financial sector expertise allows us to value global financial institutions against metrics that are often ignored, including regulatory changes, institutional complexity, leverage, volatility, and dispersion of returns.

A highly specialised and experienced team covering the sector allows us to have full understanding of banks’ balance sheets and identify alpha opportunities in the complexities of their capital structure.

The Algebris UCITS Funds plc – Sub-Funds (the “Funds”) are sub-funds of Algebris UCITS Funds plc (the “Company”) an investment company with variable capital incorporated with limited liability in Ireland with registered number 509801 and established as an umbrella fund with segregated liability between sub-funds pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) 2011. Algebris Investments (Ireland) Limited is the UCITS Management Company of the Funds. Algebris Investments (Ireland) Limited is authorised and regulated by the Central Bank of Ireland. Algebris (UK) Limited is the Investment Manager, Distributor and Promoter of the Funds, except for the Algebris Core Italy Fund, Algebris Sustainable World Fund and Algebris Strategic Credit Fund Limited for which it only acts as Distributor and Promoter since the Investment Manager is Algebris Investments (Ireland) Limited. Algebris (UK) Limited is authorised and regulated in the UK by the Financial Conduct Authority. The fund administrator is BNP Paribas Fund Administration Services (Ireland) Limited and the fund depositary is BNP Paribas Securities Services Dublin Branch.

The value of shares in the Funds (“Shares”) is not guaranteed and the value of such Shares can reduce as well as increase and therefore the return on investment in the Shares will be variable. Changes in exchange rates may have an adverse impact on the value price or income of the Shares. The difference at any one time between the sale and repurchase price of Shares means that the investment should be viewed as medium to long term. Past Performance is not a reliable guide to future performance. Neither past experience nor the current situation are necessarily accurate guides to the future growth in value or rate of return. The strategy employed by the Funds may result in the NAV exhibiting a high level of volatility and therefore may be subject to sudden large falls in value, and, if it is the case, investors could lose the total value of the initial investment. Income may fluctuate in accordance with market conditions and taxation arrangements. Changes in exchange rates may have an adverse effect on the value price or income of the product. The performance data do not take account of the commissions and costs incurred on the issue and redemption of units.

The Company has issued a Prospectus and Key Investor Information Document (“KIID”) /Key Information Document (“KID”) with respect to the Funds, the English language version of each of which is available from Algebris Investments on request and from www.algebris.com. Where required under national rules, the KIID/KID will also be available in the local language of the relevant EEA Member State. Information relating to investor rights including information on access to collective redress mechanisms at EU Level and national level, where available, can be found in English at https://www.algebris.com/cbdr-investor-rights/. A decision may be taken at any time to terminate the arrangements made for the marketing of the Funds in any EEA Member State in which it is currently marketed. In such circumstances, Shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the Funds free of any charges or deductions for at least 30 working days from the date of such notification.

The Funds are considered to be actively managed with certain Funds being managed in reference to a benchmark. The performance data do not take account of the commissions and costs incurred on the issue and redemption of units. This document is suitable for professional investors only. Certain of the Funds may invest in contingent convertible securities. These securities have unique risks, for example, due to equity conversion or principal write-down features which are tailored to the issuing entity and its regulatory requirements, which means the market value of the securities may fluctuate. Additional risk factors associated with contingent convertible securities are set out in the Prospectus.

This is a marketing communication. Please refer to the Prospectus and the KIID/KID before making any final investment decision. The decision to invest in the Funds should take into account all the characteristics and objectives of the Funds as described in the Prospectus. More information on the Funds sustainability-related aspects is available at https://www.algebris.com/esg/.

The State of the origin of the Funds is Ireland. In Switzerland, the Representative is ACOLIN Fund Services AG, Maintower, Thurgauerstrasse 36/38, CH-8050 Zurich, whilst the paying agent is Banque Cantonale Vaudoise, Place St-François 14, 1003 Lausanne. The basic documents of the Funds as well as the annual and, if applicable, semi-annual report may be obtained free of charge from the Representative.

A potential investor expressing an interest to invest will be provided with a Prospectus, a KIID/KID and a subscription agreement (together, the “Fund Documents”) for the investment and an opportunity to review the documentation relating to the investment. Prospective investors must review the Fund Documents, including the risk factors, before making any decision to invest and should rely only on the information contained in the Fund Documents in making their investment decision.

Please see www.algebris.com/disclaimer for more important information about this document.

Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc., Algebris Investments (Asia) Pte Ltd, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© 2025 Algebris Investments. Algebris Investments is the trading name for the Algebris Group.