We think Elizabeth Warren will likely win the Democratic primaries, and may have a substantial probability of beating Donald Trump in the U.S 2020 Presidential elections. We are still at the very early stages in the race, and there is no guarantee of a Warren win, however, there could be very disruptive consequences to markets if this outcome were to materialise.

As the US and the global economy slow, we take three lessons from recent policy and political shifts around the world – pointing us in this direction.

1. Monetary policy is stretching its limits.

The unintended consequences of easing and negative interest rates are growing, like impaired banking systems and asset bubbles. The marginal impact of easing is increasingly to absorb the left tail of economic risk, but not enough to make the economy accelerate.

2. Trade uncertainty is backfiring.

Even a short-lived rise in unemployment is enough to change consumer behaviour. While financial markets stay up thanks to low interest rates, business investment on Main Street has slowed due to persistent uncertainty. History shows that three consecutive months of rising unemployment typically thwart consumer spending: so far this hasn’t happened, yet the pace of hiring has slowed. In addition, people are increasingly worried about the likelihood of a recession, as Google data shows.

3. Time is up for populists.

After a brief honeymoon with populism, voters may be shifting towards politicians with a more pragmatic framework. Greece is a case in point of a failed populist experiment, where the country lost a quarter of its GDP during the crisis and under Tspiras’ government. Following this year’s election of PM Mitsotakis, Greece is now the Eurozone country with the highest PMI, while GGB yield are now close to investment grade levels. In Italy, the Northern League and Five Star Movement, who promised free pensions and lower taxes, were sidelined by a more moderate and pro-reform coalition last summer. Ukraine is also on a positive path, as new President Zelensky has been appointed on an anti-corruption platform.

Of course, three examples do not make a trend. However, the recent decline in Trump’s popularity, vis a vis the slowdown in the US economy may suggest that American voters, too, may soon realise the inefficacy of quick-fix policies, and look elsewhere for solutions.

Elizabeth Warren is the most promising Democratic candidate, in our view, and the only one who would be able to shake up the U.S. economy from its structural issues. With Joe Biden marred by his recent corruption scandal and Bernie Sanders suffering from health issues, Senator Warren is also the most likely candidate, according to the most recent polls for the Democratic primaries.

How would the US and global economy fare under President Warren?

Most investors see a potential Elizabeth Warren win as a negative for markets and the economy. While that may be true, the long-lasting effects on growth and productivity may be positive.

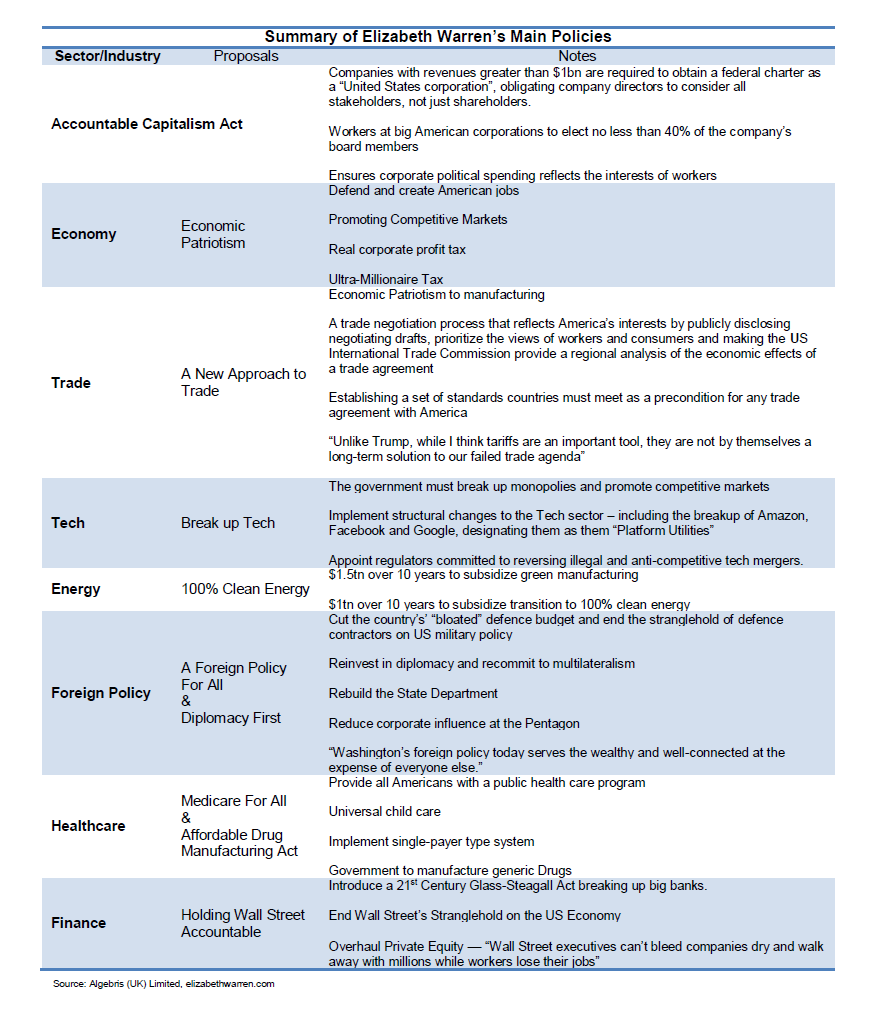

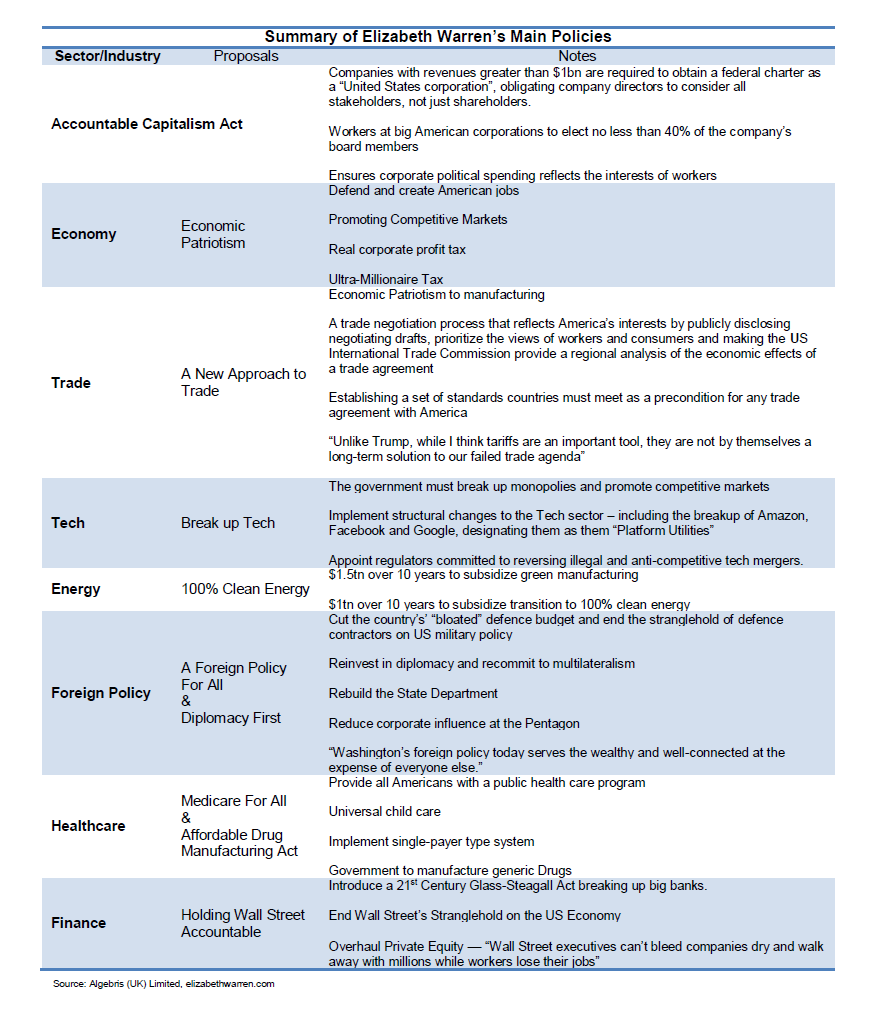

Elizabeth Warren’s economic plans focus on pre-distribution as well as redistribution, on rebalancing the economic system to improve long term productivity and reduce inequality.

She favours the break-up of monopolies, including in the finance and tech industries, which have been a strong contributing factor to the decline in productivity over recent decades (see also The Myth of Capitalism). At the same time Warren would promote investment in infrastructure, where the U.S. spends less than Europe and China, education, and would introduce a wealth tax on the richest households.

While feared on Wall Street for her tax proposals, we think this package of measures could actually have positive long term consequences (see also Central Banks have broken Capitalism).

The result may be a mirror image of Trump’s presidency, which started with a sugar-rush fiscal stimulus, but ended with little progress on structural reforms, infrastructure investment and trade.

Which President would China prefer to deal with?

There are two schools of thought on whether the Chinese may prefer to deal with President Trump or President Warren ? and what this means for trade negotiations.

On the one hand, some believe that a weakened President Trump may be considered a “paper tiger” by the Chinese, and that China’s incentive may be not to give an inch to Trump now, as he may not be there next year.

On the other hand, people who have been closer to the President, which we met recently in New York, believe China’s incentive may be to actually keep Trump in office ? through a small deal rather than a comprehensive one? given Warren’s tougher stance on human rights and environmental regulation.

In any case, we think a mini-deal including a delay in the October tariffs and some purchases of agricultural goods, may cause a short squeeze in markets, but will not be enough to reverse the declining trend in manufacturing and business investment.

Per ulteriori informazioni su Algebris e i suoi prodotti o per farsi inserire nella lista di distribuzuione, si prega di contattare il dipartimento Investor Relations all’indirizzo algebrisIR@algebris.com. Gli articoli passati sono disponibilii sul sito Algebris Insights

Questo documento è emesso da Algebris (UK) Limited. Le informazioni contenute nel presente documento non possono essere riprodotte, distribuite o pubblicate da alcun destinatario per qualsiasi scopo senza il preventivo consenso scritto di Algebris (UK) Limited.

Algebris (UK) Limited è autorizzata e regolamentata nel Regno Unito dalla Financial Conduct Authority. Le informazioni e le opinioni contenute nel presente documento hanno solo scopo informativo, non hanno la pretesa di essere complete o complete e non costituiscono una consulenza in materia di investimenti. In nessun caso qualsiasi parte del presente documento deve essere interpretata come un’offerta o una sollecitazione di qualsiasi offerta di qualsiasi fondo gestito da Algebris (UK) Limited. Qualsiasi investimento nei prodotti cui si fa riferimento nel presente documento deve essere effettuato esclusivamente sulla base del relativo Prospetto informativo. Queste informazioni non costituiscono una Ricerca di Investimento, né una Raccomandazione di Ricerca. Con il presente documento Algebris (UK) Limited non organizza o accetta di organizzare alcuna transazione in qualsiasi tipo di investimento, né intraprende alcuna attività che richieda l’autorizzazione ai sensi del Financial Services and Markets Act 2000.

Non si può fare affidamento, per nessun motivo, sulle informazioni e sulle opinioni contenute nel presente documento, né sulla loro accuratezza o completezza. Nessuna dichiarazione, garanzia o impegno, esplicito o implicito, viene data in merito all’accuratezza o alla completezza delle informazioni o delle opinioni contenute in questo documento da parte di Algebris (UK) Limited , dei suoi direttori, dipendenti o affiliati e nessuna responsabilità viene accettata da tali persone per l’accuratezza o la completezza di tali informazioni o opinioni.

La distribuzione di questo documento può essere limitata in alcune giurisdizioni. Le informazioni di cui sopra sono solo a titolo di guida generale ed è responsabilità di ogni persona o persone in possesso di questo documento informarsi e osservare tutte le leggi e i regolamenti applicabili di qualsiasi giurisdizione pertinente. Il presente documento è destinato esclusivamente alla circolazione privata per gli investitori professionali.

© Algebris (UK) Limited. Tutti i diritti riservati. 4° Piano, 1 St James’s Market, SW1Y 4AH.