Europe is at a crossroads. With ECB quantitative easing about to end, markets are bearing the weight of uncertainty from populist governments confronting the EU in Italy and the UK. Here is how we think things will play out.

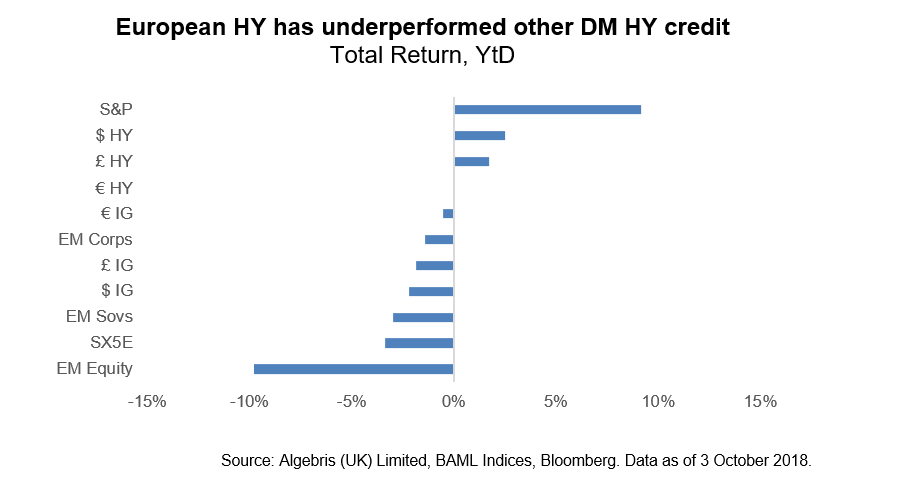

1. Divergence and opportunity. 2018 has turned out to be a year of divergence between the US and the Rest of the World. Compounded by tariffs and trade protectionism, US assets are almost the only one to have generated positive returns year to date. In credit, US high yield bonds and the energy sector in particular have been the best performer: bonds which traded at 50c on the Dollar in 2016 are today above par with little upside left.

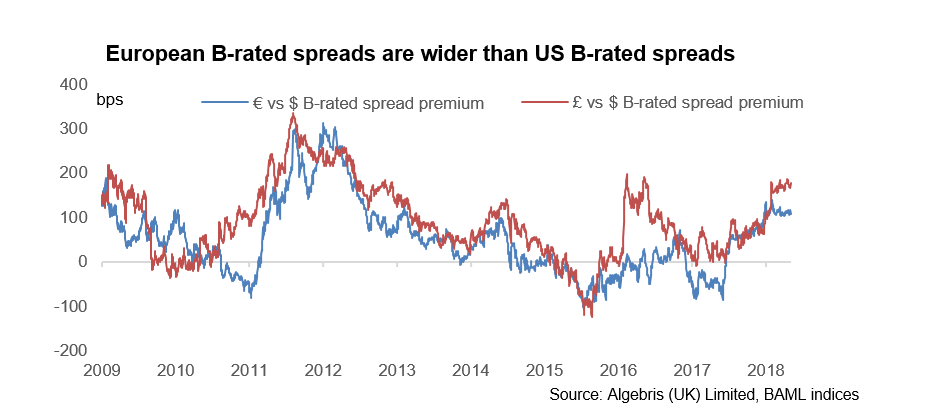

2. Credit is still tight overall, but opportunities are arising. The divergence in growth and valuations in stock and bond markets between the US and the Rest of the World is now nearing a post-crisis high. This divergence may be justified by the stronger economic performance of the US economy, as well as by binary events hanging on Europe’s future (Brexit and Italy’s new government) and China. That said, even European firms outside of the UK and Italy trade at a record premium to their peers in the US, controlling for rating quality.

3. Europe at a crossroads: Brexit and Italy. This is not the first time that Europe finds itself at an existential crossroads, and with markets pricing in elevated levels of tail risk. The management of the UK’s exit from the EU is one risk which could – in theory – create a cliff effect hurting the UK and albeit less, the European economy. Italy’s new government has adopted a stark confrontational stance with the EU, threatening to undo years of reforms and attempts to reduce the country’s high debt/GDP ratio. Both events are likely to unfold over the coming months. Investors who have been active in Europe over the last decade may remember many cases where the EU or the Euro were seen nearing the edge of a cliff, yet thanks to European institutions, the worst case scenario was eventually avoided. Is this time different?

4. Italy: looking through electoral propaganda. “In the Land of Toys, every day, except Sunday, is a Saturday” – says Pinocchio’s friend Lamp-Wick, inviting him to the party. “And if the Fairy scolds me?” “Let her scold. After she gets tired, she will stop.”

The new Italian government recently published a budget draft including a 2.4% deficit plan for 2019, accompanied by an unwind of pension reforms and generous growth forecasts. The budget was received with popular acclamation and sold as a turnaround point for Italy’s fortunes, despite rising concerns in financial markets.

As a result of the government’s confrontational stance against the EU and the Euro, many investors have moved away from Italian government paper, pushing 10-year BTP spreads as well as funding costs for Italian corporates to record highs. Needless to say, the budget’s growth assumptions are unrealistic, in an environment where Europe and the global economy are both slowing.

That said, electoral promises have to be put into the right context: the governing coalition is made of the Northern League (NL), representing votes from the industrial North, and the Five Star Movement (5S), which won heavily in the South. The two parties have had very different agendas: NL promised to fight immigration and lower taxes, 5S promised universal basic income and job growth.

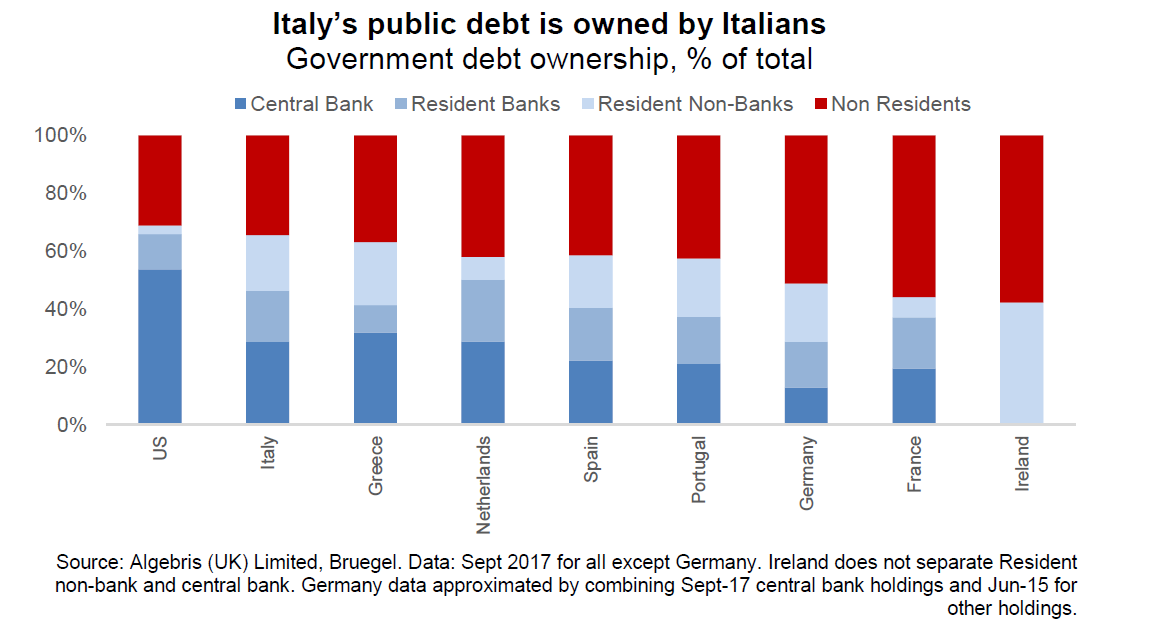

Today, short-term bonds as well as CDS markets price a high probaility of re-denomination/exit risk, and 10-year Italian BTPs trade only 90bp tighter than Greek GGBs. We think short-term exit risk is overstated. Italy remains a country in current account surplus and with nearly 70% of its debt owned by domestic institution. The real risk is for Italy to accumulate further additional debt of a potential economic slowdown ahead. Italy’s public debt currently stands at 132% of GDP: any slowdown in growth worse than -1% a year could push debt/GDP near 140%.

In Collodi’s book, Pinocchio breaks away from his friend Lamp-Wick, escapes the Land of Toys and is finally saved by his master. Italy’s governing coalition is fragile and Matteo Salvini, initially a minority partner, has proven to be its real leader. One likely scenario is that the coalition between the Five Star Movement and the Northern League will eventually break, perhaps after European elections. This means the next government may be a centre-right coalition led by the NL, with a business-focused agenda. In this context, the proposed three-year measures should be seen as expensive electoral propaganda, rather than a long-term plan.

5. Kick-The-Can Brexit. Our expectations are for a kick-the-can Brexit extension deal, though the journey to an agreement will likely be volatile. We think either Brexit extremes – a Hard Brexit or Soft Brexit – are unlikely at this stage of the negotiations. A Soft-Brexit deal would be rejected by pro-Brexit Conservative MPs while a Hard-Brexit deal would be rejected by both Labour and pro-EU Conservatives. We expect a final deal will likely include an extended transition period during which the UK would remain in the customs union(see alsoThe Silver Bullet | Introducing the Brexit Walrus).

6. Tail risks vs European institutions. As we have seen before, market prices imply a relative risk premium for European assets as elevated as in 2011. We think this is exaggerated. In part, this is due to a structural underweight from global investors as well as the difficulty to price political binary events. That said, European institutions have evolved and are potentially stronger than they were at the start of the crisis. The ESM, for instance, still has nearly €500bn of firepower and the OMT is available to countries asking for help, albeit with conditionality, in addition, the ECB recently signaled some flexibility to twist the duration of its reinvestment programme.

7. ECB normalisation. To make things more difficult, the ECB will soon reduce its quantitative easing purchases and has guided a rate hike next summer, which should gradually move interest rates up from -0.4%. We have long argued how the exit sequencing in Europe should have been different than in the US, where financial markets make up a larger part of financing. In our opinion, the ECB should normalise deposit rates first rather than ending QE, helping bank profitability and lending to the real economy in the periphery (without fearing the impact of a higher currency on exports, which are most sensitive in Germany). But the normalisation path is set, and perhaps ending QE purchases too quickly, it may contribute to some volatility in bond markets. That said, experience in US markets shows that credit spreads and rates volatility reacted before the end to Fed purchases, and calmed down thereafter.

8. What about China and EM? In the IMFs latest Economic Outlook, 2019 global growth was lowered, especially amongst EM countries. The IMF have attributed weaker EM growth partly to idiosyncratic risks (Argentina, Turkey) and partly to the rise in trade tariffs – China’s 2019 growth was revised lower by 0.2pp. In our view, EM risks remain skewed to the downside. We think that positive market momentum from China’s reserve requirement cut or Brazil’s left-wing parties losing ground, may be eclipsed in the short-term by stronger macro forces including rising US real rates and further escalation of trade-wars. In our view, trade wars will persist into early next year, even if Democrats win a majority in Congress, given popular backing of trade wars amongst US voters.

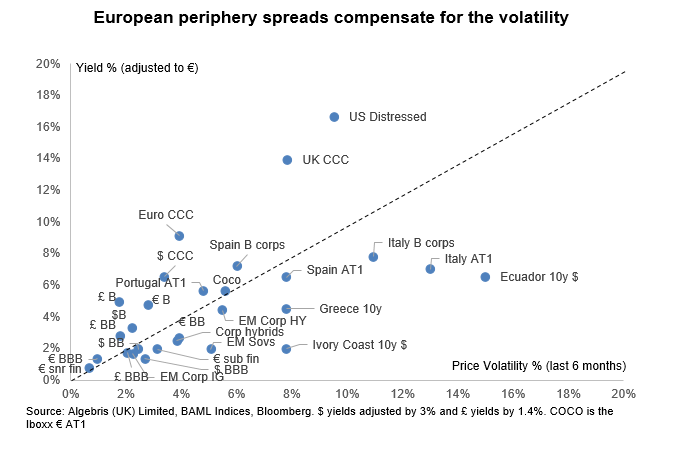

9. Do investors get paid enough for European risk? Assuming investors want to take a contrarian positive view on Europe the question is whether they can withstand a volatile mark-to-market over the coming months. The chart below shows the yield premium, adjusted by currency, for a sample of investment grade and high yield rated bonds, comparing with annualised volatility over the past 6 months. Despite a volatile price action, medium and short-term maturities in Euro and Sterling high yield appear attractive in comparison to emerging market debt.

10. What are we doing? We do not know when the bottom will come for European and non-US assets more generally. However, we do see elevated signs of investor fear, which makes us more positive about the potential for an opportunity. If Europe survives over the coming quarters and the binary events of Italy and Brexit get resolved through a compromise and an extension, respectively, then holders of European credit will get paid very well to wait.

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

This document is issued by Algebris Investments. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.