The QE party is ending. Last year’s Goldilocks global expansion has left the way to an environment of divergence, where the US continues to outperform the rest of the world and the Federal Reserve is the only central bank no longer behind the curve on policy normalisation.

At the beginning of the year, we prepared for an environment of benign divergence, where the distribution of global growth would become increasingly skewed in favour of the US, yet still remain positive elsewhere. Today, this is worth reconsidering. While our base case scenario is still positive, volatility is returning to markets, and one by one some of the most vulnerable economies are being tested: Argentina and Turkey in emerging markets, Italy and Spain in developed markets.

Are these crises idiosyncratic events, or signs that the global recovery is about to turn into a broader slowdown?

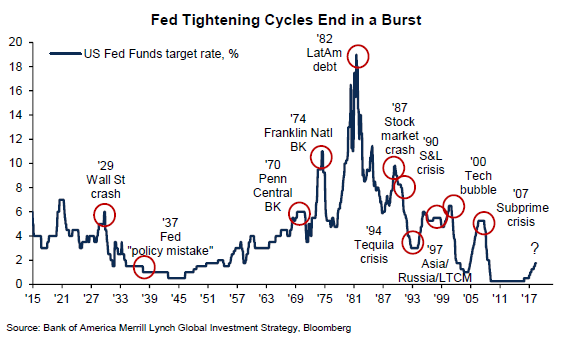

The standard explanation for the repricing in risk premia we are experiencing is the withdrawal of central bank liquidity by the Federal Reserve. Historically, this has coincided with unwind of carry trades and bursting of financial asset bubbles, as shown below.

That said, there are peculiar characteristics which make this tightening cycle different from others: asset overvaluation, rising wealth inequality and misallocation of resources resulting from persistent low/negative interest rates. On the one hand, we believe these overhangs will make withdrawal of stimulus trickier for central bankers. On the other hand, they will make a potential future slowdown more difficult to navigate for investors.

Why are financial markets more fragile?

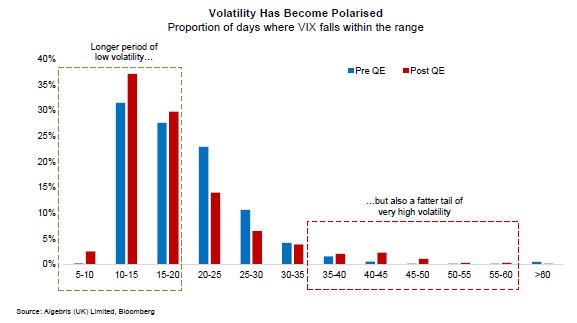

With asset prices influenced by central bank demand and investors accustomed to ten years of extraordinary stimulus, we have evidence of increased fragility. One area of fragility is trading liquidity in equity and bond markets, which has become scarcer as asset managers have taken higher risks and banks have re-trenched due to tighter regulation. Since 2007, equity and bond markets have experienced at least eight flash crashes. While the median level of volatility is lower than the pre-QE period, the magnitude of volatility shocks is larger. Put differently, markets are alternating between longer periods of calm and sharper, more sudden shocks. Adding to the lack of trading liquidity and polarisation of volatility shocks are passive and quantitative-driven trading flows, which now account for over half of all equity trading flows, and which can also exacerbate downward moves. Scarce liquidity and herding both act as feedback loops, amplifying shocks in what H. Minsky first described as financial fragility.

If financial markets are more fragile, they are also still linked to the economy. Monetary easing relied on a positive wealth effect from rising asset prices, as the BIS has pointed out in several papers. The question is whether asset price shocks may eventually defeat the initial purpose of monetary easing, and push policymakers to lower interest rates again.

How would a slowdown look like this time around?

No one owns a crystal ball predicting markets and the economy. Our base case scenario is for growth to continue to be positive, as confirmed by recent data in Europe and the US, and for inflation to move towards its target in the US and (more slowly) in other developed economies. However, after one of the longest recoveries in history, it is useful to run a hypothetical exercise.

We imagine how a slowdown would hurt the economy, think about policymakers’ reaction functions, and draw investment conclusions. There are some key differences between today and 2007:

1. Monetary ammunition is limited. Even though the Federal Reserve has some room to normalise policy, other central banks are having a much harder time due to still-high youth unemployment and high periphery spreads (ECB), low inflation (BoJ), a property bubble and the stagflationary effects of Brexit (BoE). The risk is that some of these central banks may have entirely missed the exit train, as we discussed in our last Silver Bullet.

2. Debt overhangs remain large. US high yield corporate debt ($2tn); UK consumer debt (£300bn); sovereign debt in Italy, Portugal and Greece; local debt in China are some of the largest debt overhangs which have either remained large or grown during the crisis. However, leverage has also grown in countries which were previously considered safe havens, and that lived through the crisis largely unscathed. These include Sweden and Canada, where property markets have risen exponentially together with household and bank leverage, and Australia, whose dependence on China’s economy and commodity exports combines with property overvaluation.

3. Policymakers’ reaction functions are likely to be more extreme and idiosyncratic, depending on each country’s political environment. Put differently, we think any global slowdown in growth is unlikely to be met by a coordinated emergency monetary policy stimulus. Instead, each country will likely calibrate a fiscal reaction depending on its available headroom, but also on economic and social issues. In the UK, for instance, should Labour win the next General Election, then universal basic income and monetary financing of infrastructure may be raised on the agenda, helping to reduce record-high inequality and low real wages. The Eurozone’s situation is far more complex. One ideal response could be for core European countries to use accumulated fiscal reserves to stimulate growth and build much-needed infrastructure and defence capabilities. Italy and Greece, however, which have suffered a relative disadvantage from high currency levels and still not completed all the necessary reforms, may be tempted to use pro-growth measures beyond the point of fiscal sustainability.

What has changed across policymakers’ reaction functions?

One common fallacy for economists is to consider only aggregate variables for growth, debt, unemployment, and so on. The wave of quantitative easing liquidity did not lift all the boats equally: as it retreats, some will have benefited a lot more than others. The distribution of wealth, unemployment and growth today is different vis-à-vis what it was before QE. The gap between the haves and have-nots, large cities and rural peripheries, and between the old and the young has widened. While this has benefited luxury goods firms, it has also generated a general desire for political change. Protest politics are spreading, and after the US and UK, Italy and Spain have also switched to coalitions for change, promising far-reaching policies at little cost for the electorate.

As we wrote over the past years (The Silver Bullet | Investing in Times of Populism), the political move towards a much needed redistribution of wealth and opportunity makes a repeat of monetary stimulus unlikely, as a one-size-fits all tool to fight future economic slowdowns.

1. Monetary policy is likely to become more constrained and less independent. It has already become visible in some emerging markets (e.g. Turkey), but the same could happen in developed markets, as per the QE for the people initiative in the U.K.

2. Fiscal policy is likely to produce larger deficits, with a focus on wealth redistribution and support for poorer households. Italy’s proposals for a flat tax and universal basic income are a case in point.

3. International relations are likely to become more conflictual. We are experiencing trade renegotiations between the US and Europe, NAFTA and China. The potential for this to escalate into a trade conflict or a global trade war should not be underestimated. Geopolitical risk is also likely to stay high, with OPEC countries needing higher oil prices to diversify their economies, and Israel-Iran tensions likely to continue.

How can investors navigate this environment?

Since the end of last year, we flagged that policy normalisation by the Federal Reserve could come in tandem with renewed volatility in markets. As a result, we have gradually shifted our portfolio construction in the following direction:

1. Better liquidity. We have reduced the amount invested in cash bonds and substituted derivatives, including credit default swaps, as a tactical long (or short) instrument.

2. Barbell strategies and dry powder. We have increased the amount of liquid ‘dry powder’ instruments, creating a barbell between risky and risk-free assets.

3. Shorts. We have increased our directional shorts vs. what we think are some of the weakest firms and economies. We think Emerging Market debt remains vulnerable to a repricing, particularly in Brazil and Mexico, both of which face elections this year. Triple-B rated corporate bonds which have benefited from ECB purchases may also widen.

4. Tail hedges. We have increased the amount of hedges for bigger tail events, using convex instruments like mezzanine tranches or options contingent on a change in correlation regime, for example between currency and equities, or between equities and interest rates.

Our Macro Credit Fund remains biased towards positive yield positions across the remaining attractive areas of macro and credit markets, while hedging risks and at times switching to a net short exposure.

On June 1st, 2018, we launched the Algebris Tail Risk Fund, a strategy dedicated to offering investors protection in market shocks, which will leverage and expand our macro short positions.

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

This document is issued by Algebris Investments. It is for private circulation only. The information contained in this document is strictly confidential and is only for the use of the person to whom it is sent. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Algebris Investments is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

This document is being communicated by Algebris Investments only to persons to whom it may lawfully be issued under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 including persons who are authorised under the Financial Services and Markets Act 2000 of the United Kingdom (the “Act”), certain persons having professional experience in matters relating to investments, high net worth companies, high net worth unincorporated associations and partnerships, trustees of high value trusts and persons who qualify as certified sophisticated investors. This document is exempt from the prohibition in Section 21 of the Act on the communication by persons not authorised under the Act of invitations or inducements to engage in investment activity on the ground that it is being issued only to such types of person. This is a marketing document.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© 2018 Algebris Investments. Algebris Investments is the trading name for the Algebris Group.