QE infinity is here to stay. This month, the ECB and the Fed will make a renewed push towards monetary easing, restarting bond purchases and cutting interest rates further. Will it work? Unlike what looked like a heroic last stand in 2008, when central bankers prevented a deeper crisis, the latest effort in monetary easing appears more like a pyrrhic victory.

In fact, the limitations of QE are becoming clearer to central bankers themselves. At the recent Jackson Hole conference, RBA Governor Lowe said in his remarks that monetary policy can’t drive long-term growth, and that relying on monetary policy risks further increases in asset prices in a slowing economy, which is an uncomfortable combination.

Since the launch of the second and third QE, we have been arguing that persistent low interest rates and asset purchases may create a QE Infinity Trap, where the benefits of low rates and asset purchases are gradually overshadowed by a number of collateral effects. These include resource misallocation, increased corporate oligopolistic behaviour and loss of competition, reduced productivity, increased fragility and the blowing-up of asset bubbles in the financial system. As a result of these effects, called euphemistically as non-linearities by economists, exiting QE becomes harder, as we saw last year: far from watching paint dry.

Evidence showing that low interest rates and asset purchases are either less effective or counterproductive is multiplying. A recent paper analysing lending activity in 33 OECD countries shows that it decreased where negative rates were applied. An upcoming study by the Kansas City fed suggests that negative rates may make liquidity traps worse, while the San Francisco Fed has suggested that they are historically ineffective for pushing inflation expectations back up, once they have flattened. The Bank for International Settlements has long argued that monetary policy may be ineffective at low rates, and that low interest rates may be self-reinforcing.

If easing policy has become less effective, why are central bankers coming back to it? The short answer is that it’s the only policy tool available now. The long answer is that it’s very hard for an economy to get out of negative rates and QE, once it has been stuck with it.

In the near term, easing policy remains the only tool available, since the U.S. administration is far from a resolution of trade tensions with China, which span from the distribution of supply chains to intellectual property. In Europe, discussions of a green fiscal stimulus from Germany appear far from any substantial targets, despite the country is now getting paid nearly 1% to borrow.

The second point is more troubling: low interest rates may actually become addictive, because of the collateral effects they cause, as Larry Summers in a recent article. At a macro level, increased financial fragility means normalising rates may cause asset bubbles to pop and disrupt markets and the economy, like last year. At a micro level, low rates encourage predatory behaviour by large firms, loss of competition and productivity, as well as income inequality a recommended reading on this topic remains the Myth of Capitalism by Jonathan Tepper.

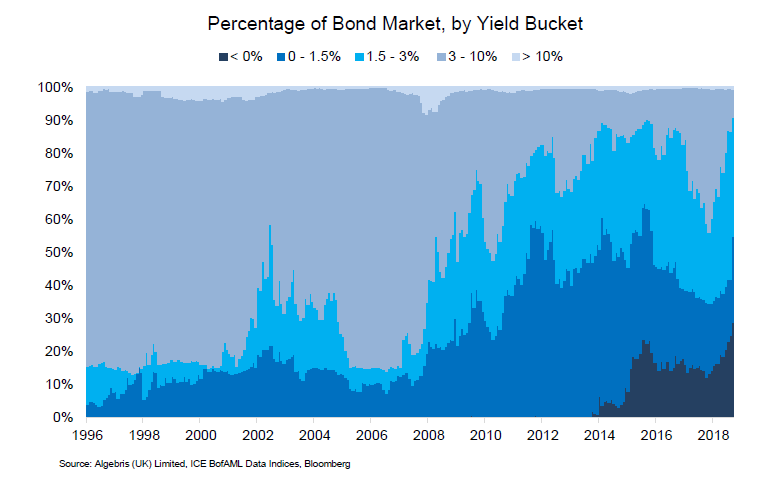

Today, only about five percent of the outstanding bonds in the ICE BofAML Global Fixed Income Markets Index yields over five percent. There are $17tn of negative yielding debt outstanding. The average pension fund discount rate is around 7.5% in the United States. Over eighty percent of UK pension funds are in a deficit, according to a report by the Pensions Regulator. The full Euro-denominated swap curve is negative.

What does this all mean for investors?

1. Low rates and QE alone will not work to re-establish inflation and growth, but they are here to stay, given increased geopolitical risk and lack of coordination on trade and fiscal policy.

2. The lower the average interest rates, the bigger the demand for positive yields may be, given ageing populations and already large gaps in the public and private pension system.

3. With sluggish growth and inflation, some of the risky, positive yield debt will become unsustainable.

For investors, this creates the opposite environment from the first QE programmes, which lifted all assets: it is now about differentiation. The weakest sovereigns and corporates are already showing that even with low rates, debt can be unsustainable: Argentina is a case in point, as well as several UK high yield rated firms which have restructured this year.

In 2016, we anticipated an environment of extreme monetary policy easing and low yields, and created an investment strategy which was able to cope with that by buying only bonds with positive or sustainable yields and avoiding or shorting countries and companies with unsustainable debt.

After a volatile 2018, our Macro Credit fund is up around 18% this year, in its Dollar share class. In the next few pages, we explain what our investment process has been so far, with some examples Argentina and Italy and where we see opportunities going forward.

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Any opinion expressed is that of Algebris, is not a statement of fact, is subject to change and does not constitute investment advice.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.