Future buildings will be structures that minimise their environmental impact and enhance the health and wellbeing of their occupants. They will use less energy, water, and materials, and produce less waste and greenhouse gas emissions than conventional buildings. They will also provide better indoor air quality, thermal comfort, and natural lighting.

As embodied by the trademark Pink Floyd tune, these buildings will not just be another brick in the wall. Rather, with their embedded efficiencies, sustainable buildings will lower utility bills, increase property value, and reduce maintenance costs. The drive towards efficiency in the building sector has the potential to create new jobs and stimulate economic growth, as these require more skilled labor and innovation than conventional buildings and offer interesting long-term opportunities for investors.

An often-ignored contributor to climate change

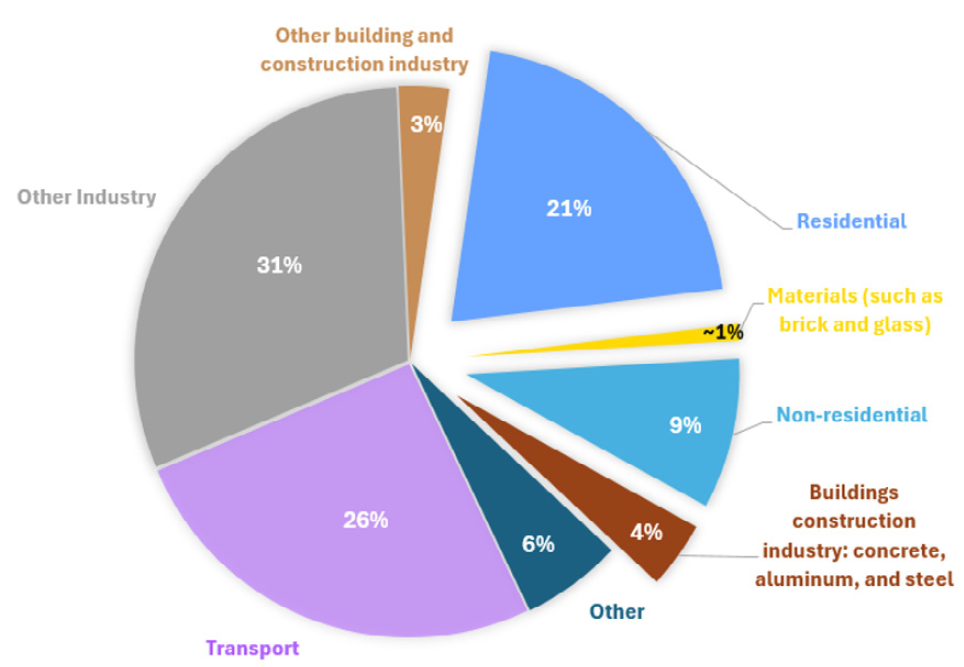

According to the UN Environmental Programme, 37% of global emissions today come from buildings, both residential and commercial. Over the last 12 years, buildings emissions have represented 9-10 Gt per year, and the share of residential to non-residential has remained stable (Figure 1). For the EU, where the stock of residential and commercial buildings is older and less efficient, the buildings sector contributes a whopping 40% to the bloc’s total greenhouse gas emissions “GHG” (EU Commission). In the US, the Environmental Protection Agency accounts that the same sector contributed about 31% of the country’s GHG emissions in 2022.

Source: IEA Building Energy Analysis 2023, Algebris Investments.

Data as at 31/12/2022

With looming global challenges, such as high energy prices coming from geopolitical instability and the need to achieve net-zero targets before climate change becomes irreversible, focusing on energy efficiency has become paramount.

Source: 2022 Global Status Report for Buildings and Construction, UN Environmental Programme, Algebris Investments. Data as at 31/12/2021

In this perspective, building materials needed to construct new buildings or refurbish old ones are just as important – and often overlooked. Globally, these account for roughly 5% of CO2 emissions (Figure 2). In Europe, building materials are estimated to contribute 20-25% of the life cycle emissions of current EU buildings. In the US, with 18% of buildings constructed before 1950, and 53% before 1980, the materials utilised and their underlying GHG footprint are also likely to be very high (Hu, 2023).

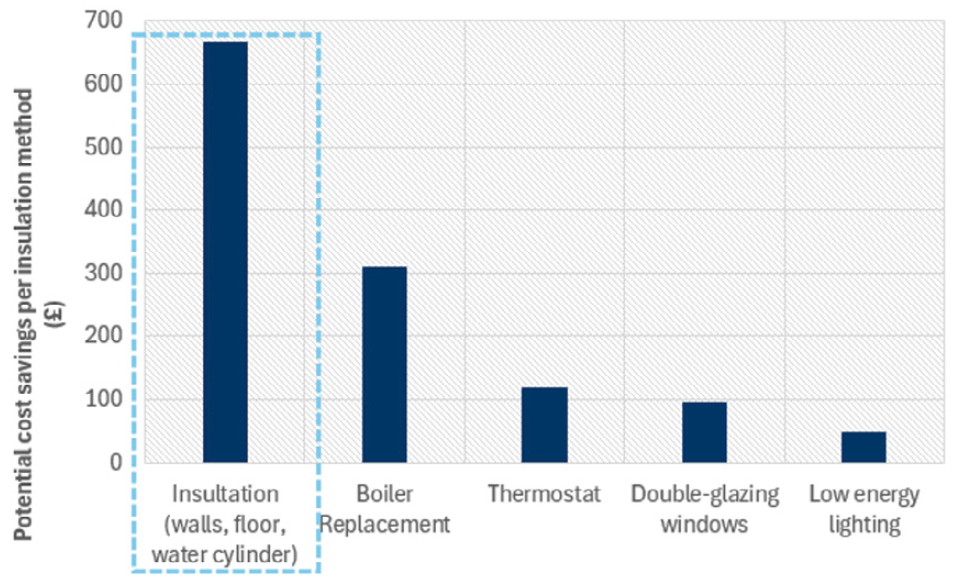

Source: UK Government, Algebris Investments. Data as at 31/12/2023

From a sustainability perspective, leveraging energy efficiency through insulation (of all kinds) is highly attractive as a decarbonisation strategy for several reasons. First, its cost-effectiveness provides fast payback periods, and offers high returns on investment. Second, it reduces overall household energy consumption by 40% according to Energy Performance Certificates, thereby lowering the demand for other decarbonisation methods such as solar and wind power. And lastly, it delivers significant decarbonisation benefits by cutting down on the overall energy footprint of the building structure.

Going a step further, we see that reducing the detrimental impact of construction by leveraging sustainable/long-lasting building materials is the clear next step to help decarbonise buildings even more.

Some governments are taking notice

Over the last three years, Europe has made a significant shift towards improving energy efficiency. While the Covid pandemic fiscal stimulus initially prompted efforts to enhance energy efficiency, it was the war in Ukraine and the subsequent increase in energy costs that really intensified the drive for energy security and independence. The US has followed suit, with many seeing the opportunity of using building renovation and appropriate construction to reduce energy intake at the source.

Europe’s commitment is embodied in recent policy initiatives, especially the Energy Performance of Buildings Directive (EPDB), as well as specific targets in the broader FitFor55 and RePowerEU packages.

- FitFor55 mandates that Member States renovate at least 3% of the total floor area of all public buildings each year, while the RePowerEU package seeks to raise the energy efficiency floor from 9% to 13% by 2027.

- The EPDB, revised and upgraded just two months ago, acts a strong support for both the energy efficiency and renovation markets. The directive mandates that all new buildings in Europe must meet zero-emission standards by 2030, with public buildings targeting a 2027 deadline.

In the United States, the policy landscape for energy-efficient building renovations has been more fragmented, with a mix of federal, state, and local initiatives.

- The Energy Independence and Security Act of 2007 and the American Recovery and Reinvestment Act of 2009 provided funding and incentives for building retrofits and energy efficiency improvements. More recently, the Biden administration’s climate and infrastructure plans in the US Inflation Reduction Act (IRA) have proposed significant investments in building upgrade programs, including tax credits up to 30%, rebates, and low-interest financing.

- At the state level, programs like California’s Energy Upgrade California and New York’s RetrofitNY have also driven progress in building decarbonisation.

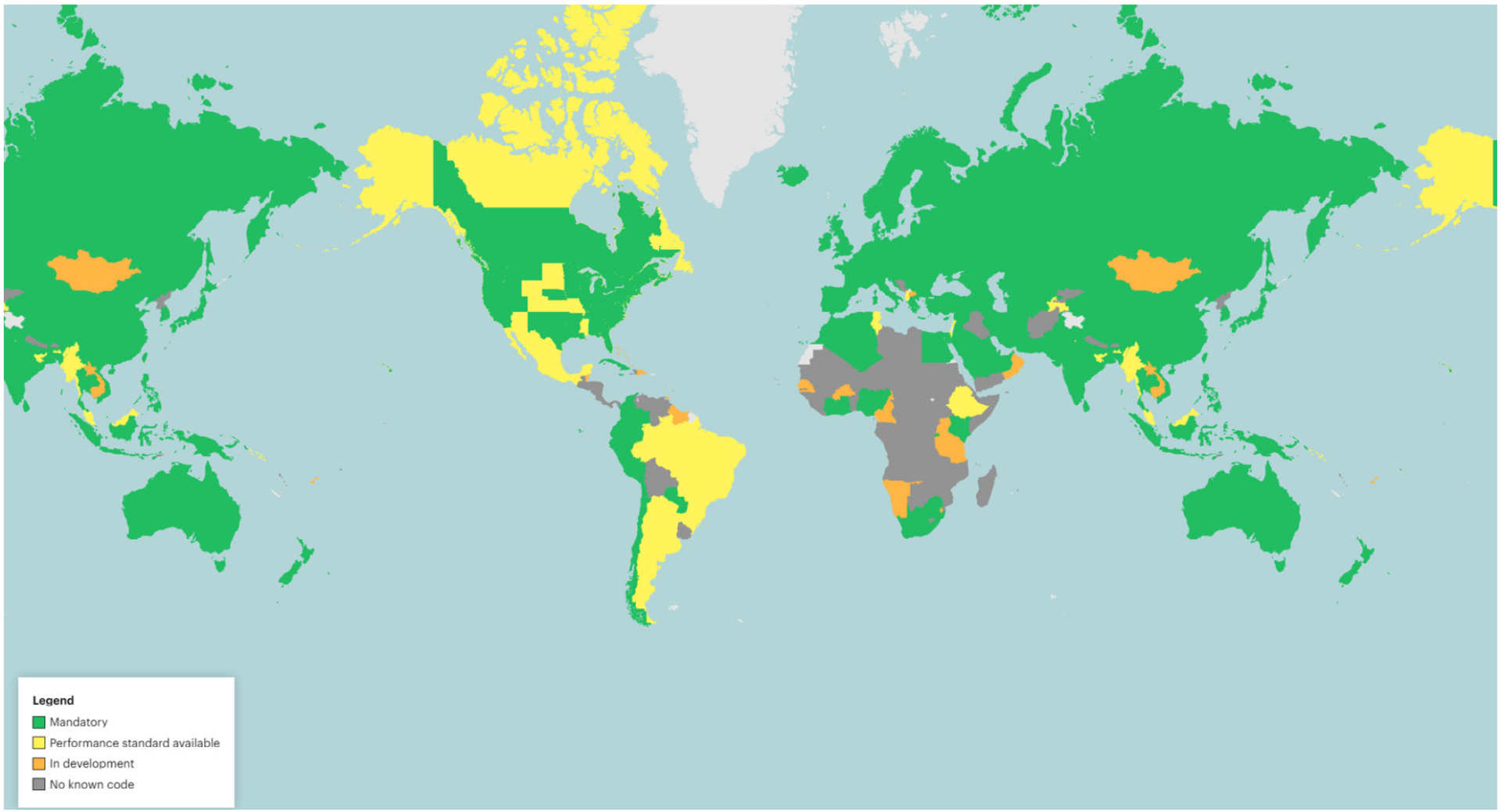

Source: IEA analysis based on UNEP (2022) Global Status Report on Buildings and Construction and IEA (2023) Energy Efficiency. Data as at 15/07/2024

While large spending packages are currently boosting the energy efficiency renovation market and therefore the likely growth of the companies operating in this space, there are many local building codes and municipal incentives that represent baseline support for the sector’s growth (Figure 4). As mandatory standards are adopted and updated, they protect these companies from downside risk and enable strong visibility in future demand trends.

In this perspective, building materials needed to construct new buildings or refurbish old ones are just as important – and often overlooked. Globally, these account for roughly 5% of CO2 emissions (Figure 2). In Europe, building materials are estimated to contribute 20-25% of the life cycle emissions of current EU buildings. In the US, with 18% of buildings constructed before 1950, and 53% before 1980, the materials utilised and their underlying GHG footprint are also likely to be very high (Hu, 2023).

Where’s the money coming from?

Together, these policies are directing government budgets and funding towards energy efficiency renovation projects, which are expected to increase the demand faced by companies that operate in this sector.

In the US, the IRA foresees a combined $369 billion in spending on clean technologies and energy efficiency. Though visibility on capital allocation is limited, the majority is composed of tax credits for residential homes. The IRA provisions a $362 million tax deduction for energy efficiency in new commercial building projects and $1 billion for the updating of local building codes and regulations.

The EU has a longer history in energy renovation investment. From 2012-1016, annual spending on renovating residential properties totalled $540 billion, of which half ($210 billion) were energy related investments. For non-residential, these figures were $228 billion and $71 billion respectively. However, today, 75% of European buildings are still highly inefficient and the EU Commission currently estimates that an additional $275 billion are needed annually for energy renovation investments so all buildings meet their Fitfor55 targets ($2.8 trillion cumulative).

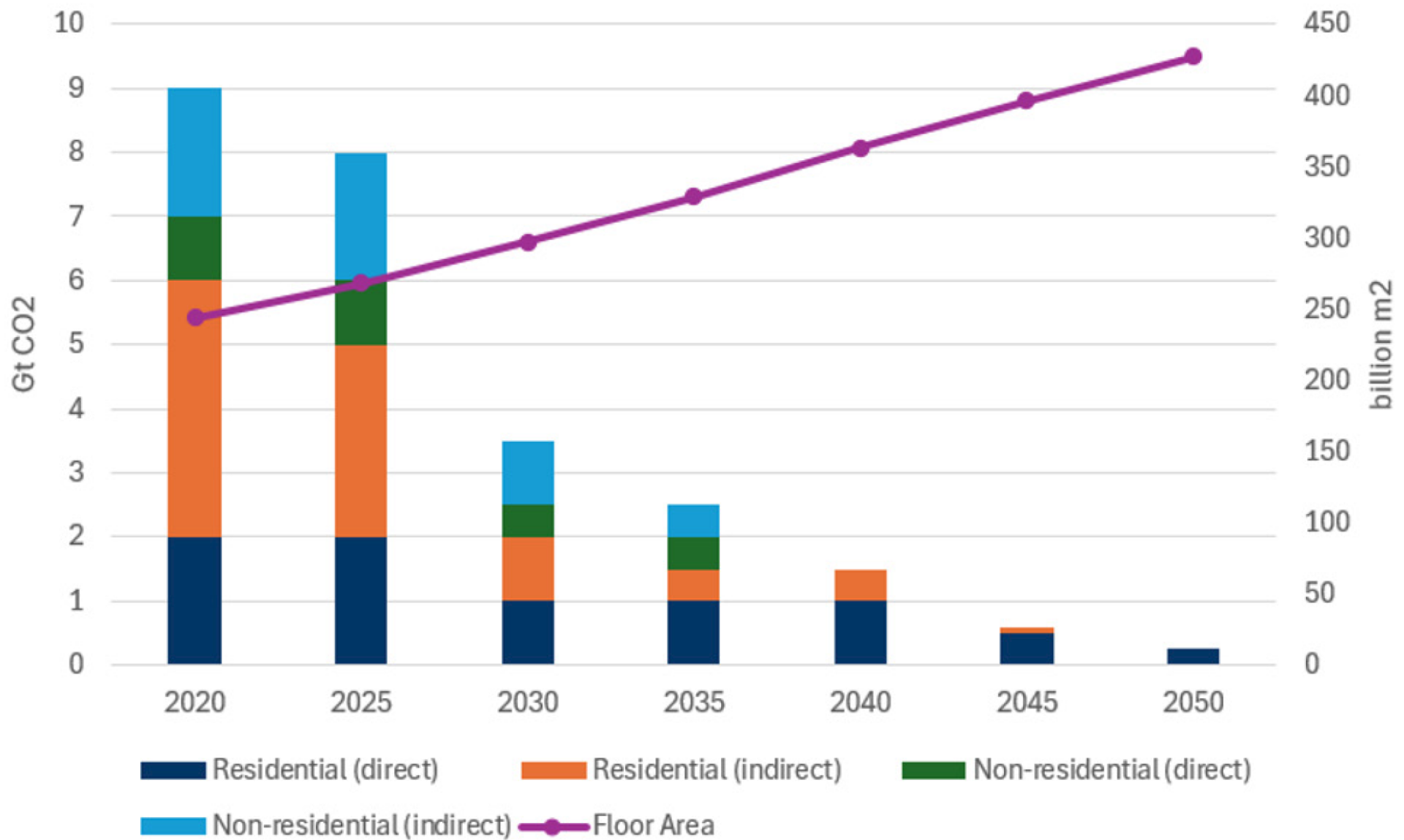

Source: IEA’s Net Zero by 2050: A Roadmap for the Global Energy Sector, Algebris Investments. Data as at 31/12/2022

At a larger scale, considering that the EU and US will try to stay within the boundary of the International Energy Agency’s Net-Zero Scenario, building emissions should follow the projected path in Figure 5. An exponential decrease in both residential and non-residential emissions, however, is hindered by increased global construction due to demographic factors such as population growth and urbanisation. Constantly increasing floor area poses a challenge to meeting these targets, but a massive opportunity for energy renovation including insulation and building materials.

Source: Buildings Performance Institute Europe. European Commission, Algebris Investments. Data as at 31/12/2022

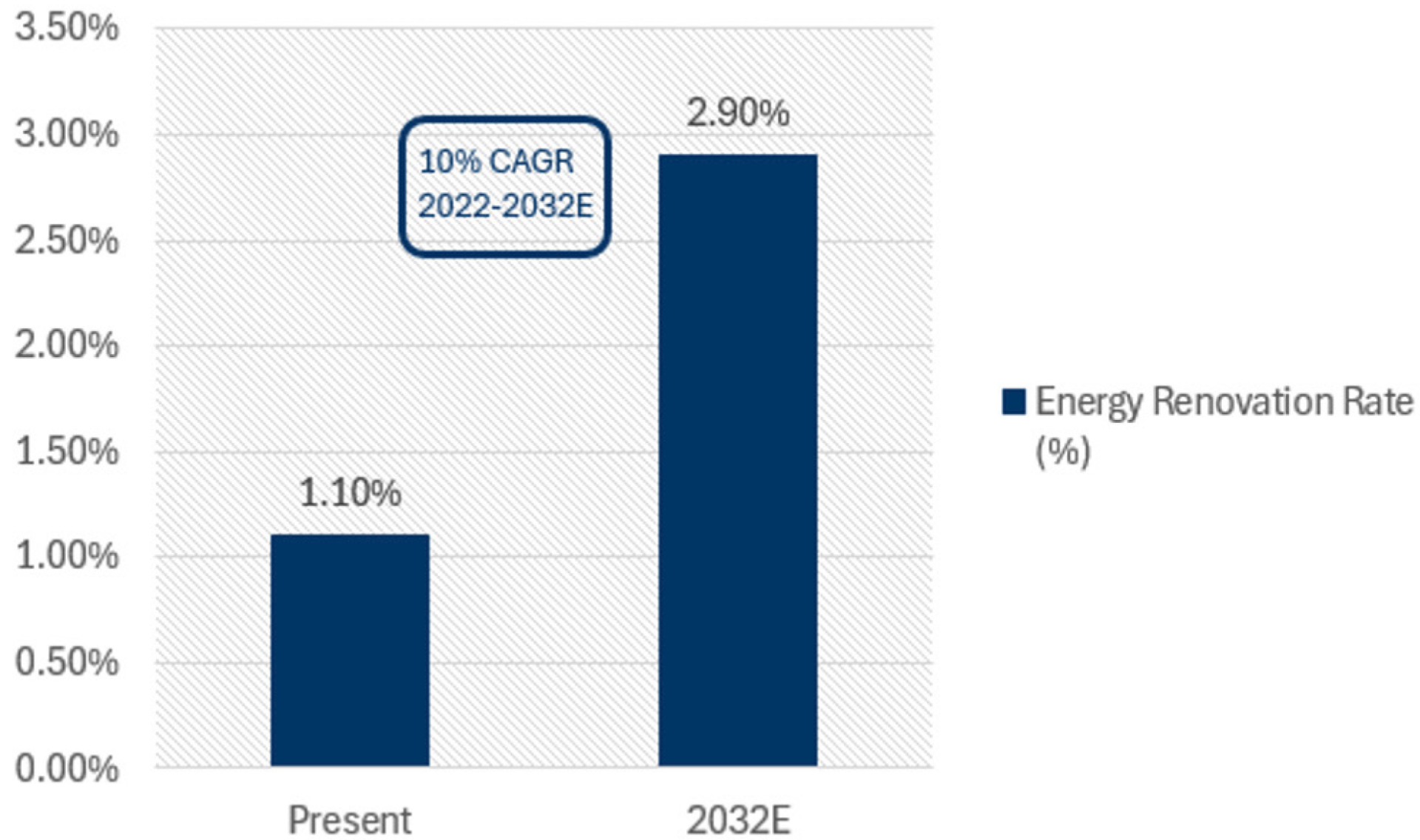

This incremental increase, likely to be actualised by 2026, will represent a 27% uplift in renovation spending, and will likely drive strong underlying demand growth for the energy renovation market. Possibly, this will lead the energy renovation rate of buildings to rise from 1.1% pa to 2.9% pa by 2032 (a compounded average growth rate (CAGR) of 10% over the next 8 years) according to Building Performance Institute estimates (Figure 6).

However, in 2019, insulation spending accounted for less than 1% of the overall EU building construction market, while it offers the highest return on energy saving. According to the EU, insulation has the potential to address roughly 15% of the bloc’s CO2 emissions. With such high energy efficiency potential, and assuming the renovation rate’s 2x-3x increase, the insulation market alone is projected to grow by 1.7-2.3x (5-9% CAGR) according to Goldman Sachs.

The green materials end-market is equally as likely to undergo structural growth over the next 8-10years. The EU Commission estimates that green cement and other sustainable materials could lower CO2 emissions in the EU by 15-20% by 2050. Mandates (namely the EDBP) include tax breaks and grants to have new construction meet strict quality requirements. Biomaterials can be utilised in various parts of buildings, both structural and non-structural, such as insulation, façades, walls and floors, thereby replacing more environmentally harmful and limited construction materials.

Together with assistance from tax credits in the IRA the global market for sustainable materials is projected to reach $82 billion by 2028, with a CAGR of 25% according to IWG. This indicates a significant potential for these materials and the underlying companies producing them.

How to play the sector

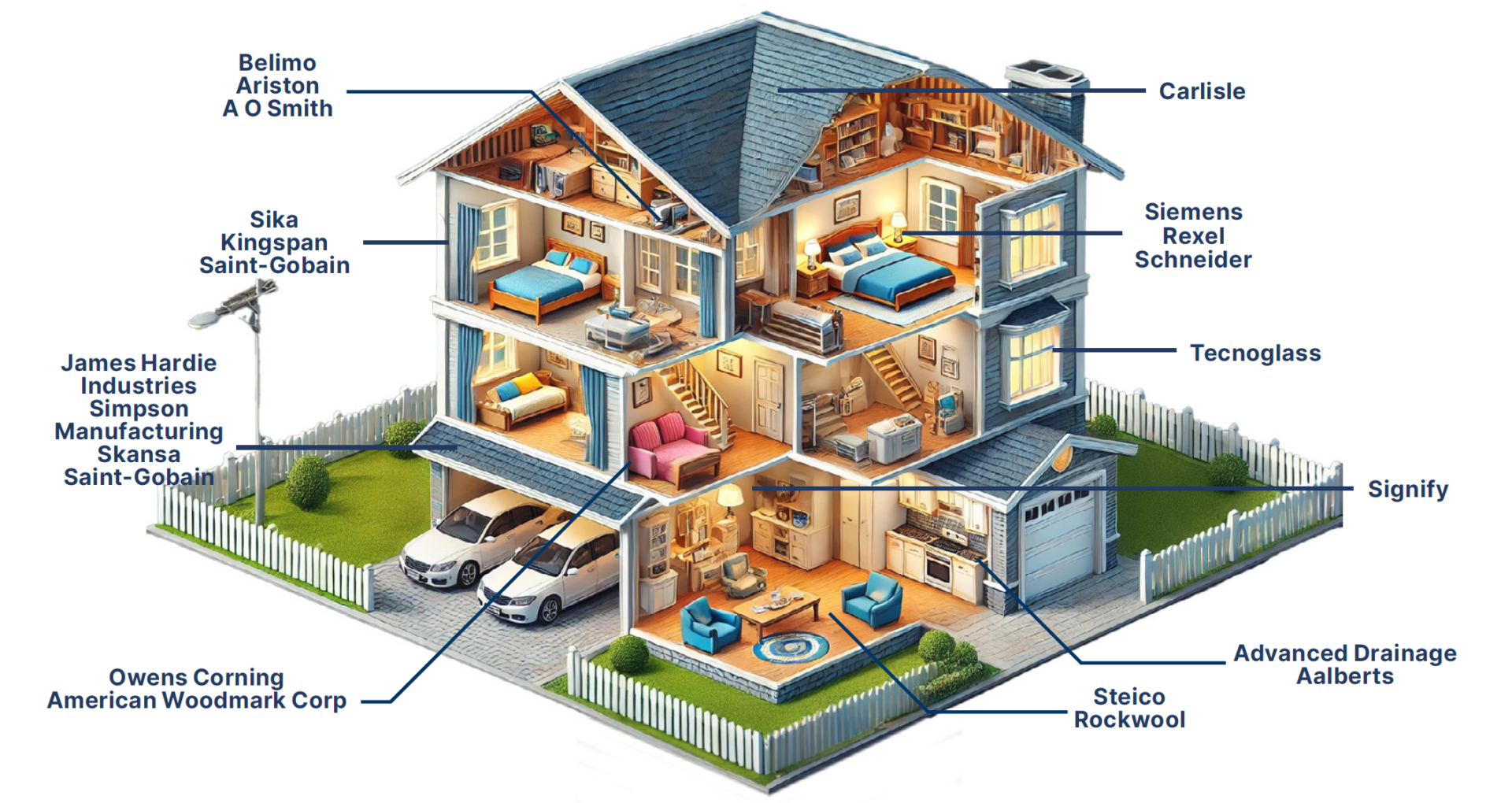

In the push for energy efficiency, companies specializing in insulation by making paneling, insulating materials, and windowpanes (like Compagnie de Saint Gobain, Kingspan, and Sika in Europe and Owens Corning in the US) are likely to benefit from this government investment wave both in the EU and in the US.

Insulation materials made by Kingspan over 2023 are expected to avoid nearly 771 million MWh of energy usage and 173 million tons of CO2 emissions over their lifetimes, while Sika’s insulation walls have produced energy savings of 35% or more per edifice (according to Sika’s internal research).

Windowpanes produced by Tecnoglass are as important to reduce the energy consumption of households and commercial buildings, enabling windows to keep the heat out during the summer or the heat in during winter, lowering the utilisation of centralised HVAC systems

Companies identified via internal research. Source: Algebris Investments. Data as at 15/07/2024

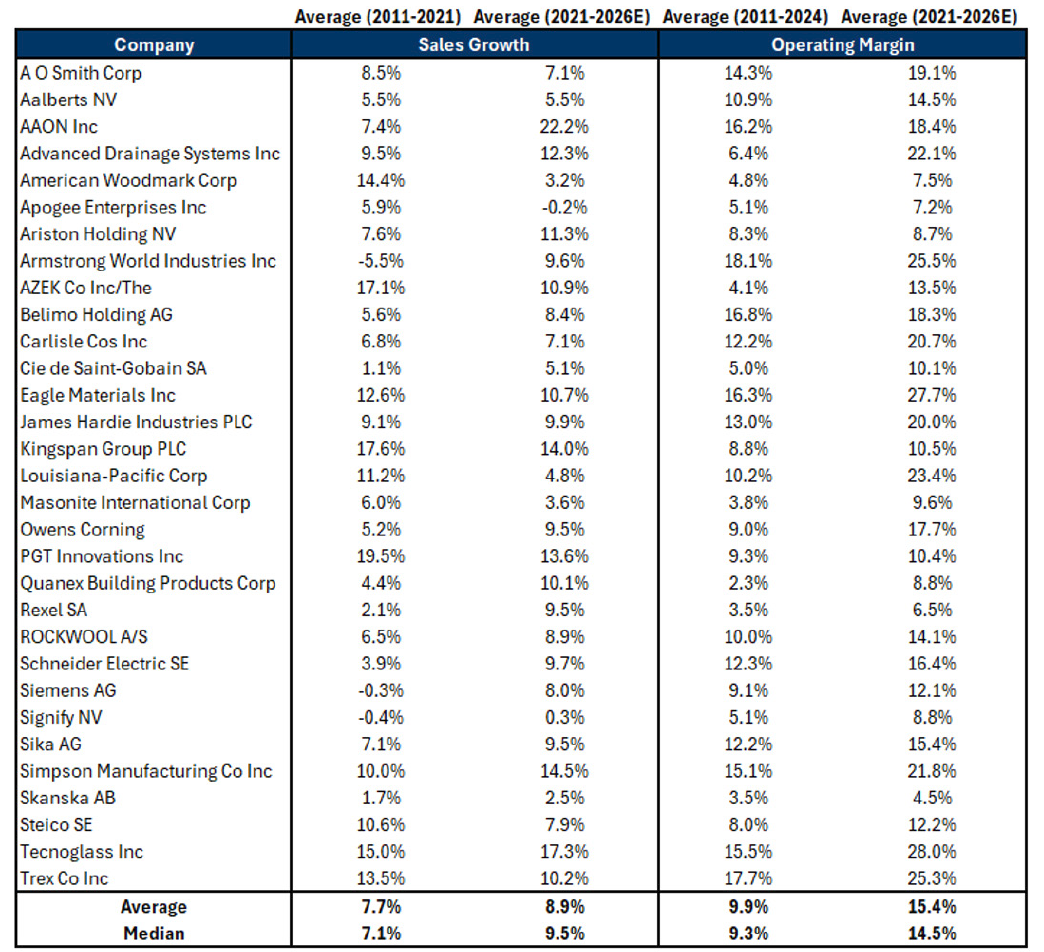

In the push for refurbishment and home improvements to meet efficiency standards, companies such as Simpson Manufacturing that provide construction services are ripe to leverage many of the IRA’s tax breaks. This will incentivize residential homeowners to undertake efficiency improvements given their lower costs and will drive SSD’s revenue growth. On the commercial side, a similar trend is likely, with either efficiency investments carried out by companies such as Siemens, Schneider, or Steico, or new construction supported by companies such as Skanska accelerating sales and operating margin growth YoY in many cases from high single-digits to low double-digits, as of recently (as shown in Figure 8).

Source: Algebris Investments, Bloomberg Finance LP. Data as at 15/07/24. Future projections may not materialise.

Conclusion

As highlighted throughout the analysis above, green buildings are not only a smart choice for the environment, but also financially. They bridge multiple benefits such as improving quality of life, health, and cost reductions. As more and more consumers, businesses, and governments demand and support greener solutions, they are a growing trend in the global market.

We see value in exploring the opportunities that companies involved in sustainable building offer. These companies include leaders in green building design, specialised materials, and construction, and have a proven track record of delivering high-quality and high-performance projects in residential, commercial, and public sectors.

Indeed, considering the backdrop of strong policy support, we see these companies having accelerated growth and improved margins in the next 2-10 years. In particular, companies with strong competitive advantages – as they can adapt to the changing environmental and social demands and regulations, and provide solutions that are more efficient and resilient – are expected to see an increase in value over the next decade.

This document is issued by Algebris Investments. It is for private circulation only. The information contained in this document is strictly confidential and is only for the use of the person to whom it is sent. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Algebris Investments is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

This document is being communicated by Algebris Investments only to persons to whom it may lawfully be issued under The Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 including persons who are authorised under the Financial Services and Markets Act 2000 of the United Kingdom (the “Act”), certain persons having professional experience in matters relating to investments, high net worth companies, high net worth unincorporated associations and partnerships, trustees of high value trusts and persons who qualify as certified sophisticated investors. This document is exempt from the prohibition in Section 21 of the Act on the communication by persons not authorised under the Act of invitations or inducements to engage in investment activity on the ground that it is being issued only to such types of person. This is a marketing document.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© 2024 Algebris Investments. Algebris Investments is the trading name for the Algebris Group

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

This document is issued by Algebris Investments. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.