European Banks – Attractive despite challenging political backdrop

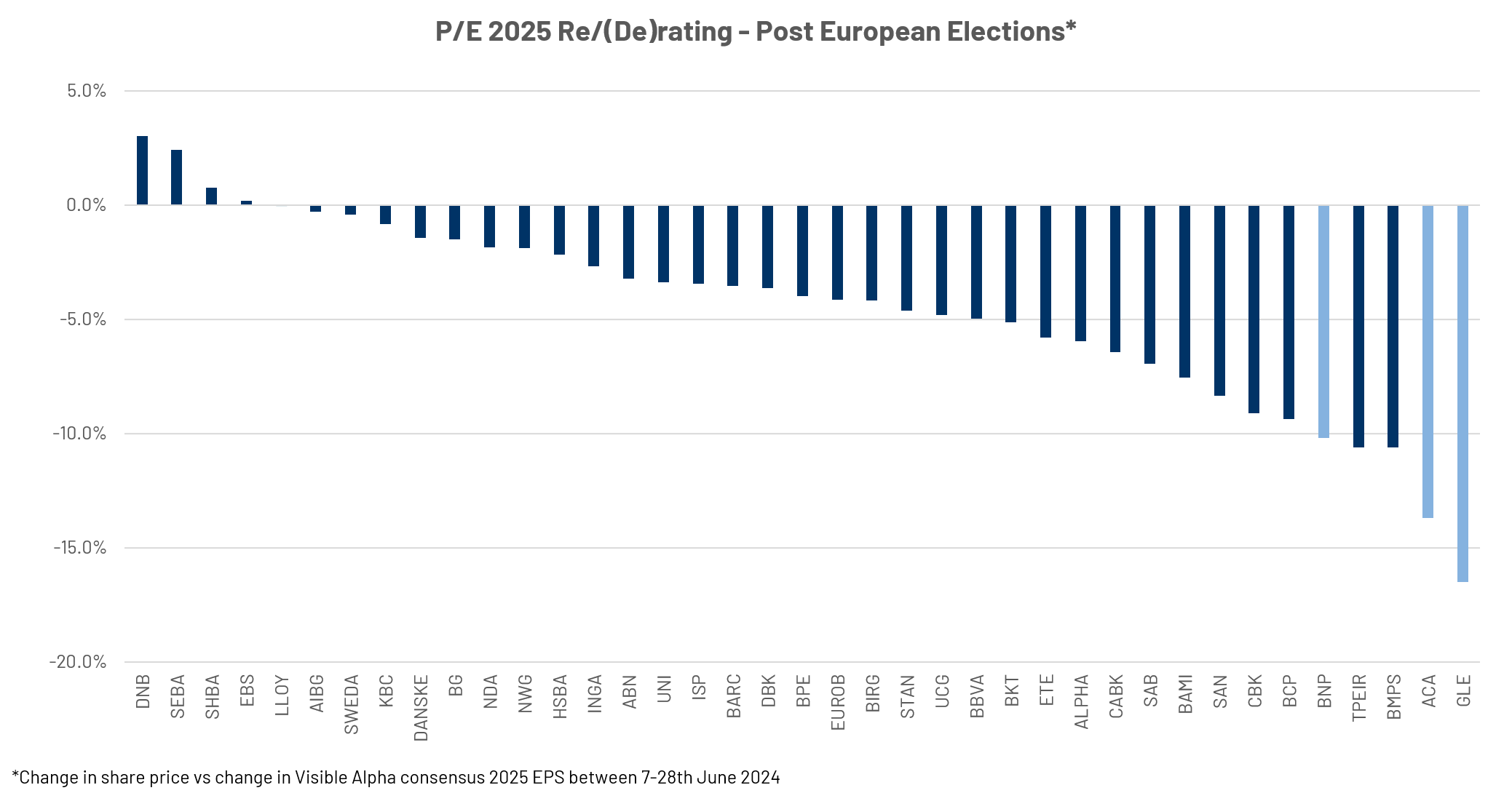

Recent events have reminded the market that 2024 is the ‘year of elections’ with around 50% of the world’s population taking to the polls and the surprise calling of French parliamentary elections leading to share price volatility in the past few weeks. It is difficult to divorce banks from their political backdrop given potential implications for growth, funding costs and asset quality. However, where market sentiment overlooks fundamentals, it can create attractive investment opportunities.

The challenges facing the French economy (twin deficits, sluggish growth) are not new while the structure of domestic balance sheets means French banks aren’t beneficiaries of higher rates to the same extent as European peers. However, if base case expectations for a hung parliament/modest far-right majority and continued Macron presidency play out, it’s not clear we will see material spillover impacts to the broader European economy (or ECB reaction function) in the near-term. That makes recent weakness in some (non-French) European banks look particularly interesting. Individual stock selection is increasingly key, but we still think the investment case for the European bank sector remains attractive given continued earnings upgrades, annual yields in the form of dividends plus buybacks in double-digit territory and valuations at a significant discount to their long-run average.

Weighty Fortunes – Unleashing the gold within obesity therapies

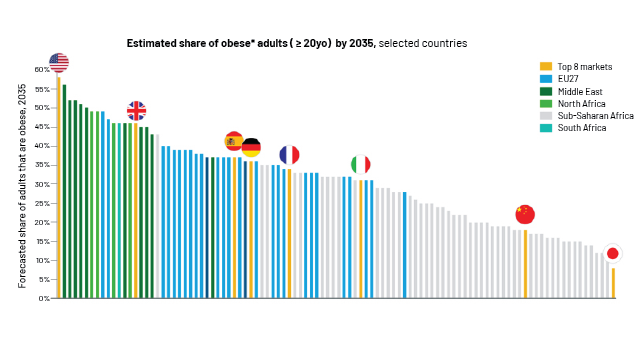

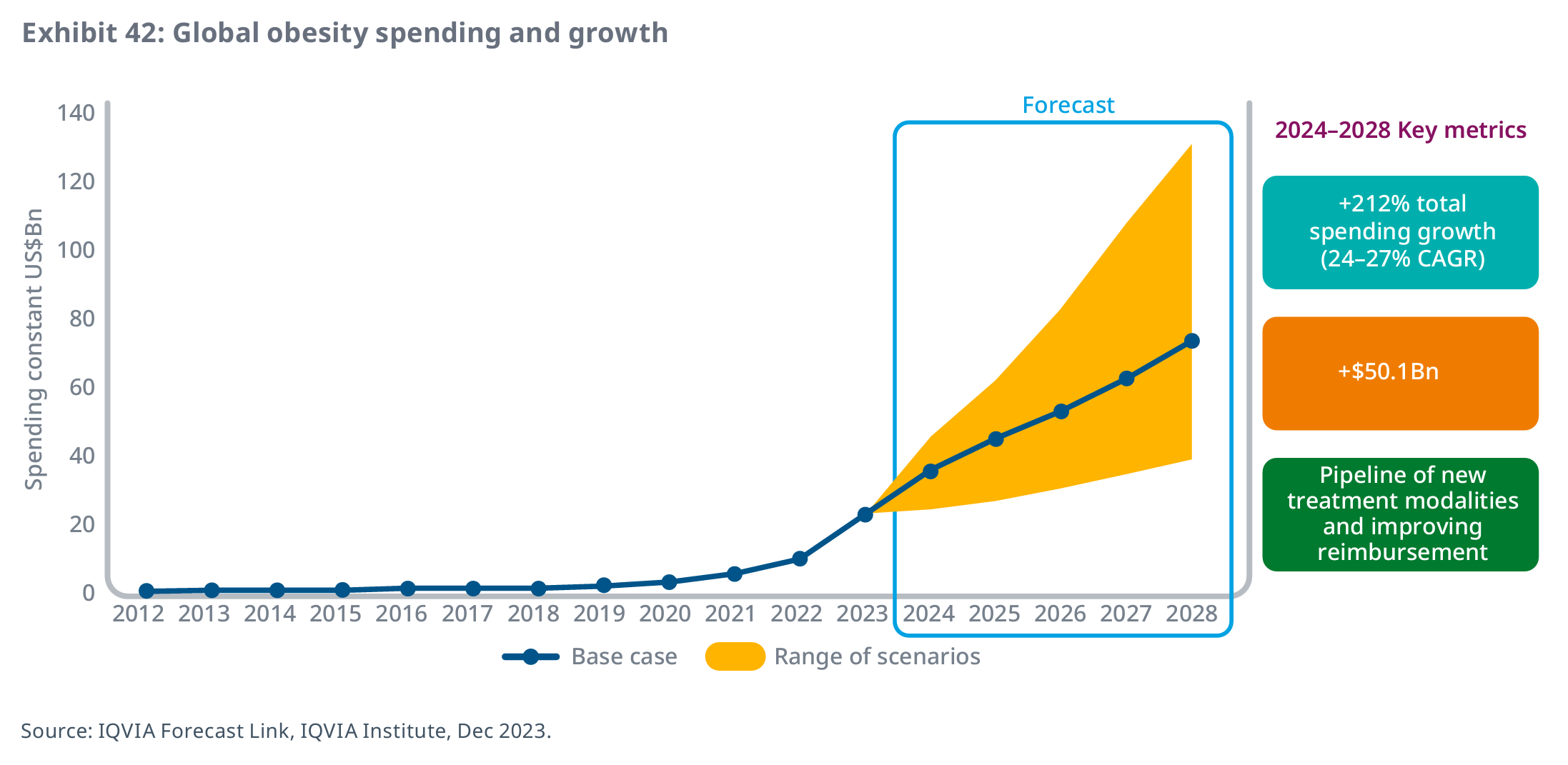

Both Eli Lilly and Novo Nordisk have again been among the best performers in both the S&P and European markets, up 53% and 45% YTD respectively, following stellar performances in the last 3 years. By market cap, Eli Lilly is now the 8th largest company in the S&P500, while Novo Nordisk is the largest company in the SXXP. This is the consequence of rising obesity rates globally and following a pressing social need for effective treatments. This dynamic market combines health impacts, economic relevance, and scientific innovation.

According to Goldman Sachs, obesity currently costs the US healthcare system $170 billion annually. By 2035, the consequences of this chronic health condition are projected to drag down global GDP by an astounding $4 trillion. Addressing obesity becomes crucial not only for health but also for economic stability.

The economic burden of obesity globally exceeds $1.7 trillion, with $1.24 trillion attributed to lost productivity. Corporations recognize the impact of employee obesity on absenteeism and productivity. Consequently, there’s a growing demand for weight loss medications as part of corporate benefits packages. Notably, medicines like Wegovy, Ozempic and Zepboung have seen high demand. Morgan Stanley Research predicts the market could reach $105 billion by 2030, up from an earlier forecast of $77 billion. In the last decade, Eli Lilly saw revenues growing 75%, net income 216%, while share price increased an outstanding 1,350%. Novo Nordisk saw revenues up by 160% and net income by 215% while share price jumped by ca. 700%. Novo Nordisk and Eli Lilly are trading now at record high 15x and 21x EV/Sales 2024 respectively, meaning that investors are still betting on huge increases in sales and profits in the years to come. Combined, they are estimated to retain approximately 80% of the global market through 2030.

Future scenarios may not materialize.

Future scenarios may not materialize.

Algebris Investments’ Financial Equity and Global Equity Teams

This document is issued by Algebris (UK) Limited. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris (UK) Limited.

Algebris (UK) Limited is authorised and Regulated in the UK by the Financial Conduct Authority. The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Under no circumstances should any part of this document be construed as an offering or solicitation of any offer of any fund managed by Algebris (UK) Limited. Any investment in the products referred to in this document should only be made on the basis of the relevant prospectus. This information does not constitute Investment Research, nor a Research Recommendation. Algebris (UK) Limited is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris (UK) Limited , its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is for private circulation to professional investors only.

© 2024 Algebris (UK) Limited. All Rights Reserved. 4th Floor, 1 St James’s Market, SW1Y 4AH.