The Divergence between Concentration and Value in Equity Markets

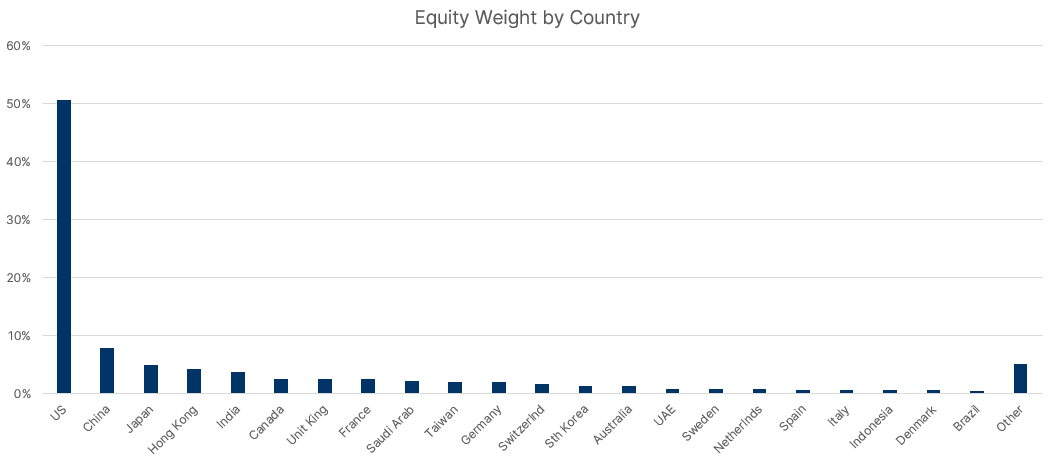

The global concentration of equity has become increasingly polarised, with a growing dominance of the United States, now 11 times bigger that the second largest country by market cap.

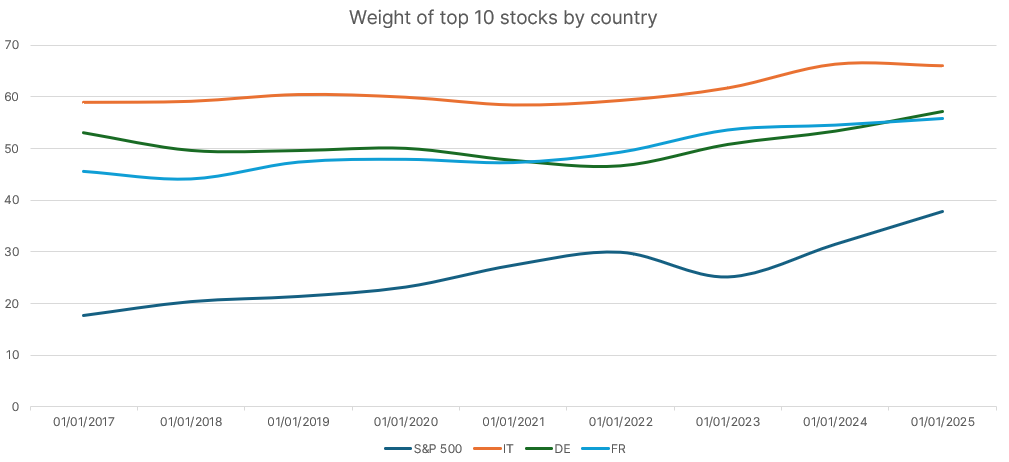

This trend is evident not only across countries but also within them, as the share of the largest stocks in advanced economies has steadily increased in recent years.

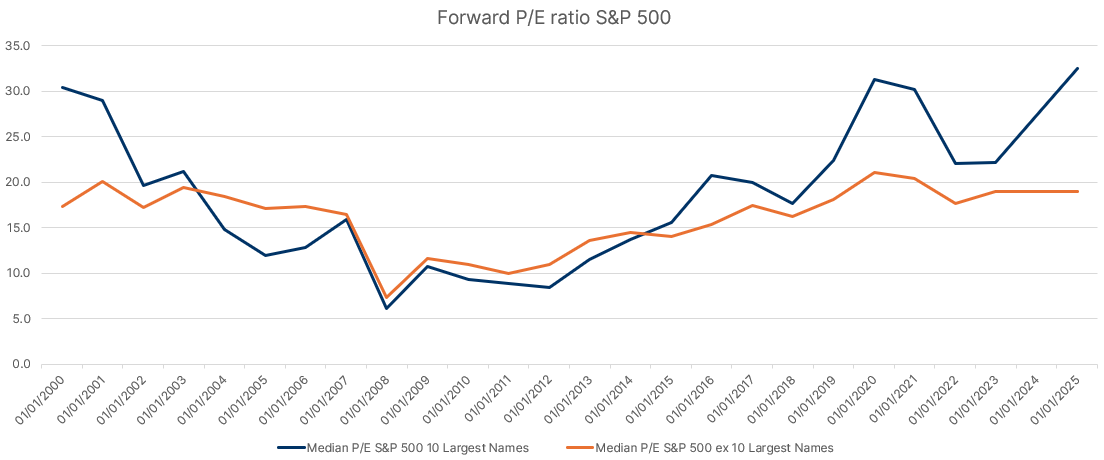

However, value can still be found within the indexes and stock picking becomes more and more important. While aggregate indicators may suggest that the stock market is overvalued, a closer examination reveals a notable divergence. While the largest stocks are trading at higher valuations than the levels observed since the early 2000s, most other stocks are priced at far more reasonable level.

Source: Bloomberg Finance L.P., Algebris Investments, data as of 20/01/2025

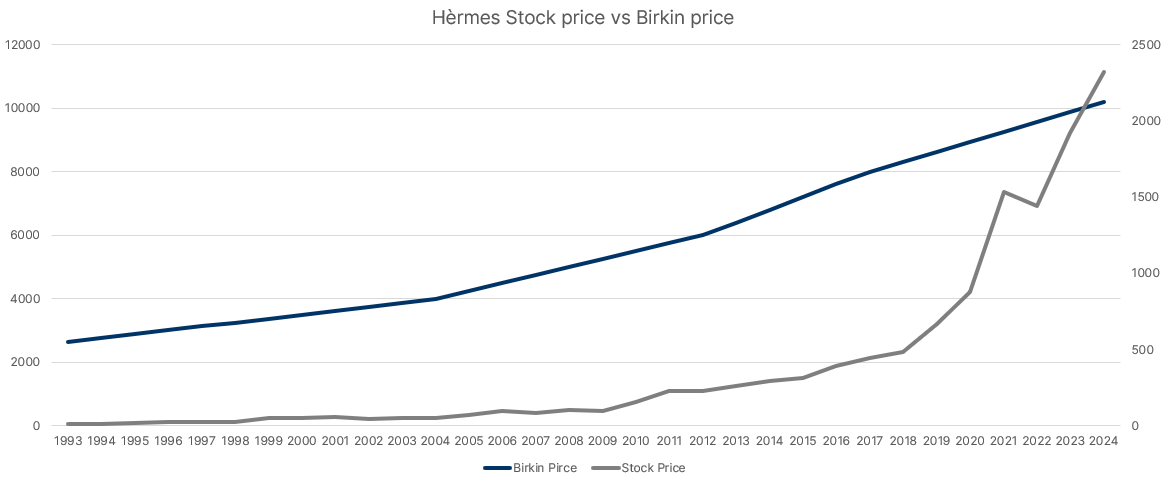

Luxury’s Great Divide: Why high-end brands keep winning.

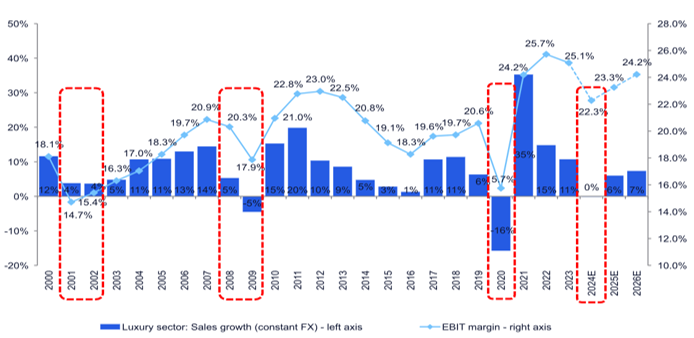

After 15 years of robust growth, 2024 has been challenging for the luxury sector, with growth turning flat to slightly negative attributed to a combination of softness in macro conditions, rising inflation and slowing GDP growth in key markets such as China. In our view, this is also due to a normalization of spending post Covid boom as well as shifting consumer behaviour from goods to experiences.

Source: Bloomberg Finance L.P., Algebris Investments, data as of 20/01/2025

This has led to a further polarisation of the market between high-end players (absolute luxury brands, such as Hermès, Brunello Cucinelli, and Ferrari) and the rest of the market, with the former still reporting positive double-digit growth for 2024. More recently, Richemont reported double digit sales growth during the holiday season, mainly driven by the high-end jewelry division at both Cartier and Van Cleef.

This polarisation is directly proportional to the inelasticity of demand in response to price increases (see Chart 2), with high-end players continuing to raise prices while maintaining strong margins and healthy FCF generation.

In this context of economic and financial uncertainties driven by geopolitical tensions and tariffs, combined with rising wages and still strong inflation, we believe this polarization is expected to intensify, and top-quality and limited-production brands with a strong heritage and established brand values can potentially emerge as key winners.

Algebris Investments’ Financial Equity and Global Equity Teams

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Any opinion expressed is that of Algebris, is not a statement of fact, is subject to change and does not constitute investment advice.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.