Europe’s Wake-Up Call: Lessons from America’s growth engine

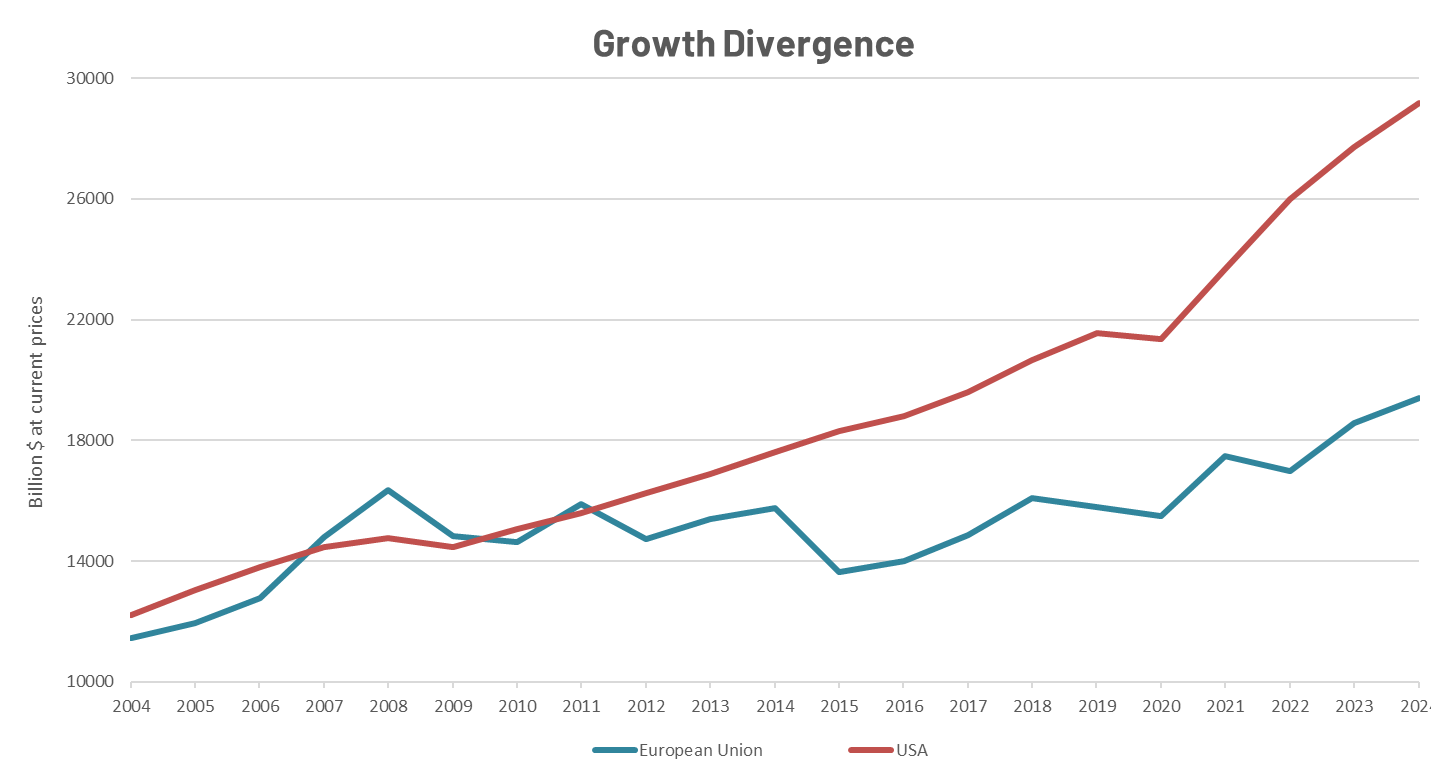

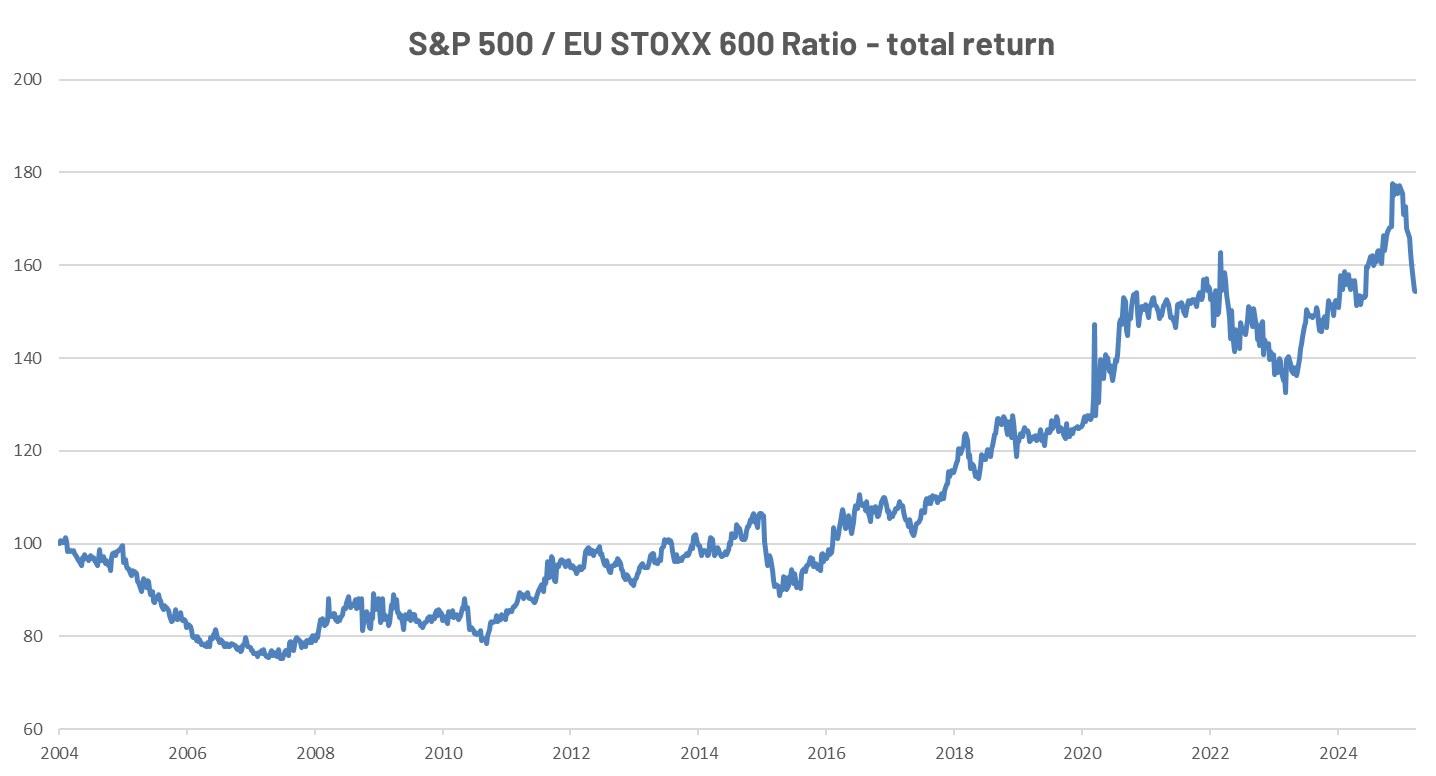

The gap between US and EU GDP has widened significantly over the past two decades, and this different pace of growth has been mirrored in the stock market performance.

In the early 2000s US and EU economies were roughly comparable in size; until 2012, the two economies had the same GDP. In the last 5 years (after COVID), the divergence further accelerated, and US GDP is now ~35% larger than in 2019 while Eurozone GDP was only ~23% higher over the same period.

Key Reasons for the Divergence:

- Tech and Productivity: The US has seen explosive growth in tech and AI-driven sectors (think: Big Tech, innovation, venture capital) with US firms investing more in R&D and tech adoption.

- Labor Market Flexibility: US labour markets are more dynamic—with easier hiring and firing, and more mobility. There is also a higher labour force participation, especially among working-age people.

- Energy and Industrial Policy: Cheap domestic energy (thanks to shale gas) boosts US manufacturing competitiveness. IRA (Inflation Reduction Act) and CHIPS Act have attracted billions in clean energy and semiconductor investments.

- Demographics & Immigration: The US has younger population growth and attracts more skilled immigrants. Europe faces aging demographics and lower birth rates.

- Eurozone Structural Challenges: Slower decision-making, more fragmented fiscal policies. Over-regulation, lower risk appetite in investing and scaling innovation.

The question mark now is what Europe can and must do to reignite growth.

Europe at a Crossroads: Will Germany lead the recovery?

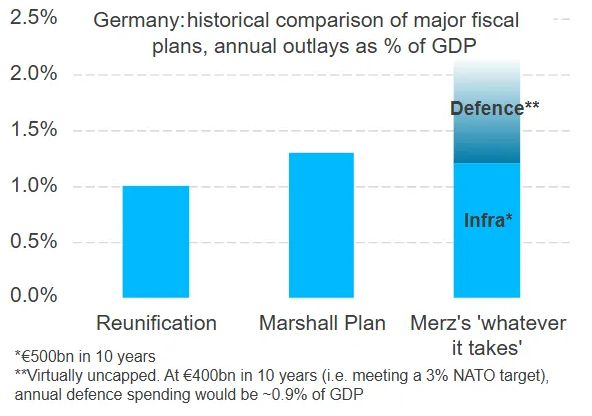

Chancellor-elect Friedrich Merz has proposed a transformative fiscal plan aimed at boosting Germany’s economy and defence capabilities. The plan includes:

- Corporate Tax Reform: Reducing the corporate tax burden to below 25% to increase competitiveness and attract investment.

- Investment Offensive: Launching the creation of a €500bn Federal Special Fund for infrastructure investments (Modernising Germany’s roads, railways, and digital infrastructure)

- Defence Spending: Increasing defence spending to meet and potentially exceed NATO’s 2% GDP target.

- Deregulation & Bureaucracy Reduction: Digitising and streamlining public administration to reduce delays for businesses and citizens.

- Labour Market Reform: Make it easier for companies to hire and retain skilled workers while encouraging greater labour force participation, including incentives for older workers and skilled immigration.

- Housing & Construction Stimulus: Accelerating housing permits and construction to address housing shortages.

- Energy & Industry Strategy: Promoting energy independence and competitiveness, especially in green tech and manufacturing.

Economists calculated that the plan might provide up to 2ppt per year to German GDP. European equity markets responded positively to the plan, with shares of defence and infrastructure-related companies rallying after the news. Is the outperformance still sustainable?

Merz’s plan isn’t just about Germany—it has the potential (and hopefully the mission) to send shockwaves across Europe.

Germany is the largest economy in the EU—if it shifts gear, the entire bloc feels it. Europe has been locked in a narrative of low growth, low investment, and excessive bureaucracy. A bold German shift—especially if it cuts red tape and boosts defence and infrastructure—could prove that the EU can act decisively thus restoring investor confidence. Moreover, Germany has long been the champion of fiscal conservatism in the EU: a proactive, investment-driven fiscal agenda from Berlin could reopen the debate on using fiscal space to foster growth—even in traditionally cautious countries.

Chart 3: Germany: historical comparison of major fiscal plans, annual outlays as % of GDP

Source: Bloomberg Finance L.P., data as of 18/03/2025

Algebris Investments’ Global Equity Team

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Any opinion expressed is that of Algebris, is not a statement of fact, is subject to change and does not constitute investment advice.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.