Political developments – Trading or investing?

Joe Biden has withdrawn from the 2024 presidential race, endorsing Vice President Kamala Harris, who is garnering support from key party figures but awaits official nomination (potentially at the Democratic National Convention on August 19). Betting odds reflect these changes: Trump’s chances decreased to 61% (down 4 points), while Harris’s odds increased to 39%. The equity market has been violent especially for sectors and companies that are sensitive to the policy differences between the two parties. We do not have any crystal ball and while this news might trigger volatility going forward, we keep focusing on long term good business rather than on short term political trading.

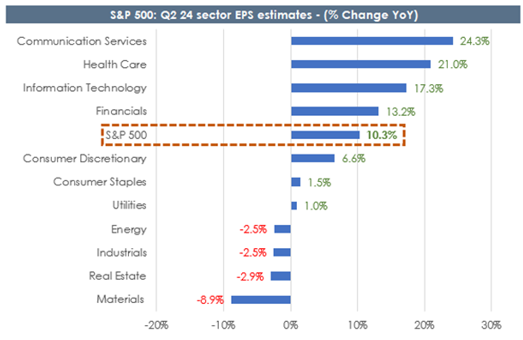

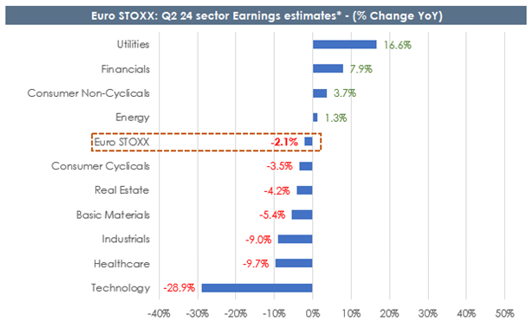

Reporting season – Bumpy Road ahead and warning wave

Going through the reporting season, we’re seeing a significant wave of profit warnings, with 34.8% of the companies that have already reported their results that missed estimates in Europe, compared to only 15.4% in the more resilient US market. Key challenges include weak consumer demand, supply chain issues, and economic slowdowns, particularly affecting industrial companies. On the other side, c. 60% of companies beat EPS estimates in EU, while in US they were c. 77%. Sectors like AI, healthcare, and communication Services are showing positive outlooks. Companies with strong pricing power may outperform, especially as deflation threatens profitability in sectors like airlines and consumer goods outside of luxury.

by LSEG I/B/E/S. Data as of 23 July 2024. Based on data from 155

companies present in the two quarters in question.

Summer peak is coming

It’s shaping up to be the summer’s peak for market activity. On the macro front, we’ve got job market insights from JOLTs, central bank decisions from Japan, Europe, and the UK, inflation numbers from the Eurozone, while in US jobs report and Fed’s meeting. Meanwhile, earnings season intensifies, with expected financial results from companies that make up nearly half of the S&P 500’s value.

US Banks – Return of M&A on the Horizon?

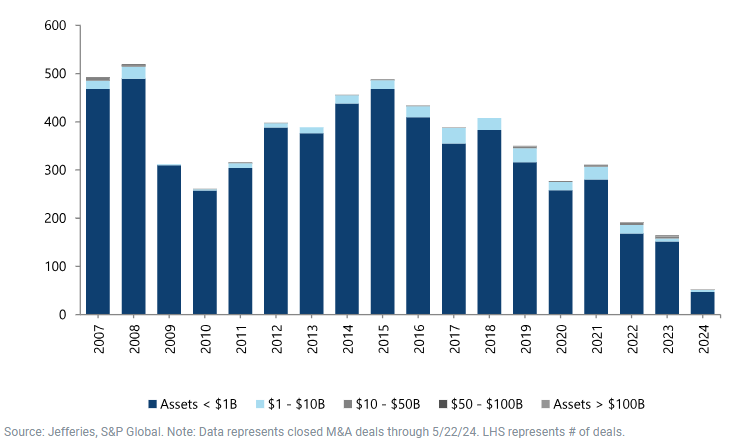

Since President Biden’s poor debate performance on June 27th, US banks have rallied on the prospect of a Trump win. This rally has been supported by tamer inflation data leading to expectations that the Federal Reserve will begin to cut interest rates and engineer a soft landing for the US economy. Small banks, which underperformed large bank peers by roughly 2000 bps between the start of 2023 and the debate, trading at an average discount of 30% relative to historical P/Es during this time, have led the way.

The strength in small banks is being fuelled in part by the hope that a Republican administration will appoint industry-friendly regulatory leadership, opening the door to increased M&A. Over the past several years, merger activity has been stifled by the approval process becoming lengthier and uncertain; indeed, many banks have shelved merger plans out of fear deals will not be approved. After a recent peak of nearly 500 deals in 2015, activity declined by almost 70% in 2022 and 2023 with 2024 on pace to be even slower. However, a favourable regulatory backdrop could quickly change this as small banks look to drive better returns through scale. Combined with lower rates and growing confidence in the economy, these factors will likely drive a meaningful increase in deal volume and become a potential renewed source of shareholder returns. While uncertainty remains regarding the upcoming months, the outlook for small US banks and M&A landscape has indeed brightened.

Algebris Investments’ Financial Equity and Global Equity Teams

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

This document is issued by Algebris Investments. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris Investments.

The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. This document does not constitute or form part of any offer to issue or sell, or any solicitation of an offer to subscribe or purchase, any investment nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefore.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is suitable for professional investors only. Algebris Group comprises Algebris (UK) Limited, Algebris Investments (Ireland) Limited, Algebris Investments (US) Inc. Algebris Investments (Asia) Limited, Algebris Investments K.K. and other non-regulated companies such as special purposes vehicles, general partner entities and holding companies.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.

This document is issued by Algebris (UK) Limited. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris (UK) Limited.

Algebris (UK) Limited is authorised and Regulated in the UK by the Financial Conduct Authority. The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Under no circumstances should any part of this document be construed as an offering or solicitation of any offer of any fund managed by Algebris (UK) Limited. Any investment in the products referred to in this document should only be made on the basis of the relevant prospectus. This information does not constitute Investment Research, nor a Research Recommendation. Algebris (UK) Limited is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris (UK) Limited , its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is for private circulation to professional investors only.

© 2024 Algebris (UK) Limited. All Rights Reserved. 4th Floor, 1 St James’s Market, SW1Y 4AH.