Reporting season – Positive overall

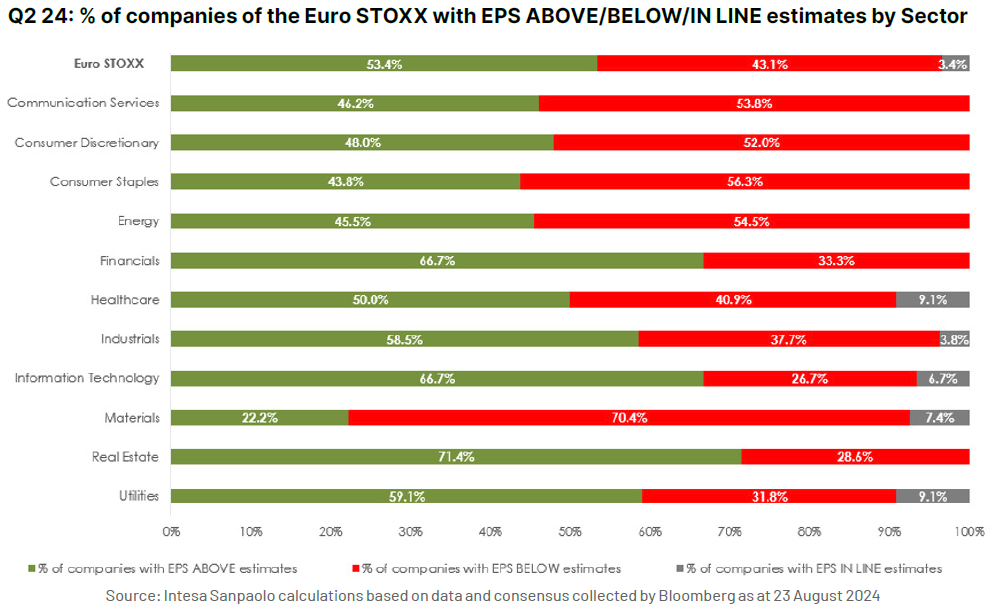

Despite some concerns on potential economy weakness, the recent reporting season has been rosy thus leaving room for EPS recovery in the second part of the year. In Europe we have seen 53% EPS beat, in line with the past 5 earnings seasons (avg 55% EPS beat). The sector with the highest % of companies with EPS above estimates is Real Estate, while the sector with the lowest percentage of companies with EPS below estimates is Materials.

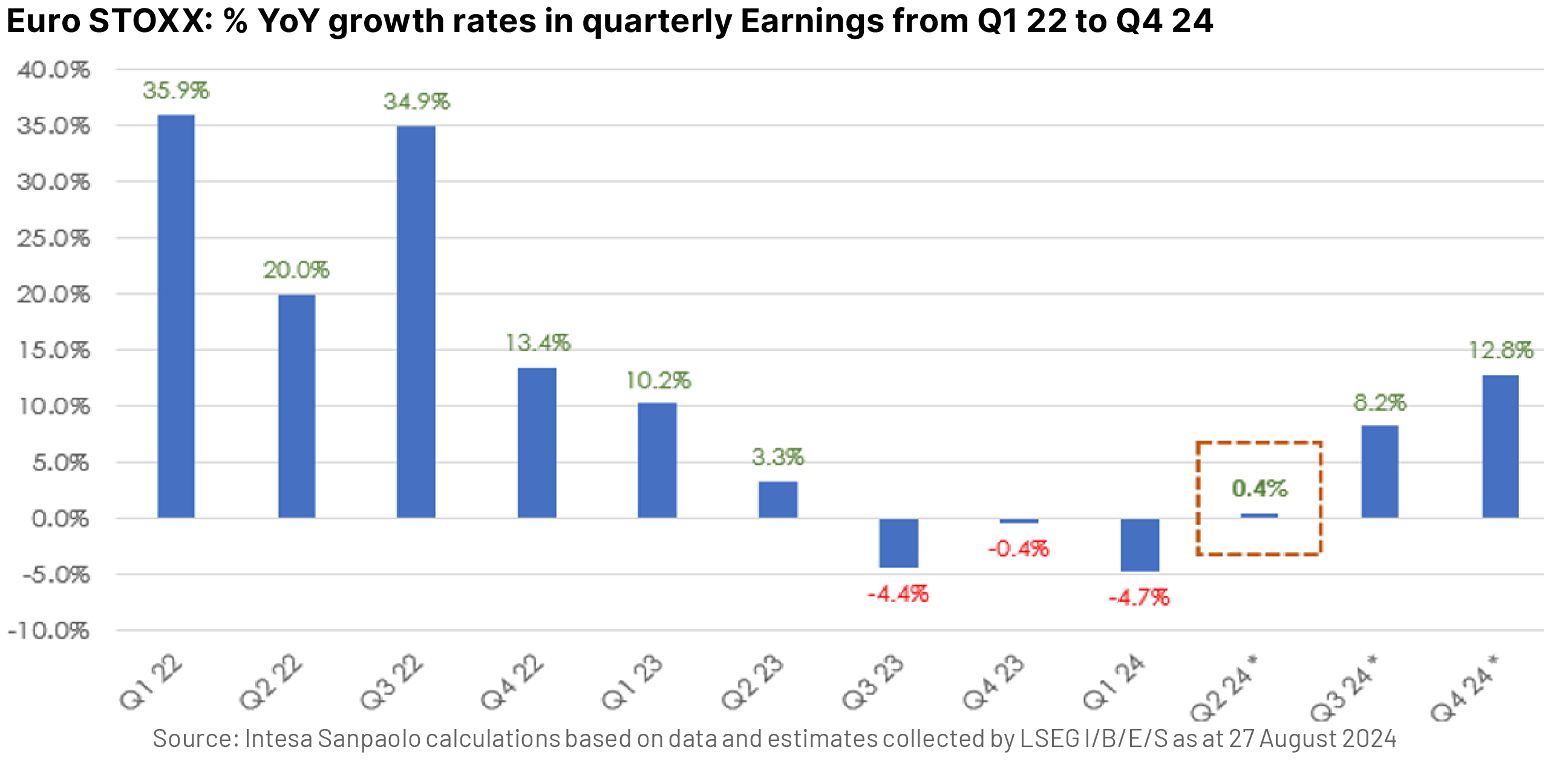

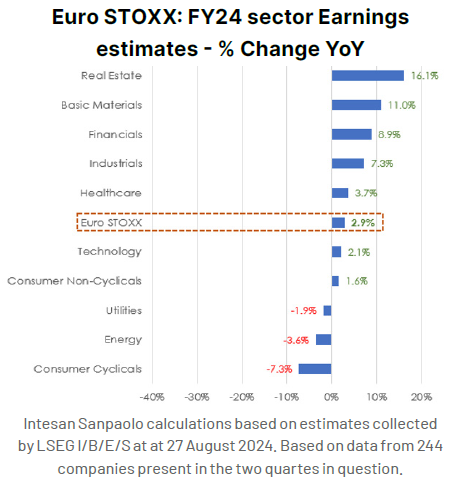

All in all, EPS grew by 0.4% in Q2 (driven by financials, +15% y/y, and Utilities, +11% y/y and dragged by Basic Material -12% y/y and Technology -26% y/y) vs -4.7% in Q1. Thanks to an easier comparison base, consensus now expects a significant acceleration in H2 24 (driven by recovery of real estate, basic materials and healthcare) bringing FY24 EPS growth to +2.4% y/y. For 2025, consensus is pointing to a further acceleration with EPS growth up mid-single digit.

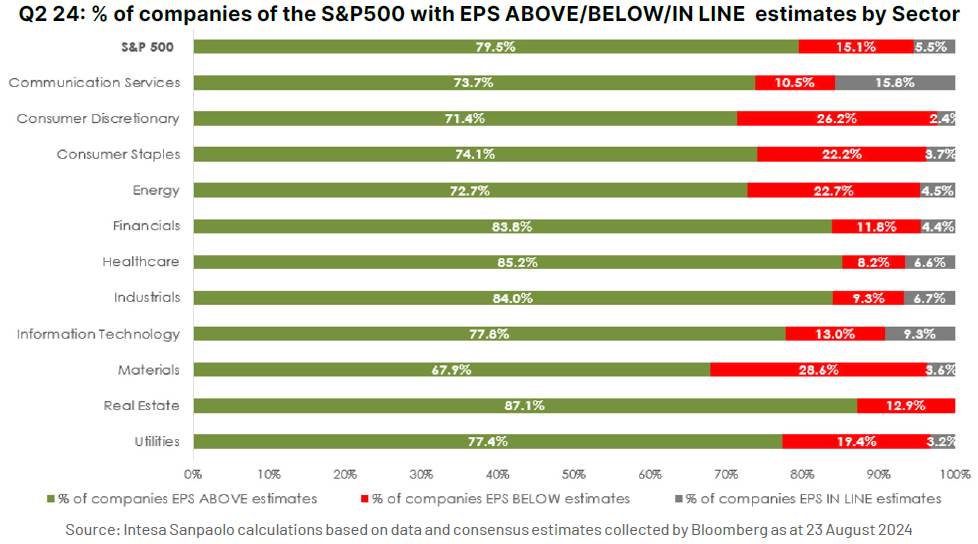

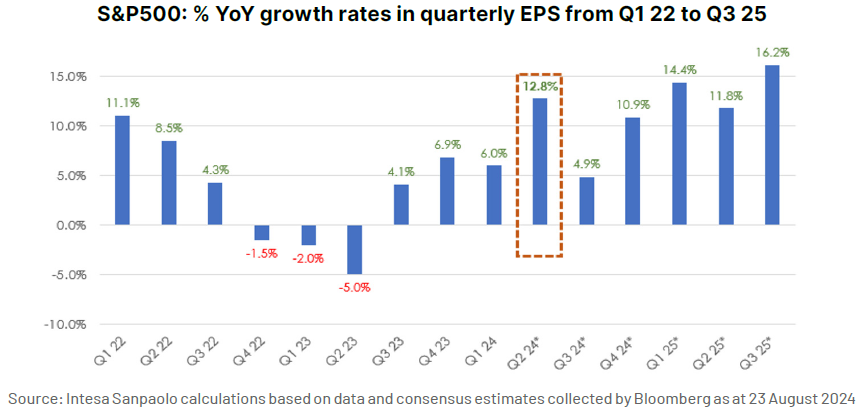

In USA we have seen 79% EPS beat in the S&P, broadly in line with the past 17 earnings seasons (avg 78% EPS beat). Also in the USA, the sector with the highest percentage of companies with EPS above estimates is Real Estate, while the sector with the lowest percentage of companies with EPS below estimates is Materials.

All in all, EPS grew by 12% in Q2 (driven by communication services, +24% y/y, and tech, +20% y/y and dragged by Real Estate -1% y/y and Materials -8% y/y) vs +6% in Q1. Consensus now expects a good high-single digit EPS growth in H2 24 bringing FY24 EPS growth to +9% y/y. For 2025, market is expecting a further acceleration with 2025 EPS growth of +10%.

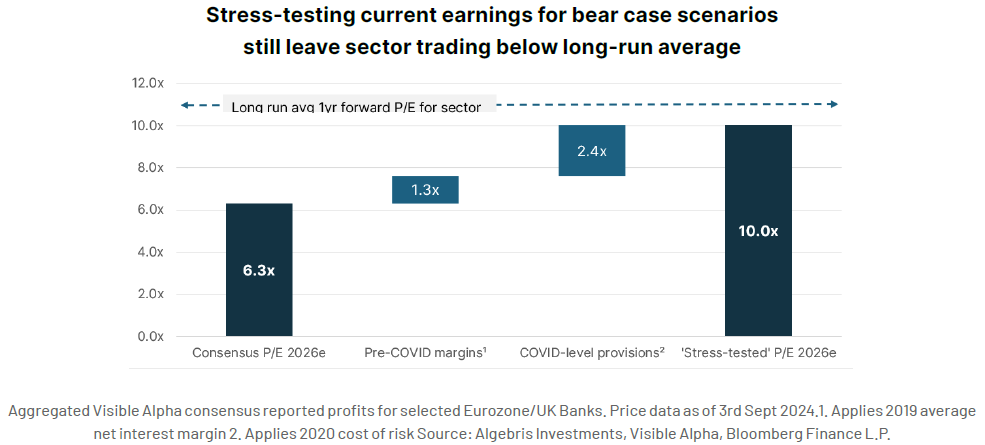

European banks – Valuations are still attractive

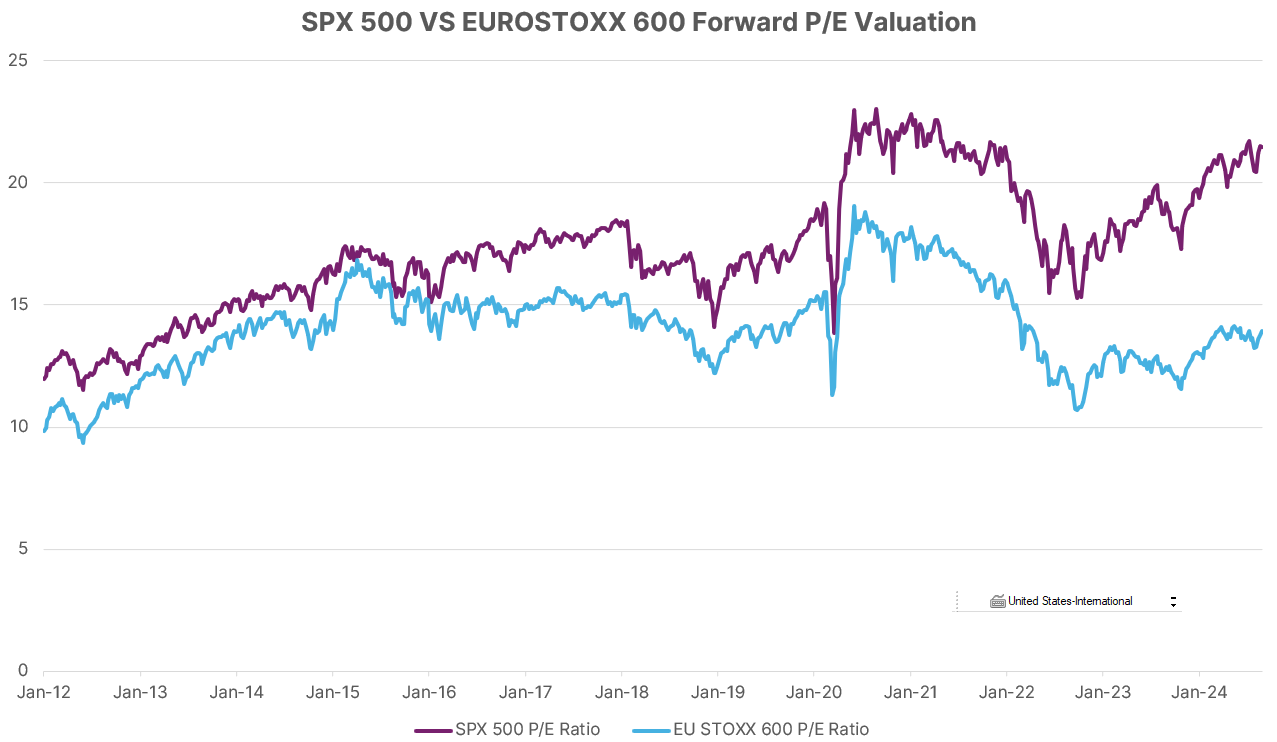

European banks have walked back most of the sell-off that struck global markets in early August (on the back of JPY sell-off/US economic concerns), but still trade on multiples well below long-run averages, leaving valuations attractive. Clearly the market remains concerned about something around the corner for European banks, whether it be steeper declines in interest rates or deteriorating asset quality. To put some context around this – if we stress earnings by assuming: 1) 2020 level provisioning (i.e. a recession scenario, which seems exceptionally harsh just on its own) and 2) net interest margins back at 2019 levels (i.e. stripping out the benefit of all rate hikes) then we still see the sector trading at 10x ‘26 earnings. This for a space that has averaged 11x 1yr forward P/E over the past 20 years. Of course, none of these assumptions are likely to be anything close to reality (market implied policy rates still seen settling above 2% in Eurozone) and yet the market is arguably pricing them all in with an additional haircut on top. Quite simply, the risk/reward profile for European banks looks significantly asymmetric with absolute and relative levels where they bottomed at in the depths of Covid, despite earnings upgrades continuing, balance sheets as strong as they have ever been, and free cash flow being ploughed back to shareholders at a historically high rate.

Algebris Investments’ Financial Equity and Global Equity Teams

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Any opinion expressed is that of Algebris, is not a statement of fact, is subject to change and does not constitute investment advice.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.