European Auto Market – A bumpy road ahead

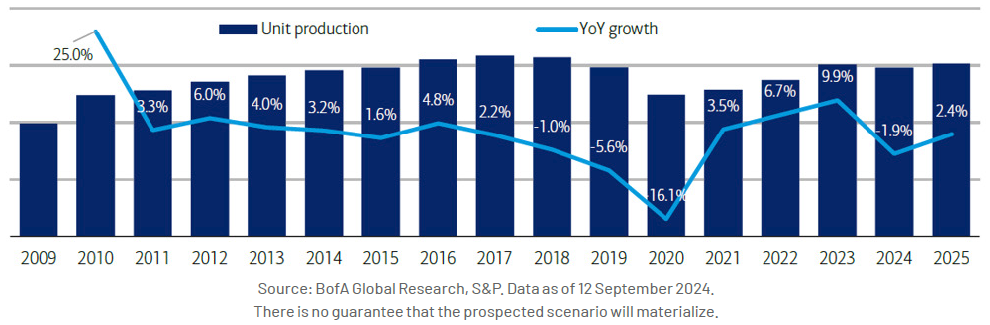

European Auto sector is currently grappling with a myriad of challenges that threaten its stability and growth. These issues are stemming from lower volumes (-2% light vehicle production in 2024), price deterioration, challenging Chinese market, stringent regulation which triggered higher capex to EV platform. Share prices have collapsed in 2024 while cost reductions remain a key priority to sustain profitability and FCF (Free Cash Flow) but not always easy to deliver.

While consumer spending is still weakening and OEMs (Original Equipment Manufacturer) should keep cutting prices to accelerate destocking and affordability, lower rates should start to have an effect only later next year. Despite expecting a further cut in profit estimates for both OEMs and suppliers, we believe that the launch of several new models planned for 2025 may bring benefits especially on the supplier side (as new models usually bring more volume and value content per vehicle).

Moreover, the sector has seen a significant number of investments which has depressed FCF and balance sheets. Consensus forecasts a gradual drop starting from of capex/R&D 2025 especially at supplier level which, together with lower rates, should translates into better FCF generation.

Among suppliers, tyre industry is the one with better visibility (more stable) and lower technological uncertainty, where premiumisation has been the lifeblood of the industry (driven by SUV boom) but has still plenty further to go as EV production grows (higher weight places greater stress on tyres) thus driving mix and margins.

US Elections – Possible scenarios for financial stocks

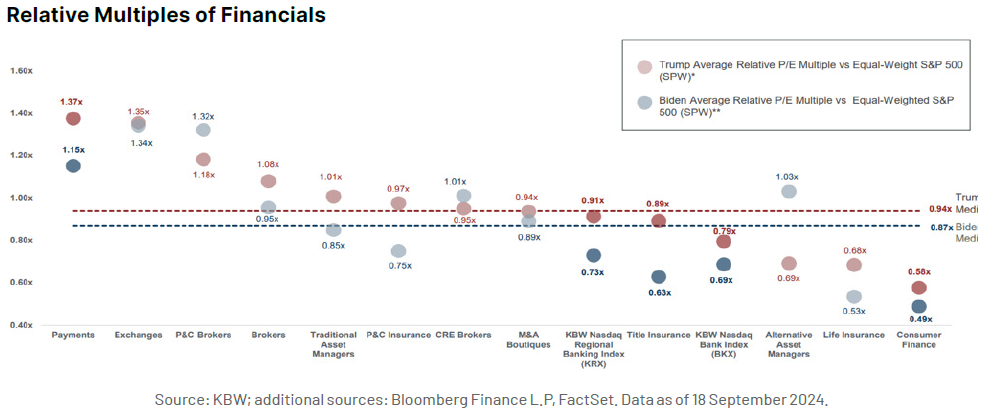

Less than a month remains before election day in the US, the results of which are likely to significantly influence the performance of financial stocks. Following President Biden’s poor debate performance in late June, and the assassination attempt of former President Trump two weeks later, US financials performed strongly in July as the odds of a Trump victory increased; indeed, regional banks were up over 20% and large banks up over 10% compared to a flat S&P 500. Over the past two months, however, banks have underperformed, likely due at least in part to Vice President Harris’ surge in the polls which now has the two candidates in a virtual tie.

A Republican presidency, and even more so a full Republican sweep, will likely be viewed positively for financials given the expected appointment of industry-friendly regulatory leadership which should result in increased M&A and reduced regulatory burdens. For perspective, the heads of eight major regulatory agencies could be replaced immediately. Moreover, Republicans could work to reshape the Federal Reserve in 2026 with the terms of both Chair Powell and Vice Chair Barr ending. Bank M&A has slowed dramatically under the Biden administration as deal approvals have become timelier and more uncertain. Under a lighter regulatory touch and less restrictive anti-trust stance, deal activity is likely to increase notably. Furthermore, regulatory scrutiny of capital levels, compliance requirements, fees and so forth are likely to be softened, all of which bode well for capital return and efficiency. Lastly, banks and other financials traded at higher relative multiples under Trump relative to Biden (with the discrepancy being especially notable for regional banks), offering the potential for meaningful re-rating post-election. While a Republican sweep is not the base case, it is a plausible scenario that could lead to notable upside for the sector.

Algebris Investments’ Financial Equity and Global Equity Teams

For more information about Algebris and its products, or to be added to our distribution lists, please contact Investor Relations at algebrisIR@algebris.com. Visit Algebris Insights for past commentaries.

Any opinion expressed is that of Algebris, is not a statement of fact, is subject to change and does not constitute investment advice.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris Investments, its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

© Algebris Investments. Algebris Investments is the trading name for the Algebris Group.