European Equities outperformance: More Than a Bounce?

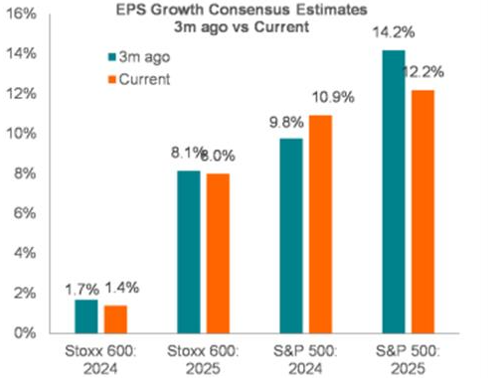

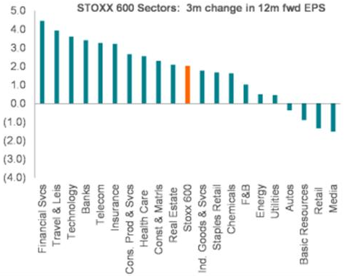

How reporting season is going: Halfway through the Q4 earnings season, Stoxx 600 Q4 EPS growth is running at 3% y/y comfortably above the -1% growth that consensus expected at this stage, with financials and healthcare delivering the main upside surprise. Ex-financials, Stoxx 600 Q4 earnings growth is tracking at -1%, though this is above consensus of -4%.

Most of the beat came from cyclicals and consumer discretionary, putting revenues on track for the first growth in almost 2 years.

European earnings growth expectations for 2025: After a mere 1.4% in 2024, consensus expects European EPS growth of 8% in 2025. While the pace of upward revisions has since moderated, 2025 EPS has been revised up for four consecutive weeks now, lending support to the rally in European equities

Source: BNP Paribas, data as at 21/02/2025

A taxing history: How tariffs went from funding America to wrecking trade

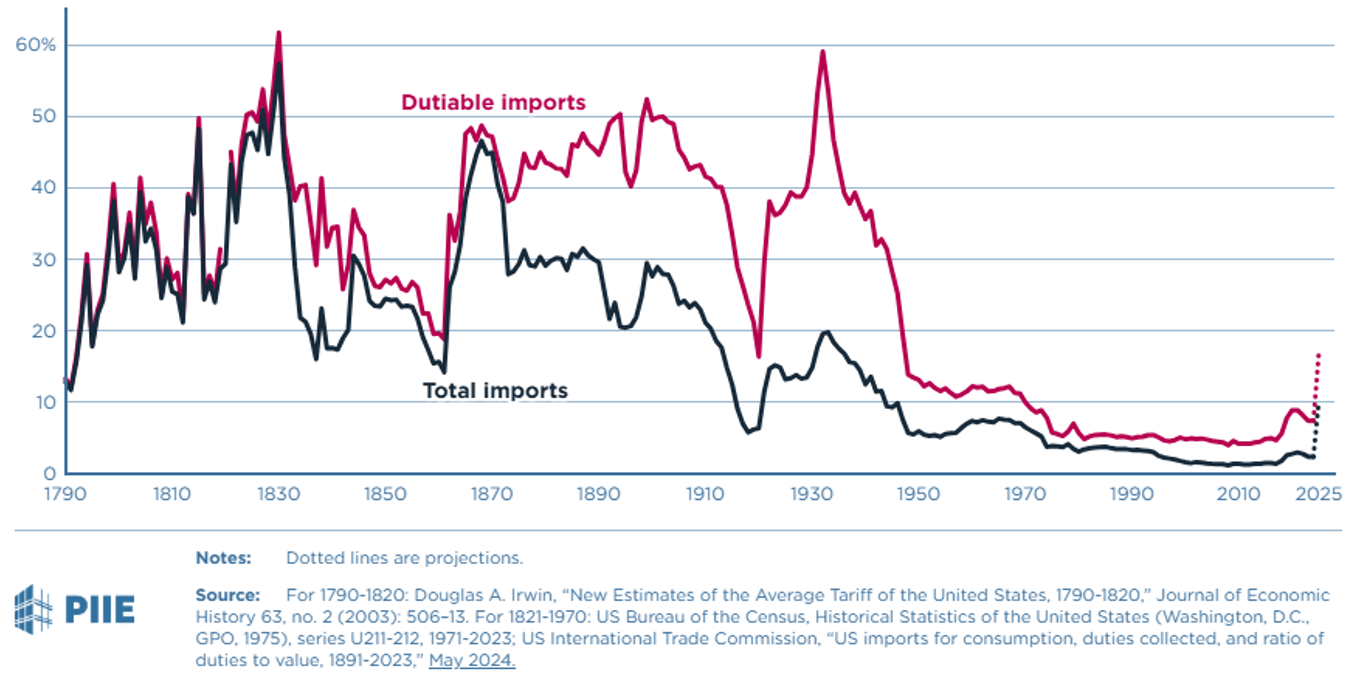

On February 1, 2025, President Donald Trump announced the imposition of 25% tariffs on imports from Canada and Mexico (except energy products from Canada, which will be taxed at 10 percent), along with a 10% tariff on imports from China. On February 3, 2025, the Trump administration decided to postpone for 30 days the implementation of the tariffs on Canada and Mexico. The imposition of these tariffs would be one of the largest increases in trade taxes in US history.

The graph below illustrates the percentage of US government revenue derived from tariffs over the past two centuries. Up until the early 20th century, tariffs were a primary source of federal income, often accounting for over 80% of total government revenue.

Hence, for a long time, the US mostly taxed foreign countries instead of its people. However, this reliance began to decline sharply in the early 1900s, coinciding with the introduction of the federal income tax in 1913 (via the 16th Amendment) and the expansion of other revenue sources such as corporate and payroll taxes.

A significant increase in tariff revenue occurred in the 1930s, largely due to the Smoot-Hawley Tariff Act (1930). This law raised US tariffs to historic levels in an attempt to protect American industries during the Great Depression. However, it backfired—other countries retaliated with their own tariffs, leading to a collapse in international trade. As imports fell, tariff revenue plummeted, exacerbating the economic downturn. This failure contributed to a long-term shift away from protectionist policies in the US.

By the mid-20th century, tariffs had become an insignificant component of federal revenue, remaining below 5% for the past several decades. This transition reflects a broader shift in economic policy, with the US increasingly favouring free trade agreements and globalization, reducing tariff barriers in favour of economic growth and consumer affordability.

To put into context, Canada & Mexico account for 29% of U.S. imports while China accounts for 14% of U.S. imports. The tariffs would raise the average U.S. tariff on all imports from 2.4% to 10.5%—the highest level since World War II.

It is true that today the US runs persistent budget deficits and carries an increasingly high national debt, exceeding $34 trillion in 2024. With government spending outpacing revenue, some policymakers argue for higher tariffs as a way to generate additional income and protect domestic industries. However, history suggests that tariffs alone cannot sustain government finances in a modern, globalized economy. Moreover, raising tariffs can lead to trade wars, higher consumer prices, and retaliatory measures from trading partners, which could slow economic growth. If fully implemented, they would signal a significant shift in U.S. economic and trade policy.

.

Source: https://www.piie.com/blogs/realtime-economics/2025/historic-significance-trumps-tariff-actions

The $330B Data Centre Gold Rush: Big Tech’s AI Bet and the Power Struggle Ahead

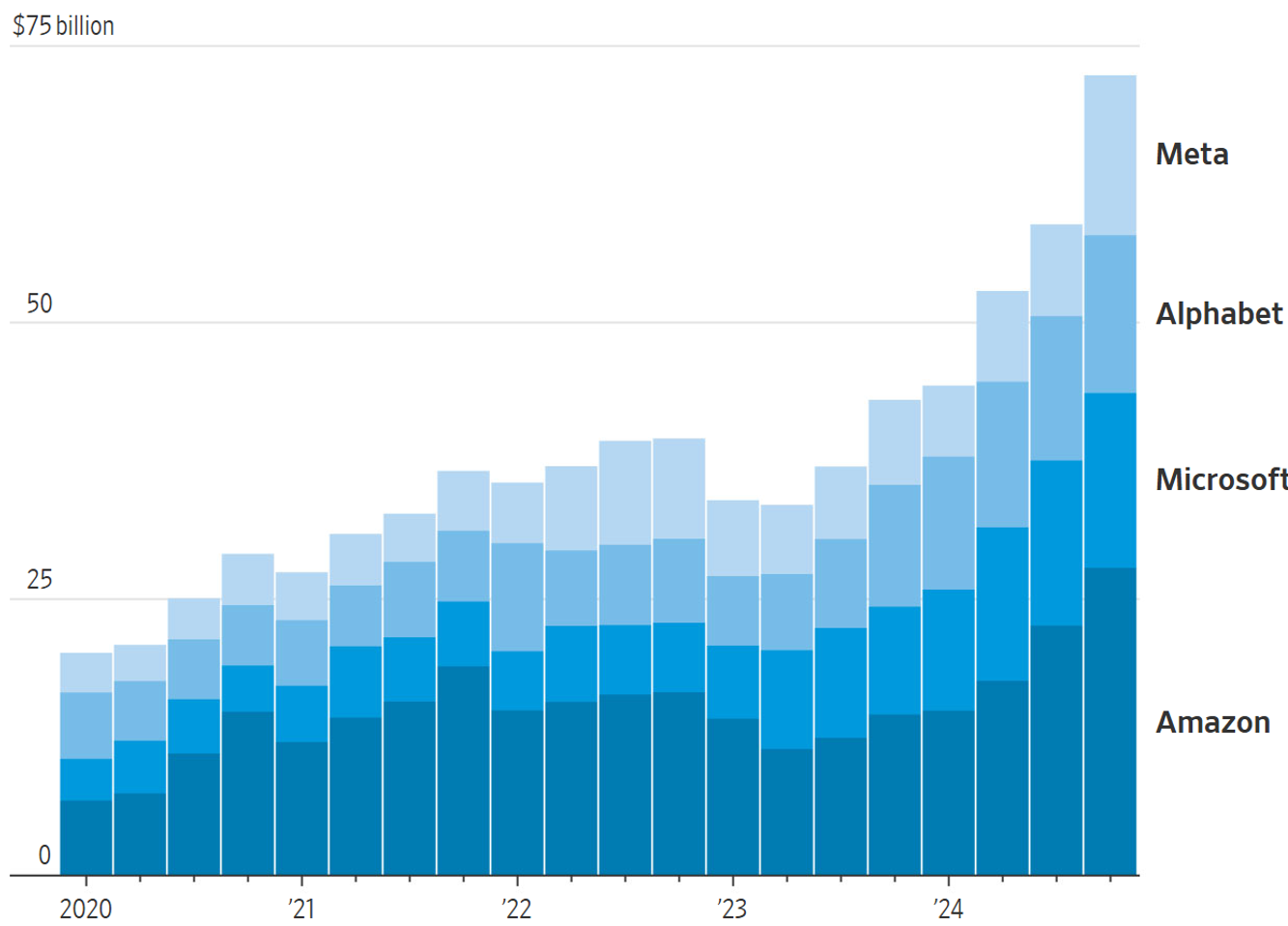

Data center spending has seen significant growth in recent years and looking ahead to 2025 major tech companies are planning massive investments. Microsoft, Amazon, Google and Meta are planning to increase their spending by roughly $100 billion compared to 2024, totaling approximately $330 billion for the year.

Most investments are in the US, particularly in states like Virginia, Texas, and Ohio, reinforcing America’s dominance in AI and cloud, while China faces chip sanctions and EU investments remain bureaucratically constrained.

Concerns about energy consumption are emerging, as data centers are projected to consume increasing amounts of electricity—potentially up to 9% of U.S. power by 2030—prompting investments in energy and efficiency measures. Since the launch of ChatGPT in November 2022 spending has clearly accelerated, but it’s worth noting that the 3-year CAGR has basically never been below 10% in recent years, signaling that Data Center investments appear to be structural.

Note: Data in this chart and those below reflect purchases of property and equipment.

This chart shows data for each calendar quarter. Microsoft’s fiscal year ends on June 30.

Source: https://www.wsj.com/tech/ai/ai-chatgpt-chips-infrastructure-openai-81cf4d40

Algebris Investments’ Financial Equity and Global Equity Teams

This document is issued by Algebris (UK) Limited. The information contained herein may not be reproduced, distributed or published by any recipient for any purpose without the prior written consent of Algebris (UK) Limited.

Algebris (UK) Limited is authorised and Regulated in the UK by the Financial Conduct Authority. The information and opinions contained in this document are for background purposes only, do not purport to be full or complete and do not constitute investment advice. Under no circumstances should any part of this document be construed as an offering or solicitation of any offer of any fund managed by Algebris (UK) Limited. Any investment in the products referred to in this document should only be made on the basis of the relevant prospectus. This information does not constitute Investment Research, nor a Research Recommendation. Algebris (UK) Limited is not hereby arranging or agreeing to arrange any transaction in any investment whatsoever or otherwise undertaking any activity requiring authorisation under the Financial Services and Markets Act 2000.

No reliance may be placed for any purpose on the information and opinions contained in this document or their accuracy or completeness. No representation, warranty or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document by any of Algebris (UK) Limited , its members, employees or affiliates and no liability is accepted by such persons for the accuracy or completeness of any such information or opinions.

The distribution of this document may be restricted in certain jurisdictions. The above information is for general guidance only, and it is the responsibility of any person or persons in possession of this document to inform themselves of, and to observe, all applicable laws and regulations of any relevant jurisdiction. This document is for private circulation to professional investors only.

© 2025 Algebris (UK) Limited. All Rights Reserved. 4th Floor, 1 St James’s Market, SW1Y 4AH.